At a macro level, economic conditions around the globe ended 2018 on an upbeat note. Global consumer confidence, as reported by the Conference Board, was at its highest level in 14 years, a full seven points above the baseline confidence level of 100. That said, however, 39 of the 64 countries included in the global Consumer Confidence Index, which is produced in collaboration with NielsenIQ, reported declines in confidence, well above the 19 in third-quarter 2018.

Fast-moving consumer goods (FMCG) and GDP growth was strongest in Asia-Pacific, and consumers in the region feel the best globally about their financial well-being. In fact, 70% of consumers in Asia-Pacific report feeling feel better off than they did five years ago. Comparatively, only 37% of consumers in Europe believe their conditions have improved over the same time period.

Compared with Asia-Pacific, where average incomes have been growing in step with strengthening economies, Europe has the greatest disparity between consumers who say their conditions have improved and those who say they have worsened. That said, there are noticeable variances. For example, Romania, which posted FMCG growth of nearly 5% in fourth-quarter 2018, has a very high percentage (61%) of consumers who feel better off than half a decade ago. Finland, Italy and Norway are at the opposite end of the spectrum, as 35% of consumers there say they’re worse off—the highest percent across Europe.

In Latin America, economic strides in the fourth quarter were mild, as the region posted GDP of just 1.7%. A few countries posted stronger results, but the worsening recession in Argentina constrained overall progress in the region. Up north, in the U.S. and Canada, inflationary conditions continued to weigh on the FMCG market, with volume growth flat as the year ended. Optimism across North America fell four points to 117, but that level remained significantly higher than the global average of 107.

Looking for regional- and country-specific insights? Our global Quarter by Numbers series has you covered. These quarterly reports combine macroeconomic data, consumption trends, spending patterns and market commentary to provide brands, manufacturers, businesses, marketers and retailers the insights they need to drive organizational growth.

Here, we look at overarching trends in select countries across our five regions.

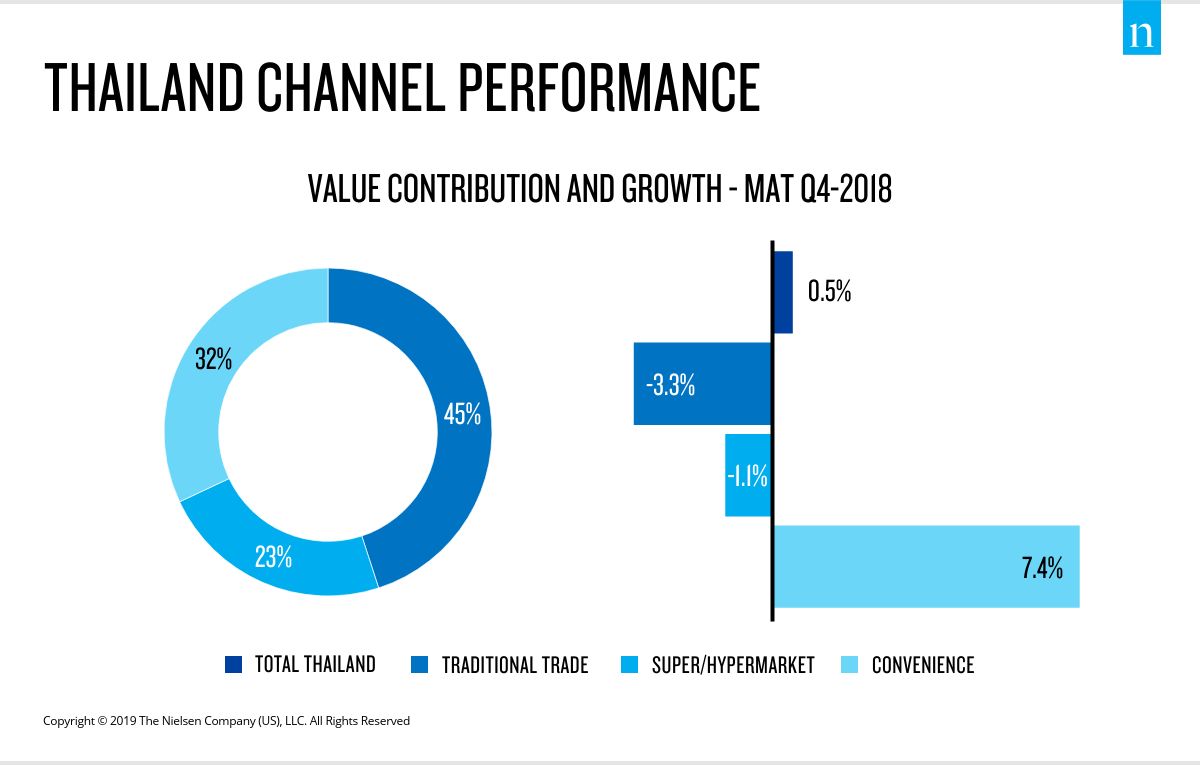

Thailand’s FMCG market continued to strengthen in Q4 2018

The Thai economy expanded by 3.7% in fourth-quarter 2018, supported by a growth in private consumption (durable goods, car sales, and non-durable goods); private investment; and an increase in exports. Consumer confidence also improved following the confirmation of a general election in March 2019. This optimism was buoyed by an improving economy as well as the government’s year-end economic stimulus package, which provided a maximum 15,000-Baht income tax deduction on purchases of tires, books, and locally made goods from village communities.

The FMCG market continued its positive momentum, reaching the highest growth over eight consecutive quarters. The government’s welfare card program, which enabled higher spending among lower income and elderly consumers, especially in up-countries, helped drive the growth. The impulse, personal, and household categories were growth leaders and boosted sales through new product launches and the expansion of premium segments. Though overall sales of alcoholic, tobacco, and beverage categories were down year-over-year (following the excise and sugar tax implementation), there were signs of recovery with the fourth quarter posting the first positive growth.

With a smooth change in the Thai government, as well as the recovering tourism sector, the country’s spending and private investment is expected to improve. We also expect demand for products and services targeting elderly consumers to grow, given the higher number of aging consumers in Thailand year-over-year. And along with the government emphasis on tourism, both from foreign tourists and Thais to secondary cities and local communities, retailers and manufacturers should be planning to expand their physical stores and product distribution into those areas to capitalize on the opportunities.

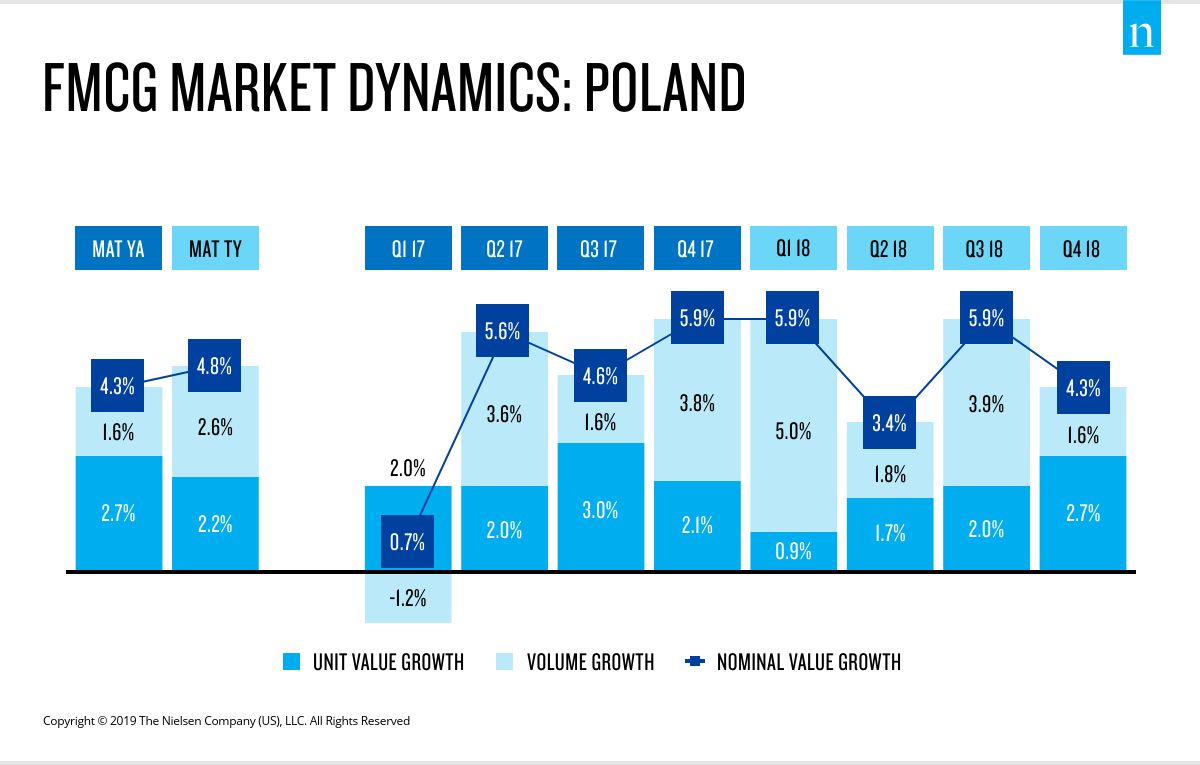

2018 was a strong year for Poland’s economy

Last year was a very strong year for Poland’s economy, which posted GDP growth of 5.1% for the year. The country’s macroeconomic conditions were favorable, aided by the government’s initiated social transfers, leading to higher household disposable income levels and high consumer optimism.

Consumer confidence in Poland reached an index level of 105 in fourth-quarter 2018, significantly above the European average of 84. Polish consumers remain positive about their job prospects, which reflects continued low unemployment levels (below 6% on an annual basis) and optimism surrounding their personal finances in the next 12 months. In light of record-low inflation level (1.6% for 2018), concerns about increasing food prices are also declining.

FMCG nominal value growth in 2018 reached 4.8%. It was slightly lower in the fourth quarter (4.3%) than in the third quarter (5.8%) as a result of the exceptional summer-season boost to many categories. Increasing prices (2.2%; above the inflation rate of 1.6%) contributed to FMCG growth for the year, reflecting the rising importance of premium offerings across multiple categories.

There were two contradictory events in 2018 that affected FMCG performance: An exceptional summer period that boosted sales and the implementation of a Sunday trade ban regulation that limited the number of Sundays in a month that shops could trade on. As a result, we can see that hypermarkets and supermarkets did not capitalize on the favorable summer conditions, and they seem to have been somewhat affected by Sunday trade limitations. In contrast, small-format stores and discounters prospered in this environment.

While it appears that unusually favorable summer conditions have negated the expected negative impact of Sunday trade ban in 2018, further restrictions to Sunday trading in 2019 may have a more significant impact. There are still opportunities for growth in the Polish retail landscape, however, as consumers are optimistic about their personal finances and are eager to trade up to premium offerings that meet their evolving needs and conscious shopping choices.

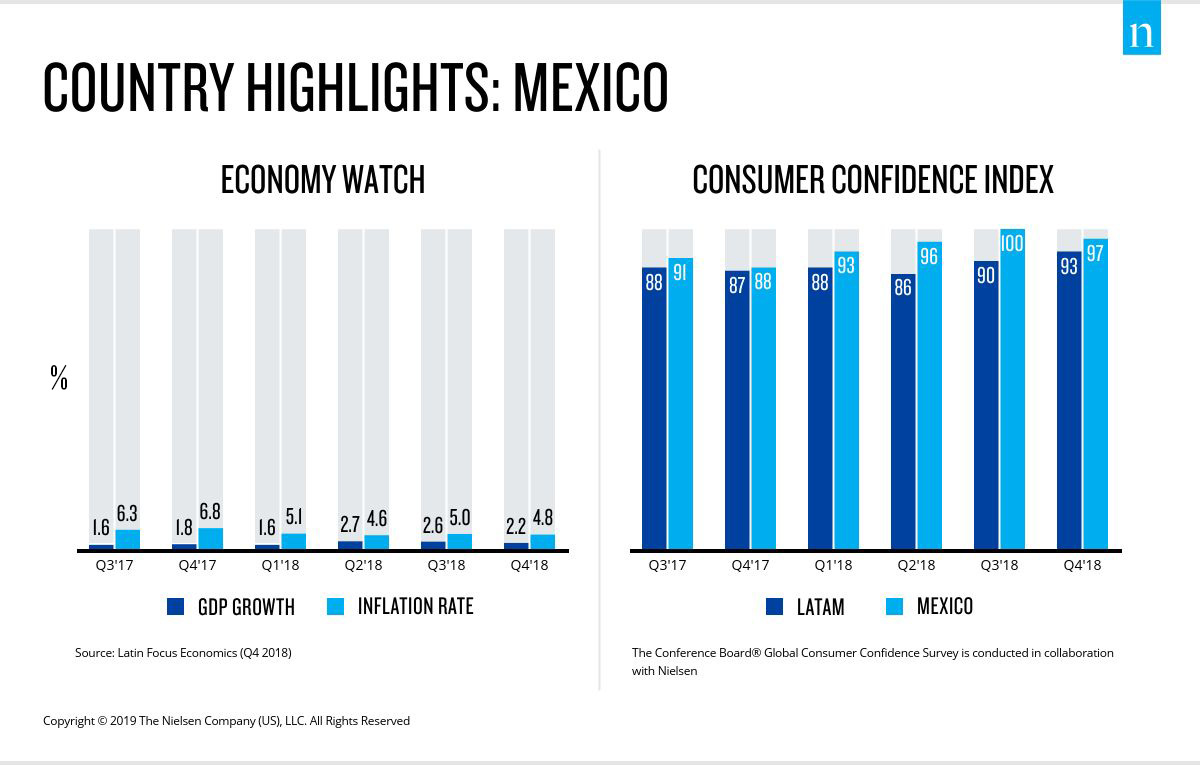

Mexico’s economy outpaces Latin America’s in fourth-quarter 2018

Economic strides were minimal across Latin America in the fourth quarter, and GDP in Mexico slowed to 2.2%, largely because of slowed industrial activity. In addition, the NAFTA renegotiation in the first part of 2018 and the presidential election in July have contributed to two years of relative uncertainty for consumers.

Nevertheless, consumers have come to terms with the most recent government actions, which is evident in consumer confidence across Mexico, which is at its highest level in 11 years. Remittances have continued to grow at favorable rates, while low employment levels have contributed to increased disposable income levels, which bodes well for FMCG growth. We expect the economy to continue growing at a healthy pace during the coming quarters.

Insecurity has, however, hindered economic advancement. Perceptions of insecurity reached record levels during 2018, with 74%* of Mexican consumers affirming that they feel insecure. This has altered their lifestyle and consumption habits. Consumers now spend more time at home and indulgence categories such as popcorn, chocolates, and ice cream have gained presence on consumers’ shopping lists.

Price increases are a constant concern for Mexican consumers—more than half of households in the lower socioeconomic groups consider it a major worry, compared to 40% in higher socioeconomic groups. FMCG consumption reflects the price pressure with a slowdown in the second half of the year. Around 44% of FMCG brands increased prices ahead of inflation, and as a result, consumers have sought product alternatives to save money via low price brands or private label offerings.

Based on price studies, NielsenIQ has found that leading brands are less elastic and dependent on the movements of the competition. In the current environment, the main challenge for manufacturers in the year ahead will be to manage price increases with the least impact.

*NielsenIQ Households Survey – Mexico

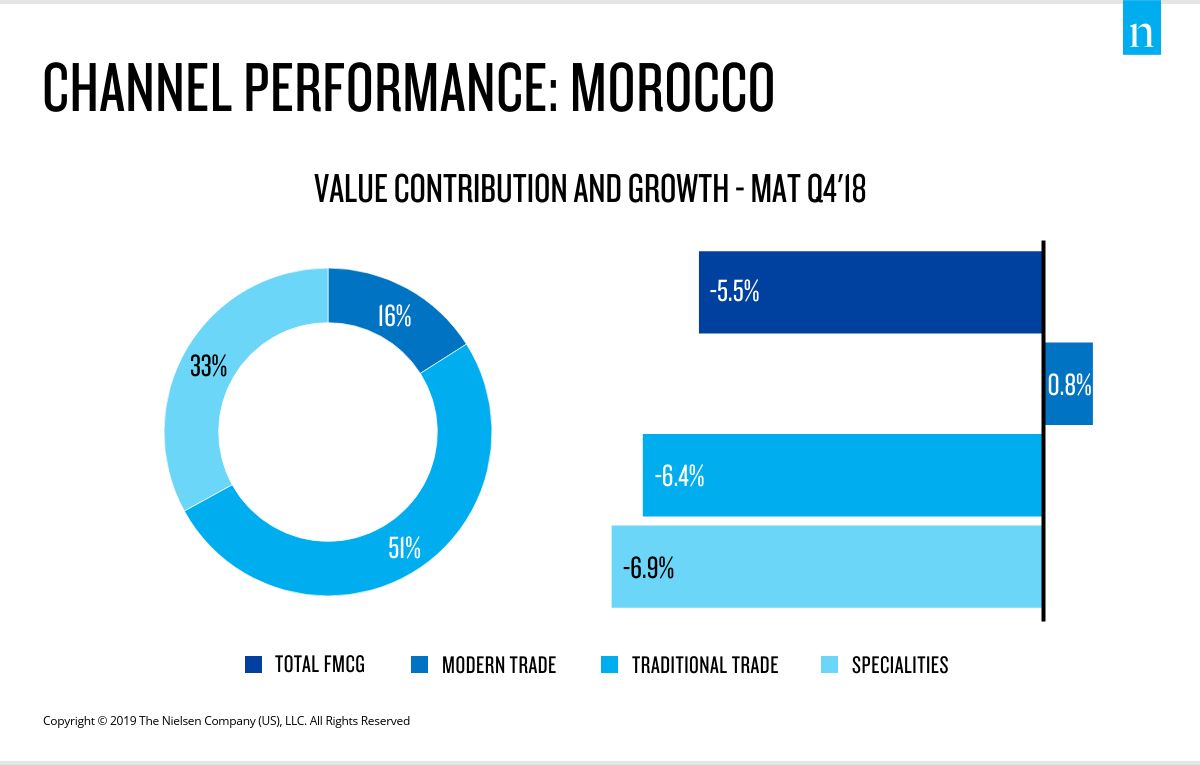

With 2018 in the rearview mirror, Morocco looks for brighter days in 2019

2018 was a difficult year in Morocco. For the first time in history, the market experienced a national social media boycott against a number of leading brands that account for a significant portion of FMCG sales. At the same time, consumer confidence is low, hovering at an index level of about 70 throughout the year—the lowest across the Africa/Middle East region.

These events had a negative impact on FMCG consumption, which declined throughout 2018, even though the year ended with consumption higher than it started the year.

Looking at the broader macro factors, we can’t ignore the impact of political decisions on Morocco’s economic performance, especially the FMCG sector. In late 2018, the tax administration proceeded with a tax recovery initiative. This affected the wholesale channel, which accounts for significant volumes of FMCG movement from companies to retailers. The administration has requested a formal invoice for each transaction through this channel. This led to several protests and a slowdown in activity that will likely affect FMCG performance at the start of 2019.

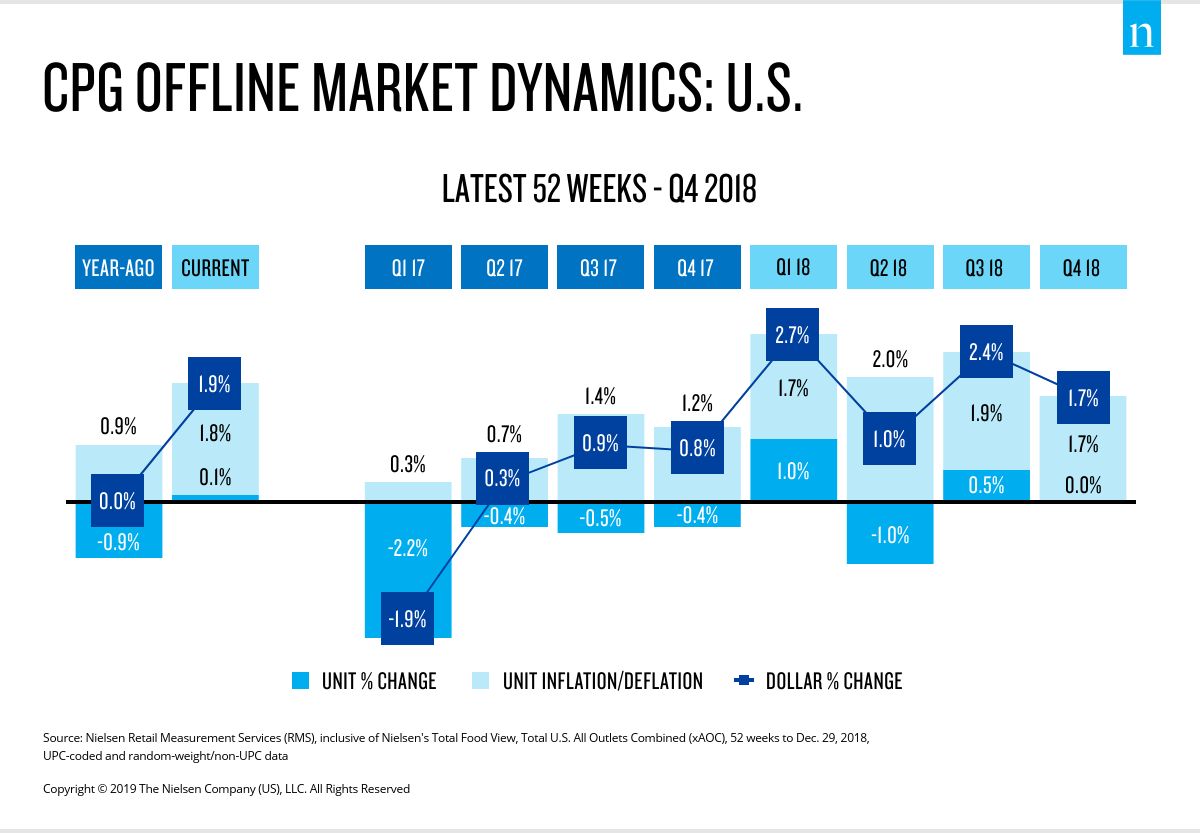

With unit volumes flat, 2019 could be turbulent for the U.S. CPG market

The final quarter of 2018 brought an additional $3.5 billion in brick-and-mortar sales of U.S. consumer packaged goods (CPG). While this uptick from a year ago remains modest, the plateau in unit volume growth (0.0%) is of prime concern. Adding to the equation that American optimism has shifted slightly below consumer confidence scores of early 2018, we’re likely facing even more turbulent times in 2019.

There are some simple truths to navigating today’s challenges. True success happens when brand owners can have their product, or product message, find its way into a person’s life—and keep it there. To truly maximize your share of a consumer’s life, you need to have a deep understanding of your individual consumer and the ability to personalize at scale. So, why aren’t we all doing this?

Well, for one thing, there are currently more data points about consumers, both collectively and individually, than ever before. And as competition grows in CPG, consumers are making faster decisions on what to “let in” to their lives. With a limited capacity for introducing new things into our lives, the job of a modern marketer is to remove the risk of trying something new.

But in order to inspire new consumption occasions for your products, you’ll need a scientific guide to gaining a larger share of your consumers’ lives. For decades, we’ve all leaned on market share as a report card. Then came the offshoots of share of basket, share of wallet, share of voice, and even share of eyeballs to calibrate impact. Take this starting point to the next level. Transform every passing moment into a real connection with consumers. Strive to win a “Share of Life” in your consumer—the ultimate market share.

Notes

For additional insights, download the Q4 2018 Quarter by Numbers lite report.

Learn more about our Quarter by Numbers report series.

Clients interested in the Q4 2018 Quarter by Numbers reports should contact their local NielsenIQ representative.

Non-clients interested in the Q4 2018 Quarter by Numbers reports can purchase them from our e-commerce site (direct links below):