Always ready for change: Multiple factors affect what consumers buy

As we enter 2023, consumers in the MEA region continue to grapple with the fallout of a challenging year. From navigating the ongoing pandemic to dealing with record-setting inflation and extreme weather events, it’s clear that the road ahead will be fraught with uncertainty and extreme situations.

In the face of these challenges, consumers in the MEA region are looking for innovative strategies to curb their spending and protect their financial futures. Whether it’s through smart investment decisions or savvy budgeting techniques, people are taking action to safeguard their financial stability in the face of ongoing socio-economic hurdles.

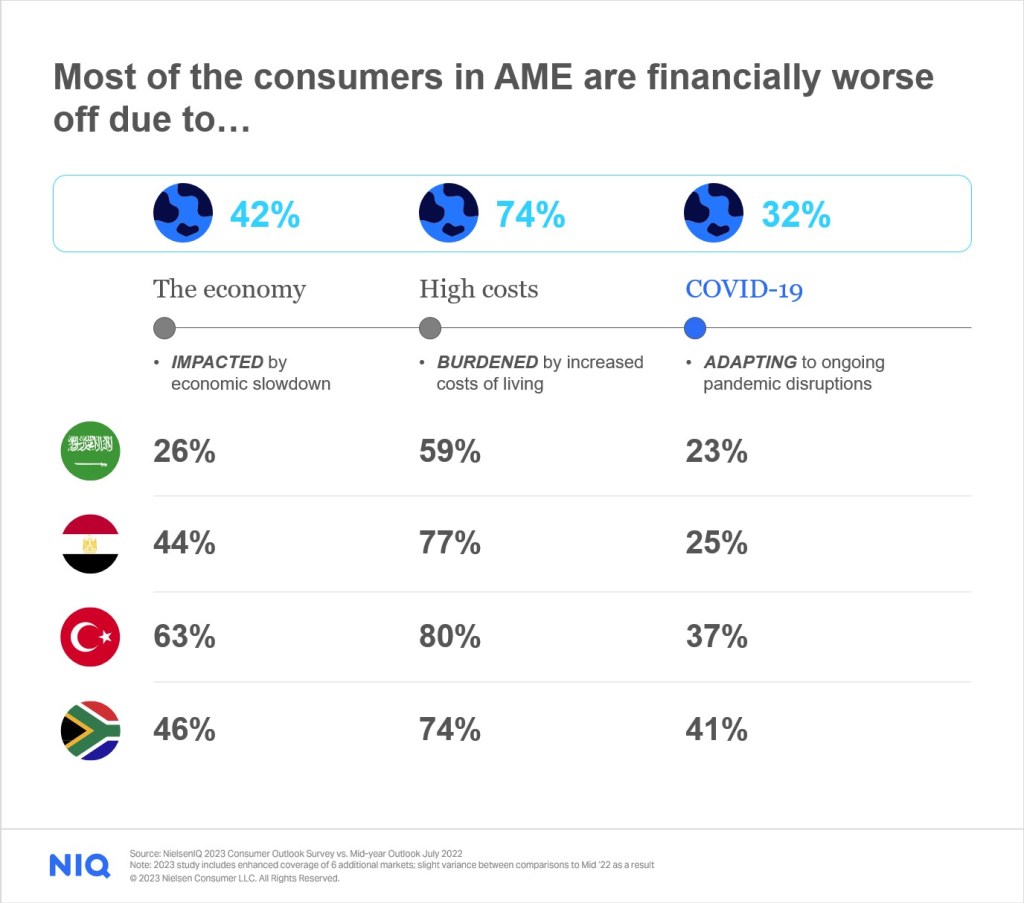

39% of global consumers say they are in a worse financial position this year. Among AME key markets, only KSA (30%) is in a better situation compared to the global average. However, consumers in Turkey (57%), South Africa (41%) and Egypt (41%) feel financially worse off than the global average.

What consumers expect: New priorities and preferences in FMCG

Impacted by these changes, consumers in MEA are not only being more mindful of how much they spend and what they prioritize, they are also shopping differently. They believe the way to combat inflation is by embracing a selective mindset. A check into how they are feeling about the economy reveals that this cautious sentiment not only persists but has intensified.

Everyone has felt the burden of rising costs, but the impact varies dramatically from household to household. As financial situations polarize further, the insecurity of “Strugglers” and the secure flexibility of “Thrivers” will grow in importance for brands to understand and follow over time.

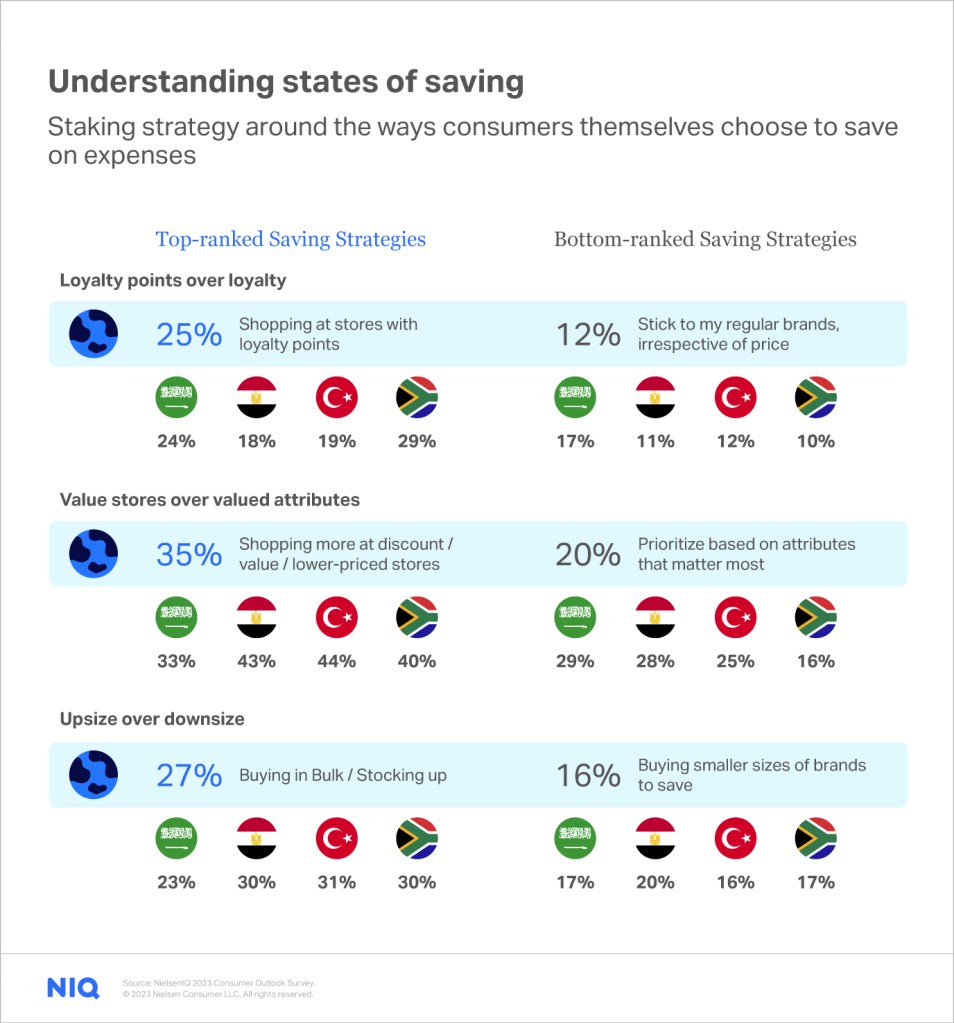

In today’s socioeconomic climate, even the most financially flexible may feel the pressures of economic uncertainty. Shoppers in AME are looking for opportunities to reduce spending and make trade-offs. On average, consumers are using several strategies to manage grocery expenses, from selecting lower-priced products from their preferred brands to monitoring the cost of baskets and shopping online.

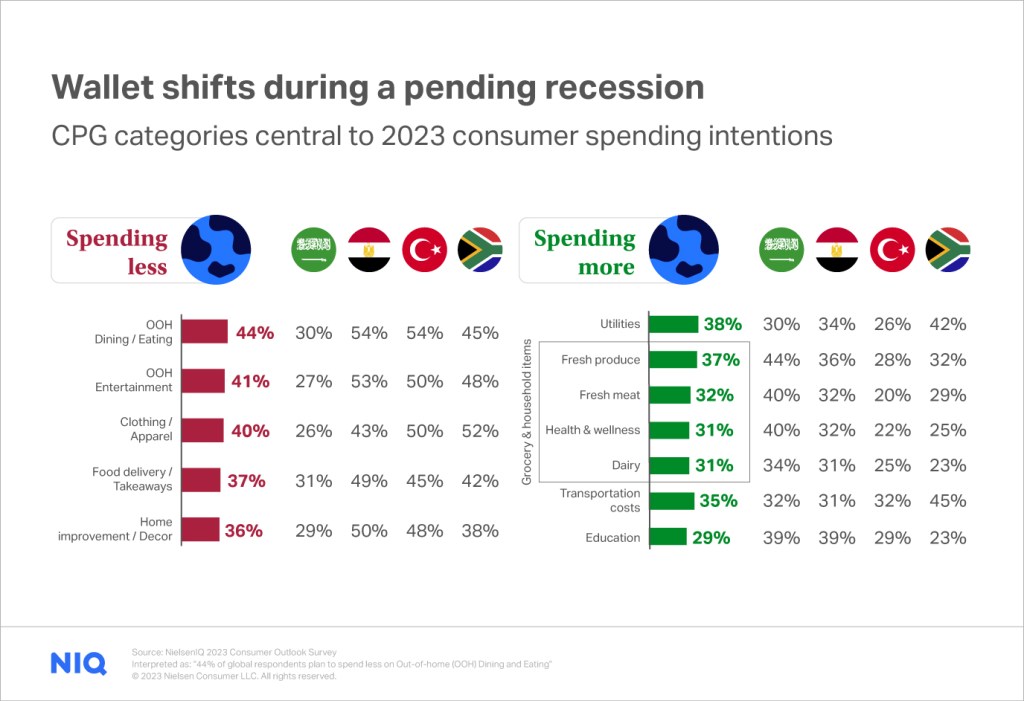

As consumers feel the pinch of higher prices, changes in consumer behavior are afoot. The NielsenIQ Consumer Outlook report shows that a substantial proportion of MEA consumers claim to be cooking more at home, spending less on entertainment, and making choices between various discretionary spending such as clothing and grooming.

Despite inflationary highs and global wage lows, there is a strong majority who are prioritizing and spending on categories they feel will propel them ahead in the long-term. Consumers in KSA, South Africa, Egypt, and Turkey are still planning to spend more on goods and services that are important for their mentall wellness and physicall health.

The opportunity for business leaders lies in understanding how these underlying changes and personal preferences are impacting shoppers’ lifestyles and spending habits — and ultimately shaping new ways of engaging with consumers as people.

Top concerns: Key areas that matter most to FMCG buyers

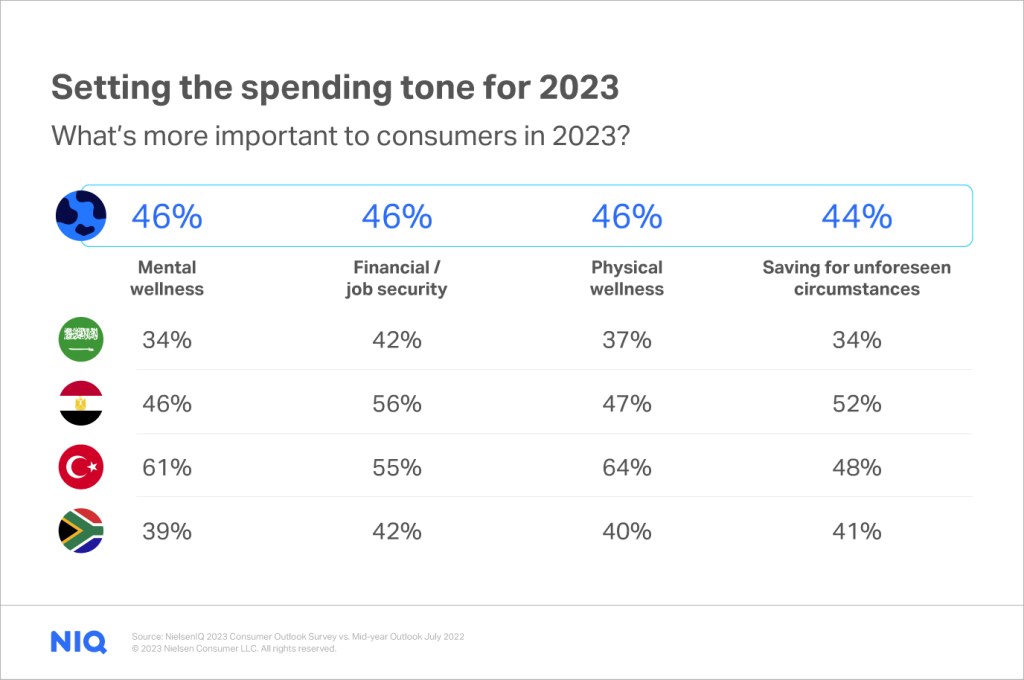

Consumers may be bracing for the worst, but they are prioritizing much more than financial solvency alone. Committed to building a better tomorrow, consumers are prioritizing a holistic view of success — balancing financial, physical, and mental health equally.

Consumers have re-evaluated the importance of many aspects of their lives, which affects purchasing decisions now and in the future. For 46% of surveyed global consumers, financial health and job security are on par with mental and physical wellness as the leading areas of greater importance to our lives. This is even more apparent in the MEA region, where the highest rates are found in Turkey and Saudi Arabia.

While MEA consumers still cite mental wellness as their top priority, in the check-in, planning and saving for unforeseen circumstances ranks higher than physical wellness. In fact, a mix of financial and health-focused priorities is what’s setting the spending tone for 2023.

Why is this important for brands?

Skyrocketing or otherwise unstable prices have made consumers less loyal. A deep understanding and knowledge of consumers will be critical to successful strategy planning for 2023. Brands must follow a common trajectory and move toward individuality and engagement by understanding and considering a changing spectrum of consumer situations, preferences, and needs.

Those brands that manage to maintain the loyalty of their customers must also maintain a sense of novelty while trying to maintain the trust of core followers and routine consumers.

From a business perspective, keep an eye on ritual habits — because consumers will now firmly decide which behavior adopted by economic changes will become permanent.

Why does this matter for retailers?

Broader adoption of shipped and delivery orders for CPG goods, as well as combined online shopping and in-store pick up trips, means retailers and brands need to carefully manage their digital and in-store shelves.

Multichannel shopping will continue to permeate the retail world, especially for shoppers with a cost-cutting mindset. From this perspective, retailers will need to develop an ecosystem of stores, online ordering, shipping, quick-commerce and rapid delivery, as well as in-store sales and promotions that can keep up with ever-growing demand.

The Future of Shopping: Predictions for consumer behavior in the FMCG industry

It’s clear that consumers feel financially pressured compared to a year ago, but resilience is evident. A look at the consumer wallet for the year ahead proves that people are committed to maintaining or even growing their spending on categories they feel will propel them toward health and prosperity in the longer term. And to the benefit of consumer goods brands across the world, grocery and household items are among the top categories consumers plan to spend more on this year.

In fact, AME consumers plan to spend less on most discretionary spending categories like out-of-home dining, out-of-home entertainment, and clothing. Instead, consumers will invest in their futures by focusing on financial services and paying off debt, while also increasing their spending on grocery and household items and contributing more to education for themselves or their families. But, despite the burden of heightened life expenses, consumers hope to spend more on categories likely to help them break through the unsettled state they find themselves in today.

Make bold decisions with superior data

When it comes to pivotal business decisions, NielsenIQ has you covered. We are here to give you not only data but also the insights to help you turn ideas into impactful strategies for what lies ahead.