CPG inflation rate slows but remains higher than pre-pandemic norm

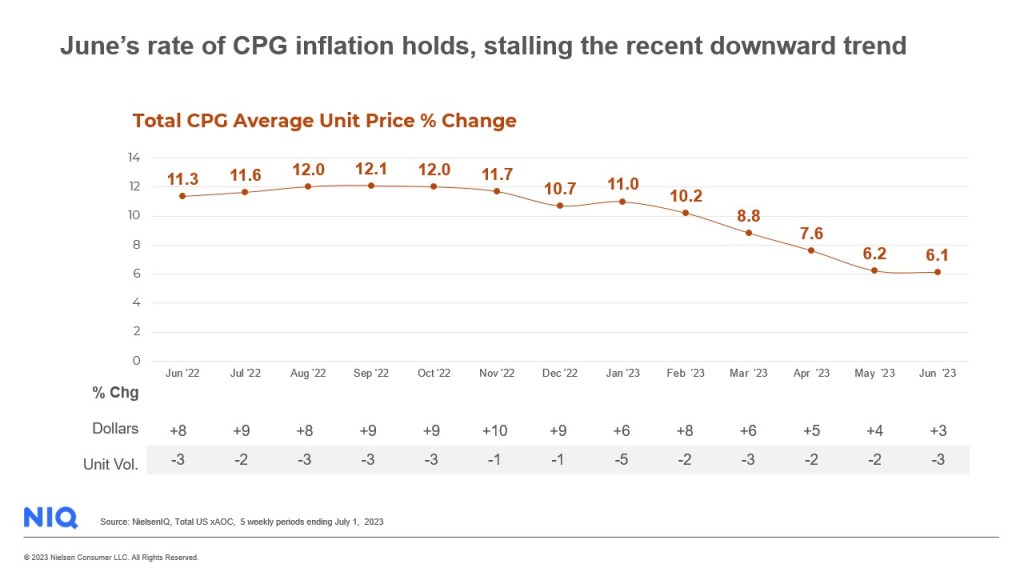

Although the rate of CPG inflation has slowed down, it remains higher than the pre-pandemic levels. In June, the CPG unit price increase rate was 6.1%, the lowest since July 2021 but significantly above the usual 2-3% range. Despite a general slowdown in overall inflation for eleven consecutive months, CPG prices are still outpacing the Consumer Price Index (CPI), which was at 3.0% in June. This high rate of CPG price increases is concerning for consumers, leading to a decline in consumption. Consumers are now spending more money but buying fewer items.

The declining consumption of CPG products compared to the same period last year is particularly worrying for the industry, as 35% of shoppers are now primarily focused on purchasing only essential items. Food inflation has also slowed down slightly but remains high at 6%, with consumption down by 3%. Non-food prices have increased by 6%, but consumers have cut back more, resulting in a 5% decline in unit sales.

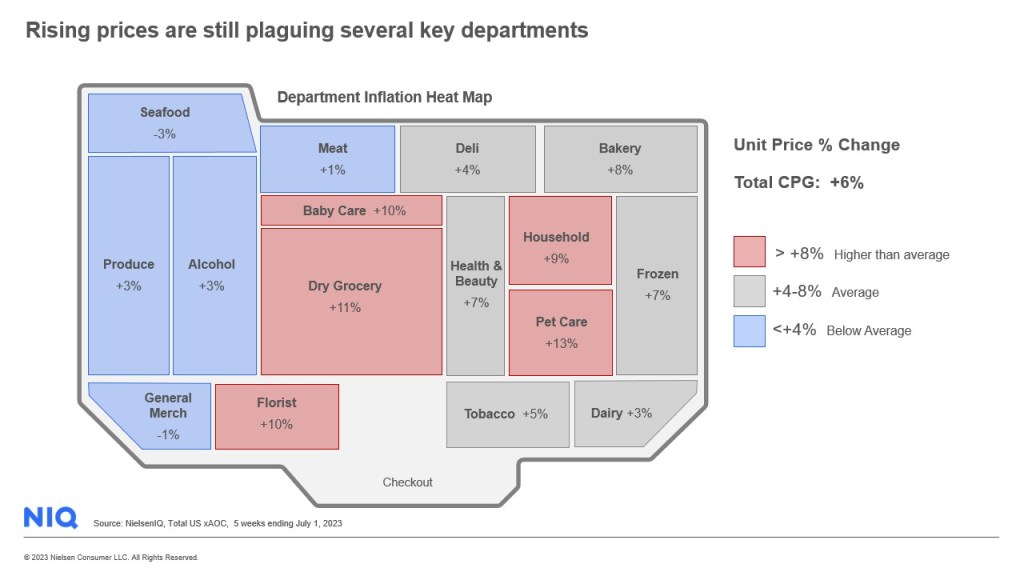

Rising prices impacting key departments

Prices continue to rise in various key departments, affecting almost all areas of the store. The increase is particularly prominent in key food departments like Dry Grocery (+11%), Bakery (+8%), Frozen (+7%), and Dairy (+4%). In the non-food category, the top 4 increases were in Pet Care (+13%), Baby Care (+10%), Household (+9%), and Health & Beauty. Food products will continue to drive sales as consumers focus on purchasing essentials.

As prices stabilize in the coming months, retailers and manufacturers must explore new strategies for growth, considering the ongoing decline in consumption. This includes focusing on innovation, promotions, and targeting specific consumer groups, such as the aging population and multicultural communities.

Consumer behavior update: Private label sales, value retailer switching, and promotions

Consumer behavior is also evolving, with an increasing preference for private label products, value-based retailers, and promotions. Private label sales, which offer an average of 13% savings compared to national brands, have grown by 4% in June. Retailers with diverse and well-established private label offerings will benefit from this trend. Value-based retailers have experienced a sales increase of 5% compared to the previous year, capturing 42.4% of CPG sales, with food being the main driver of their gains. Promotional sales have also risen by 8% in June, accounting for 27.1% of CPG sales. However, retailers must be cautious not to over-promote, as this may not be a sustainable profit strategy and could undermine customer loyalty.

Prepare for slower retail growth in the months ahead

Looking ahead, retail growth is expected to slow down further, as consumers have already adjusted their shopping behavior to cope with price increases. Lower levels of inflation will not be enough to compensate for declining consumption. Businesses will need to adopt a more strategic approach to identify growth opportunities and focus on gaining market share within their respective categories. This includes understanding the key drivers and challenges facing their business, optimizing product offerings, pricing strategies, and trade spend, and collaborating effectively with retail partners for mutual benefits.