The countdown to Amazon Prime Day has begun

For e-commerce insight leaders, understanding the peaks and valleys relevant to the operational omni environment can be a strategic differentiator to gain clarity on where to focus and allocate resources. This is an important component to any omnichannel strategy. This year, all eyes should be on the weeks leading up to and following Prime Day, which is happening on July 11 –12th.

Will CPG win Amazon Prime Day in 2023? While electronic sales will likely still dominate, the enduring cost-of-living crisis has CPG brands poised and positioned to have a major growth moment. However, success will only come if practitioners are able to effectively navigate the Prime Day landscape and offer the right products with the right promotions. Implementing the right levers with a full view into the Amazon omnichannel landscape will be critical to CPG’s success.

5 Things to Know: Amazon Prime Day 2023

1.

Consumer packaged goods (CPG) grocery and everyday essentials will play an even larger role in Prime Day 2023.

As seen in 2022, consumers are shopping Prime Day for everyday essentials. According to NIQ’s real-time reporting of how consumers shopped Prime Day in 2022, almost half of Prime Day shoppers came to stock up on everyday household items — garbage bags, laundry detergent, paper products, etc. — as they look to broaden their savings strategies, with 44% of consumers surveyed prioritizing everyday essentials and purchased household products. In 2023, watch for an even stronger CPG showing.

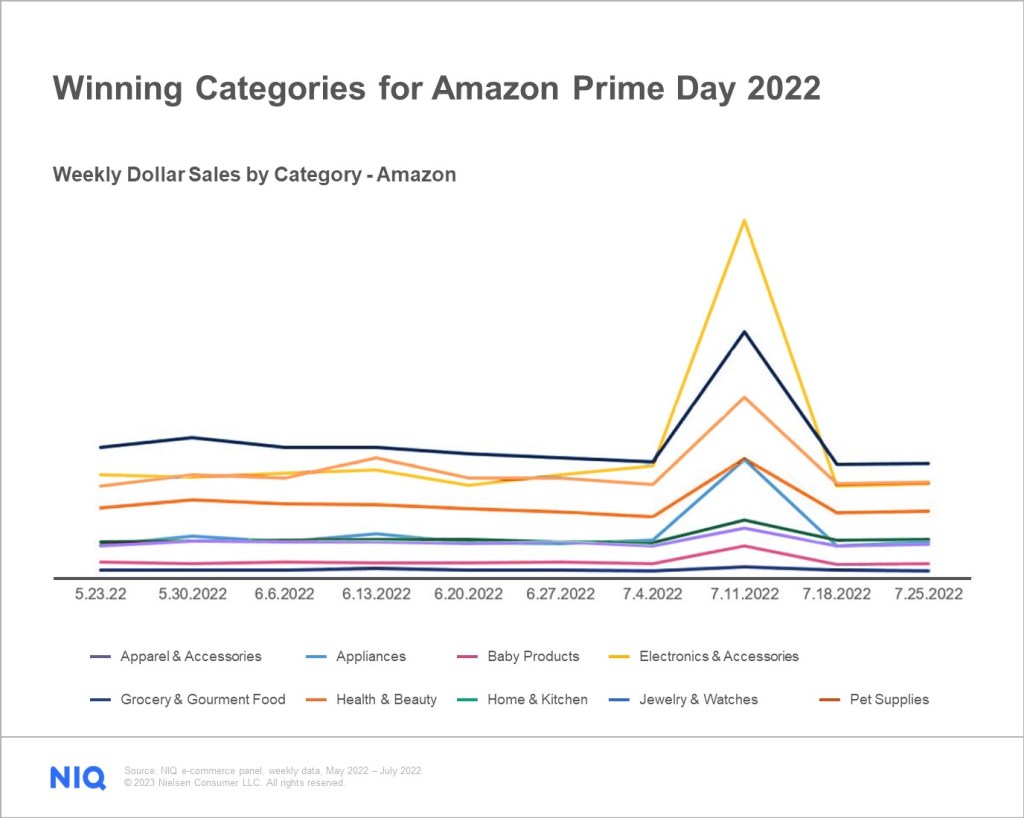

CPG’s presence on amazon prime day is growing and notable

Hands down, electronics and home/kitchen goods were the winning and top-selling categories during Prime Day 2022. However, the rising presence of CPG categories such as Health & Beauty, Grocery, and Pet supplies on the scoreboard cannot be ignored.

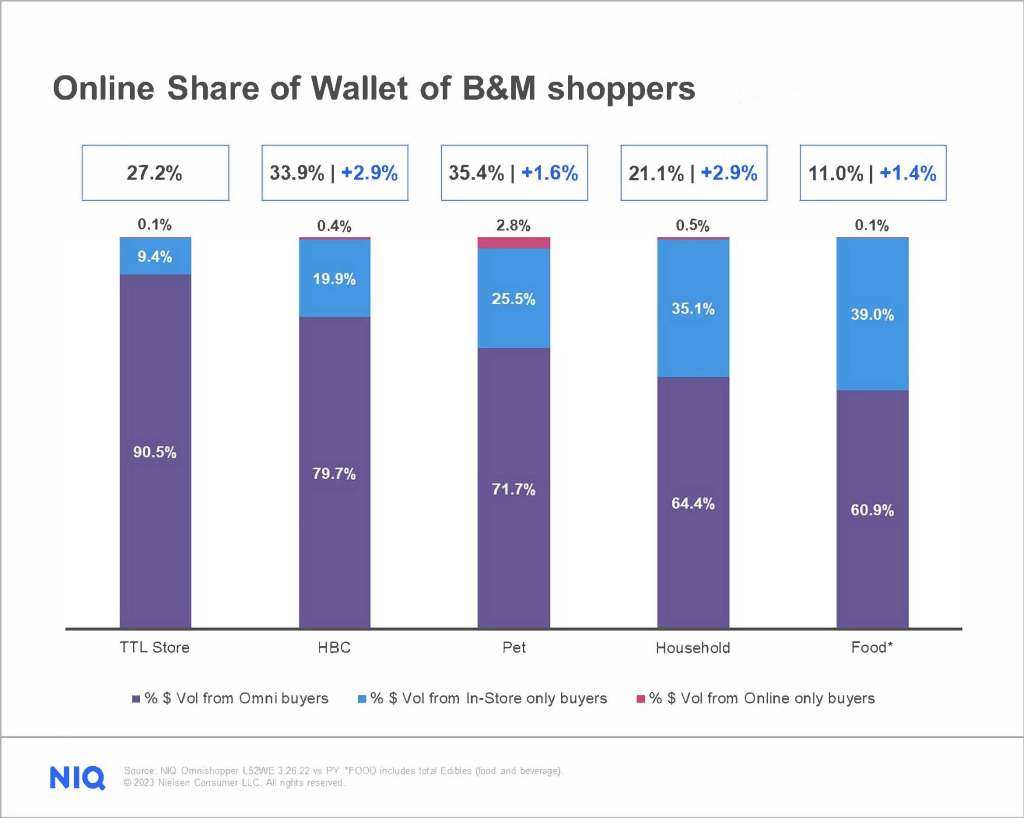

The shifting habits of consumers shopping for more CPG goods online on Prime Day is a solid reflection of the continued emergence of omnishopping. NIQ Omnishopper data shows that consumers are increasingly adopting an omnichannel mentality when it comes to grocery goods. For example, the online share of wallet of brick-and-mortar shoppers for pets now stands at 35%. For health and beauty care, the online share of wallet of brick-and-mortar shoppers stands at 33%. For food categories, the online share of brick-and-mortar shoppers stands at 11%. While food shows the lowest share of wallet on this chart, there is ample growth opportunity in food. More on that in a little bit.

As more and more consumers come to online destinations and shop deal days like Prime Day for their everyday essentials, they are often met with a bevy of CPG offerings across first-party (1P) and third-party (3P) sellers. This means that consumers are coming to Prime Day, looking for deals on a specific brand (maybe even yours) – and the purchase and interaction could be captured by an entity outside of your purview.

NIQ’s read into the 1P/3P business environment across Amazon.com shows that it is likely that your brand is participating in Prime Day, whether you know it or not. This is especially true for health and beauty care brands where 3P volume is showing higher than 1P during the week of Prime Day. Note — the battle stretches beyond just Prime Day. NIQ data shows that 3P volume for health and beauty care brands in 2022 saw a 52% lift in the week leading up to Prime Day and a 33% lift the week after Prime Day. Having a read into the 1P and 3P dynamics will enable practitioners to better navigate the 1P and 3P competitive landscape in the weeks leading up to, during, and after Prime Day.

1P Volume the week of

Prime Day in 2022:

- Baby Care: $121 MM

- Food: $193 MM

- Health & Beauty Care: $358 MM

- Household Care: $129 MM

- Pet: $134 MM

3P Volume the week of

Prime Day in 2022:

- Baby Care: $101 MM

- Food: $188 MM

- Health & Beauty Care: $622 MM

- Household Care: $65 MM

- Pet: $98 MM

Source: NIQ Amazon Sales & Share, Week ending 7.9, 7.16, and 7.23.22

2.

CPG is punching below its weight on Prime Day

NIQ Omnisales data shows that during 2022, 20% of Amazon.com sales came from CPG products. During Amazon’s July 2022 Prime Day event, only 14% of sales were of CPG products. In assessing Amazon’s October Deal Day event, the percentage of CPG sales slightly increased to 16%. There is share to grab that CPG has proven (during the rest of the year) that it can take.

For the October rise, it is possible that the growing impact of inflation compelled more consumers to do a bit of pantry loading, to seek deals, and stock up on the everyday essentials that define CPG. However, with the mindset of pantry loading front and center, let’s consider pack size sales strategies. Larger package sizes very much characterize many CPG sales on Amazon. For many CPG brands, particularly those with slow replenishment cycles, a Prime Day purchase of a large pack on Amazon could potentially fulfill a consumer’s category needs for months to come, squeezing out competitors from consumers’ shelves for months.

Opportunity is being left on the table. CPG practitioners should punch up.

3.

Deal seekers will be looking for a reprieve from specific high-priced CPG categories

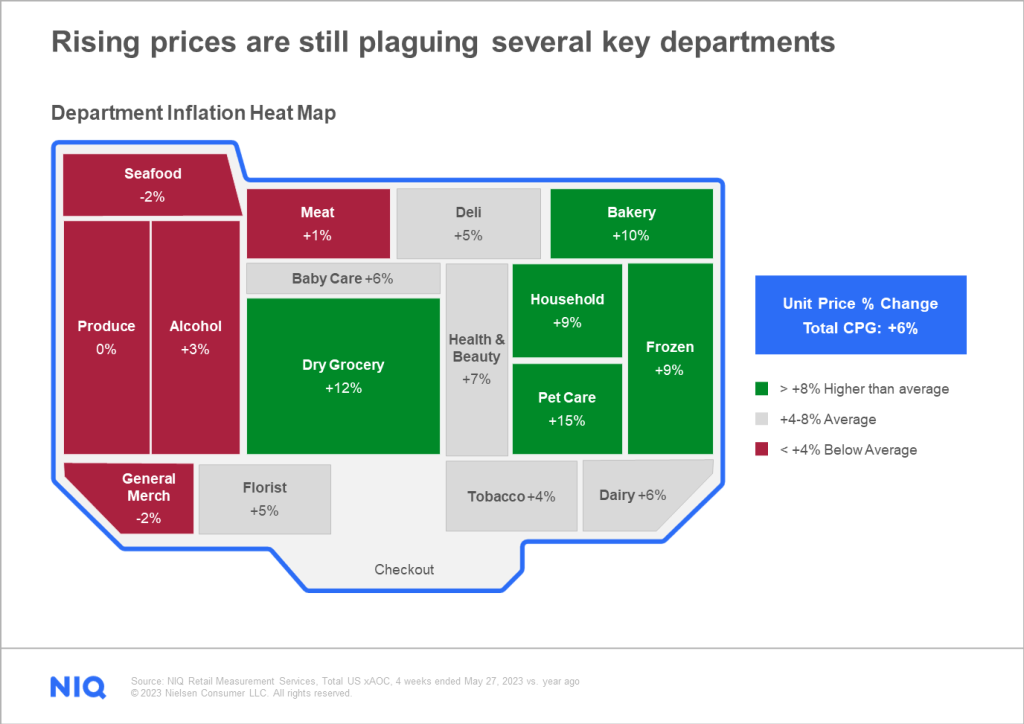

Declining consumption remains a concern for the industry as consumers focus their spending on the essentials. The latest NIQ data shows that the rate of food inflation is slowing but still high at 7%, with consumption down 2%. Similarly, non-food prices increased by 6%, but consumers pulled back more so, with a 5% decline in unit sales. Without question, consumers are at a breaking point, where they will be looking for any relief from enduringly high food prices.

The below map showcases NIQ’s view into where rising prices are still plaguing several key departments within traditional brick-and-mortar retail. While it has been well documented that consumer’s adoption to Amazon’s grocery retail offering has been slow, the extreme environment may be primed for hyper-focused, value-driven consumers who are more open than ever to shop across platforms for the best price available.

4.

Prime Access will open deals to more people in need, but deep discounts and blockbuster deals will be limited

Amazon’s launch of Prime Access, which rolled out in October 2022, is a timely move. NIQ data shows that 56% of U.S. consumers believe we are already in a recession. Building on that, NIQ’s consumer outlook report found that nearly two in five consumers (39%) feel they are in a worse financial position this year. And of those consumers, 74% say that increased costs of living are to blame for their recent financial struggles. Amazon Prime Access, a discounted Prime membership for qualifying government assistance recipients in the U.S., will bring some relief to consumers in need.

However, CPG companies struggling in the current economic environment to trigger deep discounts will likely provide moderate discounts on their products on Prime Day. This means consumers may not see many deep discounts on everyday essentials. Instead, constrained consumers will be met with fewer blockbuster Prime Day deals and, most likely, more prompts and perks toward loyalty.

5.

Food sales will be a battleground to watch

More and more consumers are adopting an omnichannel mindset and shopping for their everyday essentials, both online and in-store.

Food categories on the rise

A recent NIQ analysis shows that the following food categories saw outsized sales levels during both Prime Day holidays (July and October) in 2022. Note — within the products listed, many of the below do fall within the snacking category

- Beverages

- Coffee

- Candy/Gum/Mints

- Beverage Enhance

- Salty Snacks

- Nutrition & Cereal Bars

- Cookies & Crackers

Nuts & Seeds

Source: NIQ Amazon Sales & Share, during week of 7.9.22 and 10.9.22

As food, in general, continues to grow online, one category to watch would be snacks. So far, in 2023, within the snacking omnichannel universe, online growth (14%) is outpacing in-store (10%) for snacking dollar growth.

For CPG e-commerce insight leaders, the influence and importance of amazon prime day is undeniable. Looking across the year, it’s also interesting to note that Amazon’s share during Prime Day accounts for about 60% versus the total year, where Amazon’s share accounts for about 40%.

Source: NIQ OmniSales, 52 weeks ending 12.31.22

The rising tide of amazon prime day

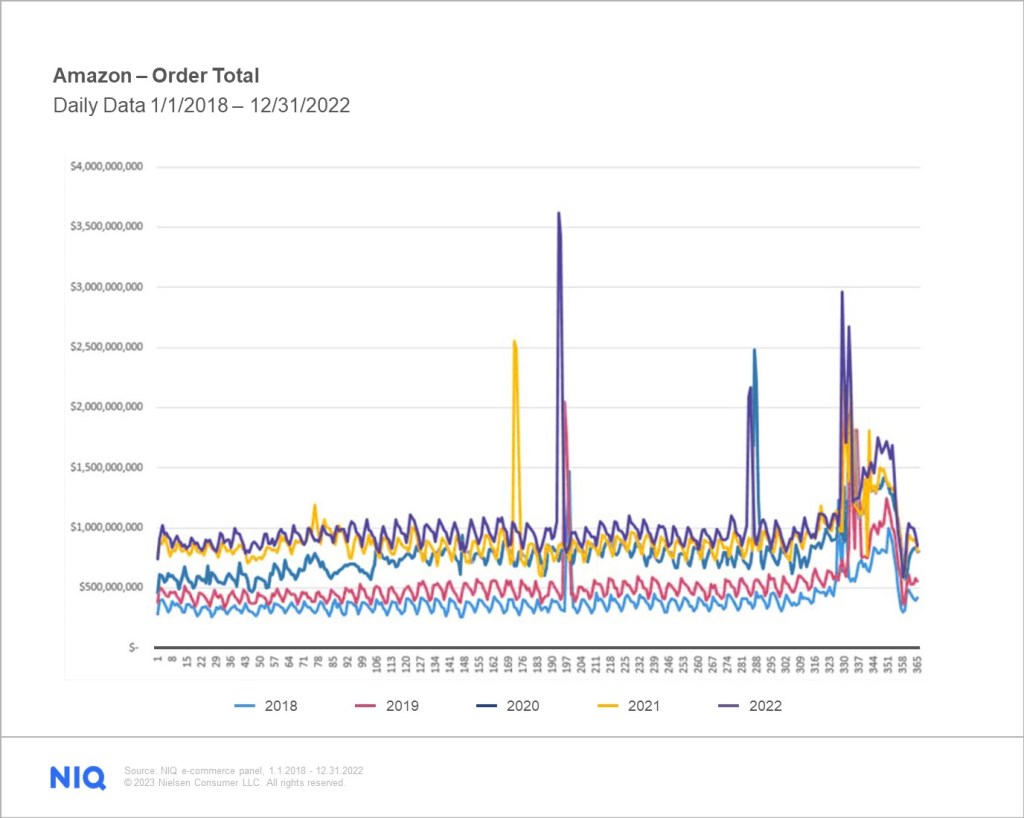

Since its inaugural launch in 2015, Amazon Prime Day sales have shown strong and impressive growth year-over-year.

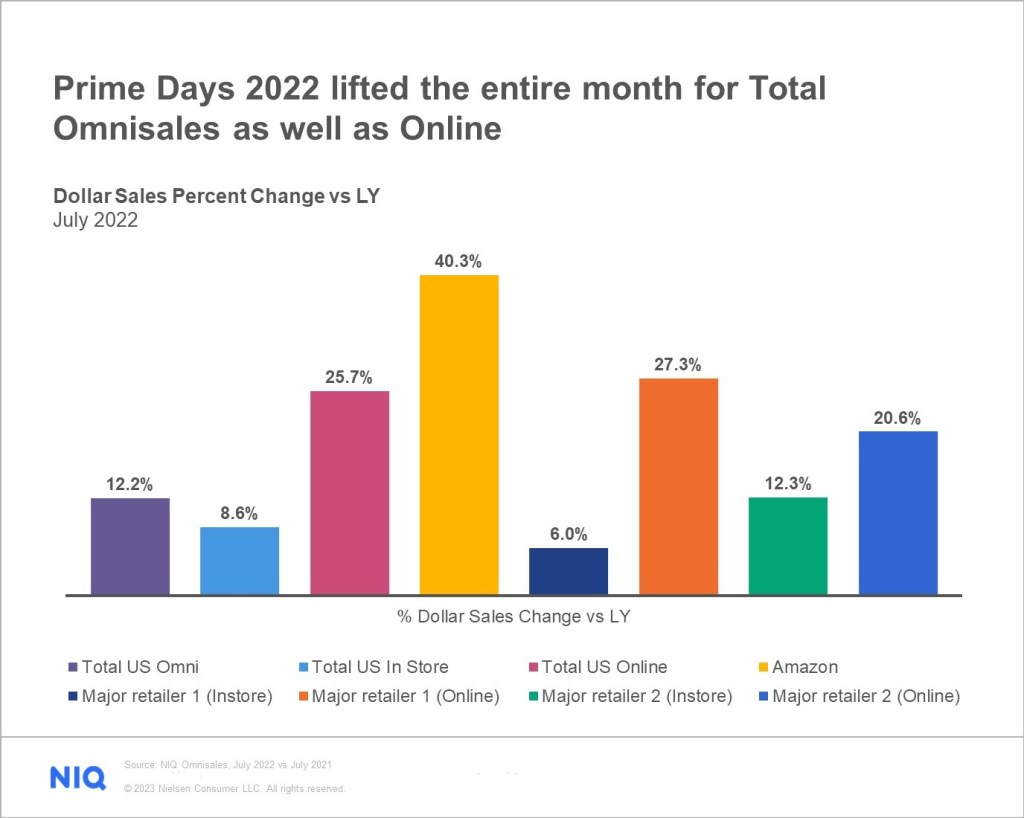

The success of Amazon Prime Day has created a sweet spot for deal day shopping that lands at a perfect time to cater to back-to-school, holiday in July, or just everyday shopping needs. In previous years, other major retailers held sales during Prime Day timing, and this year will be no different.

Amazon, Walmart, and Target will be holding competing deal day shopping events for consumers, creating a groundswell of savings for this year’s inflation-fatigued, constrained consumers.

A moment for CPG retail

- AMAZON PRIME DAY: JULY 11 – 12

- WALMART+ WEEK: JULY 10 – JULY 13

- TARGET CIRCLE WEEK: JULY 9 – 15

With this in mind, it should be noted that the massive tide of sales that’s initially sparked by Amazon’s Prime Day event ignites a firestorm of sales throughout the total omnichannel landscape across the entire month of July.