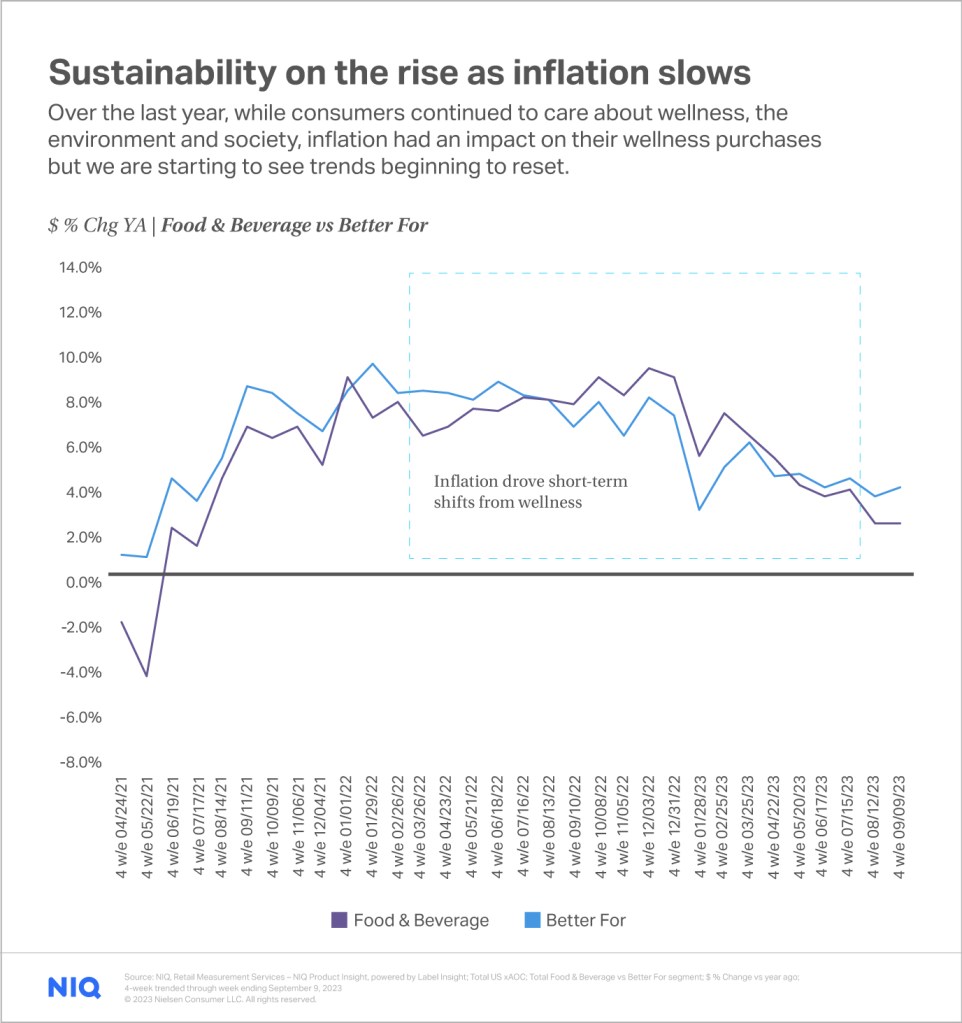

Consumer sustainability trends bounce back despite inflation

The latest NIQ data shows that sustainable consumption trends are bouncing back despite the inflationary climate. As CPG firms plan strategies for growth in 2024 and beyond, it is critical to understand the Green Divide consumer and the nuances of their purchasing behavior to achieve growth while consumers face historically high cost-of-living pressures.

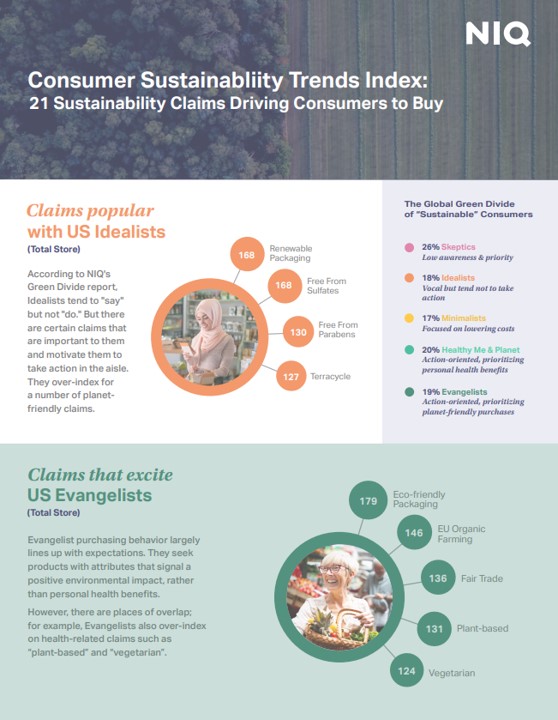

This snapshot of consumer sustainability trends was created by leveraging projected sales data from NIQ Product Insight. Popular health and sustainability claims in the US were analyzed through the lens of shoppers in each “Green Divide” consumer segment: Evangelists, Healthy Me & Planet, Minimalists, Idealists, and Skeptics.

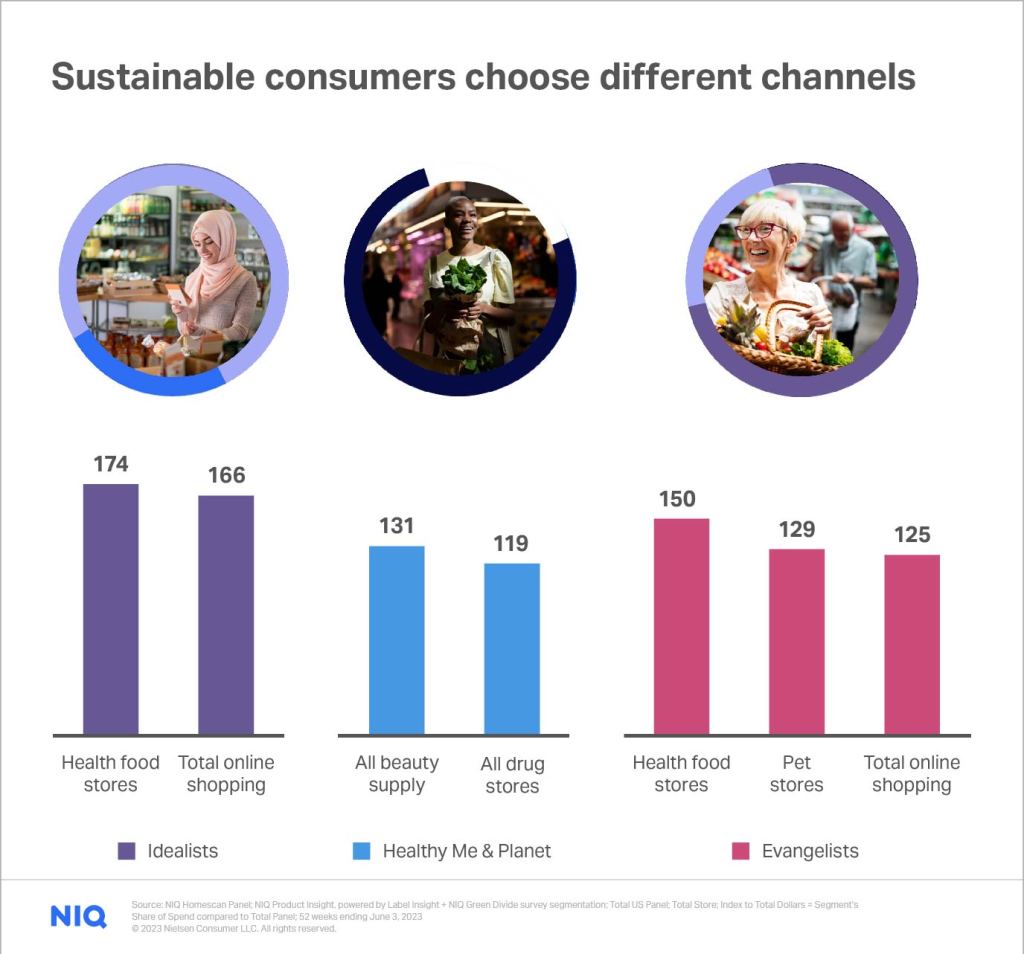

The analysis determined which attributes cohorts are spending a higher percentage of their Total Store dollars on than the average consumer. An index greater than 120 indicates a notably higher spend, and an index less than 80 indicates a notably lower spend.

Although the analysis was conducted with a subset of relevant attributes in the US, there are hundreds of attributes and claims across the globe to consider. CPG marketers should ask their data provider for a custom analysis to determine which claims are important to the “green” segments in their markets.

How can you take action with these insights?

Now that you’re familiar with the different consumer segments and which attributes they buy, what’s next?

Brands

Brands can use this knowledge to win shelf space and show their value as a partner to retailers. For example, say a beauty brand finds that a certain retailer has a gap in Idealists in the Beauty aisle, but the brand’s products over-index with Idealists. The brand can make a strong case to the retailer by showing its ability to increase engagement with the under-indexing segment. In essence, this knowledge helps companies make smart decisions to improve product placement and partnerships, ultimately driving growth and success.

Retailers

Retailers can leverage insights about consumer sustainability trends to determine if they’re winning their (fair) share of sustainable consumer segments. For example, a retailer may find that there are a high number of Evangelists (or another target cohort) in their geographic market who are not patronizing its stores. Knowing that there is a gap, the retailer can take action to attract and retain more Evangelists.

Understanding (and leveraging) where segments buy

Once you know what sustainable consumers are buying, it is equally important to identify where they’re buying those products.

What types of retailers (or e-tailers) do they prefer? Are there certain categories they prefer to buy at specialty stores?

An analysis of NIQ Homescan panel results revealed the following consumer sustainability trends in channel selection:

Curiously, US Idealists outperform Evangelists in both brick-and-mortar health food stores and online shopping. Winning their sustainability dollars will require an optimized online presence to create intuitive, user-friendly experiences. Healthy Me & Planet consumers lean into beauty supply stores for their sustainable shopping needs, and Evangelists seek out Pet stores to provide for their furry companions.

Insights like these can inform how you engage these consumer segments in the aisle. For example, with Evangelists’ high interest in Pet stores, mass and health retailers can take steps to attract them to the Pet aisle with the planet-friendly attributes they’re seeking in the category. Manufacturers can partner with retailers to place displays with environmentally conscious Pet products near the aisles Evangelists already frequent to encourage trial and retention.

How should marketers approach sustainability messaging?

Why is shopping sustainably challenging for consumers?

The next installment in our “Green Divide” series will explore the question, “Why is shopping sustainably so hard for consumers?” We will examine nuances around green consumers’ thought processes and how to create messages that resonate (rather than alienate), based on groundbreaking neuroscientific research.

Consumer decision-making when it comes to sustainability is fundamentally different from other consumption decisions, at a neurological level. Consequently, influencing sustainable consumer behavior requires an understanding of that unique decision-making process.

Want more secrets to success in sustainability?