A glimpse into car purchasing patterns in urban India

- 48% of consumers say they search for information online before visiting or consulting any offline medium

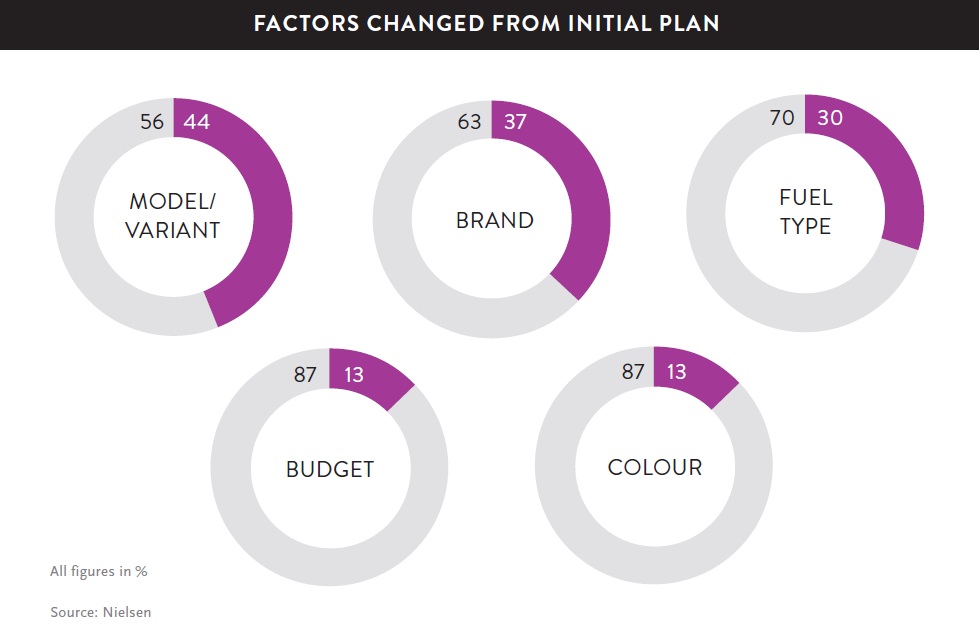

- 87% of the consumers reconsider one purchase decision factor (brand, model, fuel type, budget, colour etc.) at the time they buy

- Sales staff at showrooms can heavily influence (73%) last minute changes in decisions and guide car buyers’ choices

Today, India’s auto sector is among the top 10 automotive markets in the world and is poised to grow as income levels continue to increase and finance becomes easily available. While the market has been sluggish overall and produced very few individual successes, most manufacturers are looking at India as the next big hub. The potential is high because car penetration is low compared to other countries.

We recently conducted a survey to decode Indians’ car purchase patterns, specifically the behavioral aspects. To do so, we looked at the purchase journey as a whole from the initial search to the final buy. The consumer’s first step once the need is triggered, is searching for specific information.

While word-of-mouth remains one of the most important sources of information (used by 96 percent of consumers), other trends are also gaining traction. Almost half of the consumers are now following the Research Online, Purchase Offline (ROPO) method. Forty-eight percent of consumers said they searched for information online before visiting or consulting any offline medium.

Of late, the Internet even plays a role in consumers’ other information sources—including word-of-mouth. A large part of shoppers’ conversations and discussions between family and friends is now online.

During online searches, “technical specifications” topped the most searched information list; “car comparison” and “expert reviews” were the other key details sought online. Consumers also compared different cars they were considering and read expert reviews for their intended purchase.

Offline, 39 percent visited the dealership and 36 percent spoke to their local car mechanics for getting more information about vehicles.

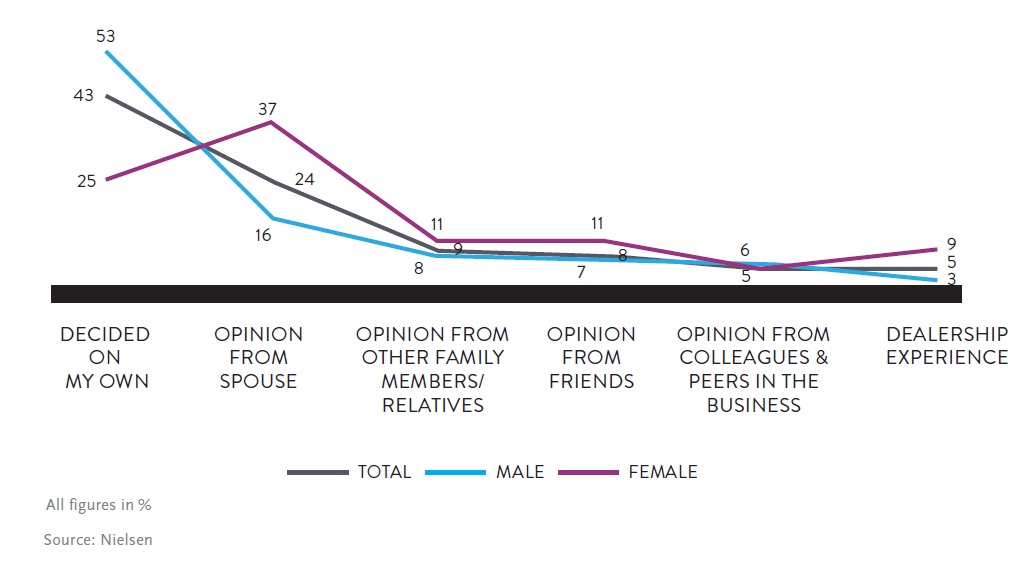

The decision makers

After collecting information from all sources, 43 percent of consumers reported making their final decision on their own while 33 percent said they consulted their spouses and close family members. This mainly reflects men’s decision-making habits—they’re more likely to make decisions on their own (53% vs. 25% for women) while women are more likely to ask their spouse and family members (48% vs. 24% for men). However, the number of women buyers is growing, especially in the luxury segment. A report by car manufacturer Mercedes noted that more than 5 percent of its buyers in India are women.

The increase in women buying cars could reflect the growing female working population and lifestyle changes. This clearly indicates that women car buyers are the next segment that marketers need to focus on and highlights the importance of understanding gender-based automotive needs.

The last mile switch

While most marketers think that the car shopper decides to buy a car before visiting the dealer, consumers aren’t as predictable as we think.

Buyers can always be influenced—right up to the last moment of their purchase. Three out of five shoppers said they had finalized their decision on the model, brand and fuel type before visiting the showroom. However, when the time came to make their final purchase, a considerable number of consumers change their minds. A third of buyers who said they’d decided about fuel type, changed their decision after talking to the salesperson, family and friends.

And it’s not only fuel type decisions that consumers change—44 percent changed even the car model they were thinking of buying! In fact, our studies show that car buyers also look at models that they had not even initially considered.