A welcome from

Marta Cyhan-Bowles

We’ve recently had an incredible opportunity to speak directly with chief marketing officers (CMOs) across industries about the challenges shaping their world. What struck me most is how universal these challenges are—whether it’s navigating fragmented data, proving return on investment (ROI) under tighter budgets, or integrating artificial intelligence (AI) in ways that deliver real business value.

Despite the complexities, one theme stood out: resilience. CMOs are drawing on creativity and business acumen to solve problems that have no easy answers. They’re balancing short-term performance with long-term brand building, finding clarity in a sea of data, and leading their organizations through disruption with confidence and purpose.

This year’s CMO Outlook: Guide to 2026 reflects those conversations and the survey feedback from other senior marketing leaders across the globe. It offers insights into the contradictions they’re grappling with and provides actionable strategies to turn these challenges into opportunities.

As you read, I hope you find inspiration and practical guidance to help you lead with confidence in the year ahead.

Chief Communications Officer & Head of Global Marketing COE, NIQ

Marta Cyhan-Bowles is Chief Communications Officer & Head of Global Marketing COE at NIQ. A proven marketing and communications leader, Marta specializes in guiding teams toward long-term customer success through data-driven rigor and a personal bias for innovative campaigns that captivate, engage, and ultimately drive measurable growth. As head of the Global Marketing COE, she leads the charge in unifying the global team at NIQ across communication and thought leadership efforts to unlock transformational value for C-suite leaders across the retail and manufacturing sectors.

Find insights, actions, and tools to support your 2026 strategies. Watch this preview and then read our CMO Outlook: Guide to 2026.

Chapter 1:

The crossroads

If the last decade has been defined by disruption, 2025 has only deepened the trend. CMOs are contending with a fresh wave of uncertainty, punctuated by shifting trade policies, geopolitical unrest, and the looming threat of an economic slowdown—driving them to recalibrate strategies in real time.

Consumers have also adapted to a “new normal” once again, with caution becoming the default. Shoppers are more selective and demanding of brands as they seek to maximize their budgets while anticipating the next disruption. This shift has placed sustained pressure on organizations to create a precise balance of value, trust, and quality. Marketing leaders find themselves at the center of this equation, tasked with delivering results in an environment in which expectations are high and resources are tight.

“Gone are the days where allocation of budget is based on judgment. It’s much more fact-based, and every single dollar is interrogated much more than it ever used to be.”

—Mark Cooper, Global SVP, Marketing Operations and Portfolio Management, Coty

Every marketing dollar is now under the microscope. With organizations seeking cost reductions and marketing budgets often in the crosshairs for cuts, CMOs are in the critical position of demonstrating their strategic value in driving awareness and growth while delivering lasting brand loyalty. They must do more than spend wisely; they must prove impact.

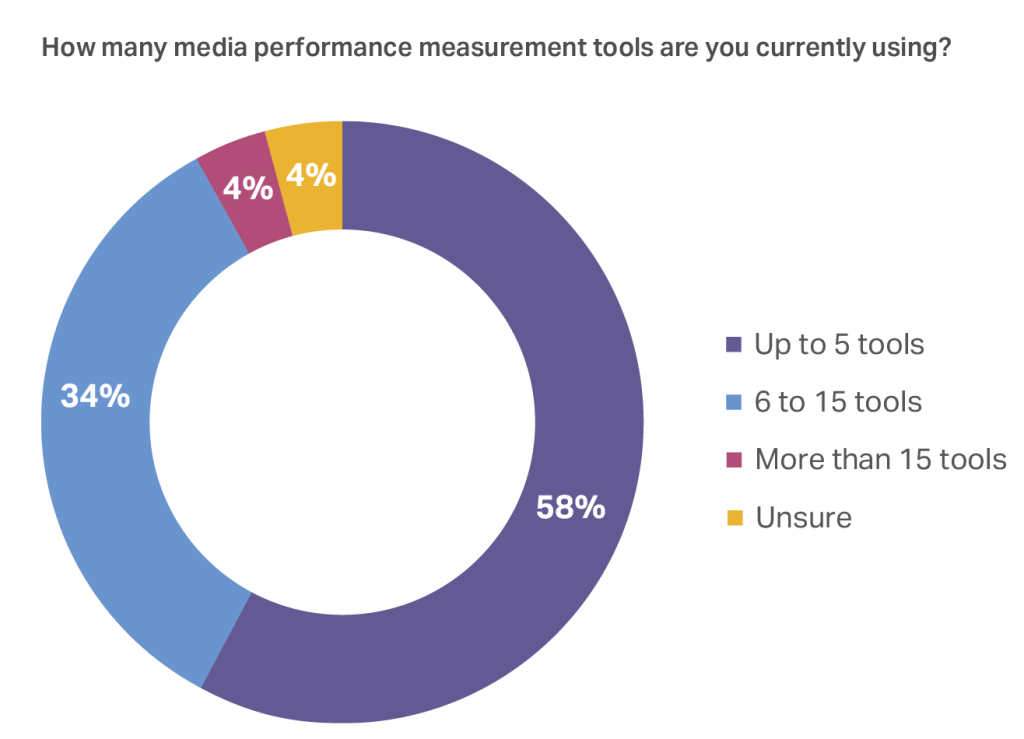

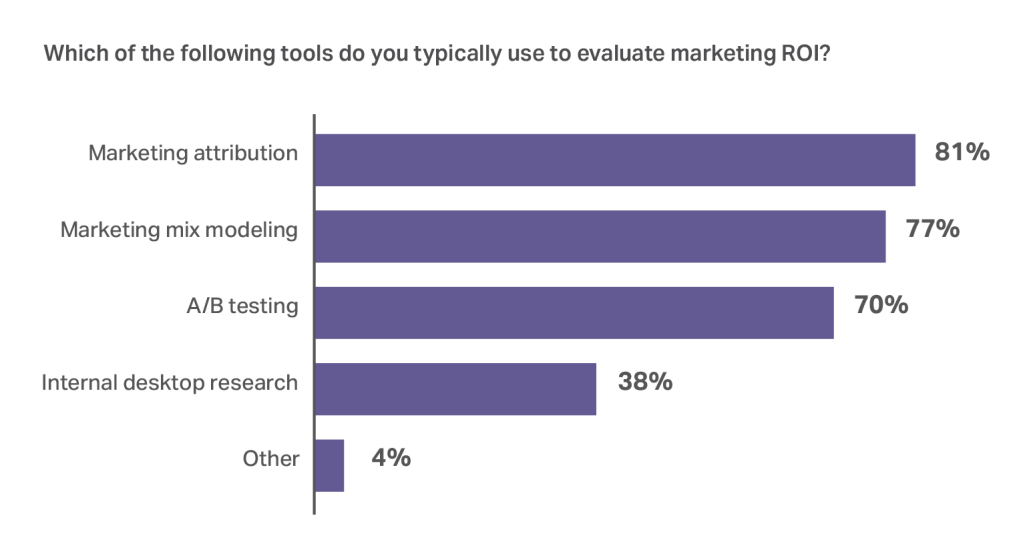

The pressure is palpable: 74% of CMOs say they’re under more scrutiny to prove marketing ROI. Yet at the same time, only 34% say they must work harder than other business functions to secure budget, and only 38% feel their brand is more affected by today’s economic environment than their competitors—suggesting a shared understanding that the present challenges are universal.

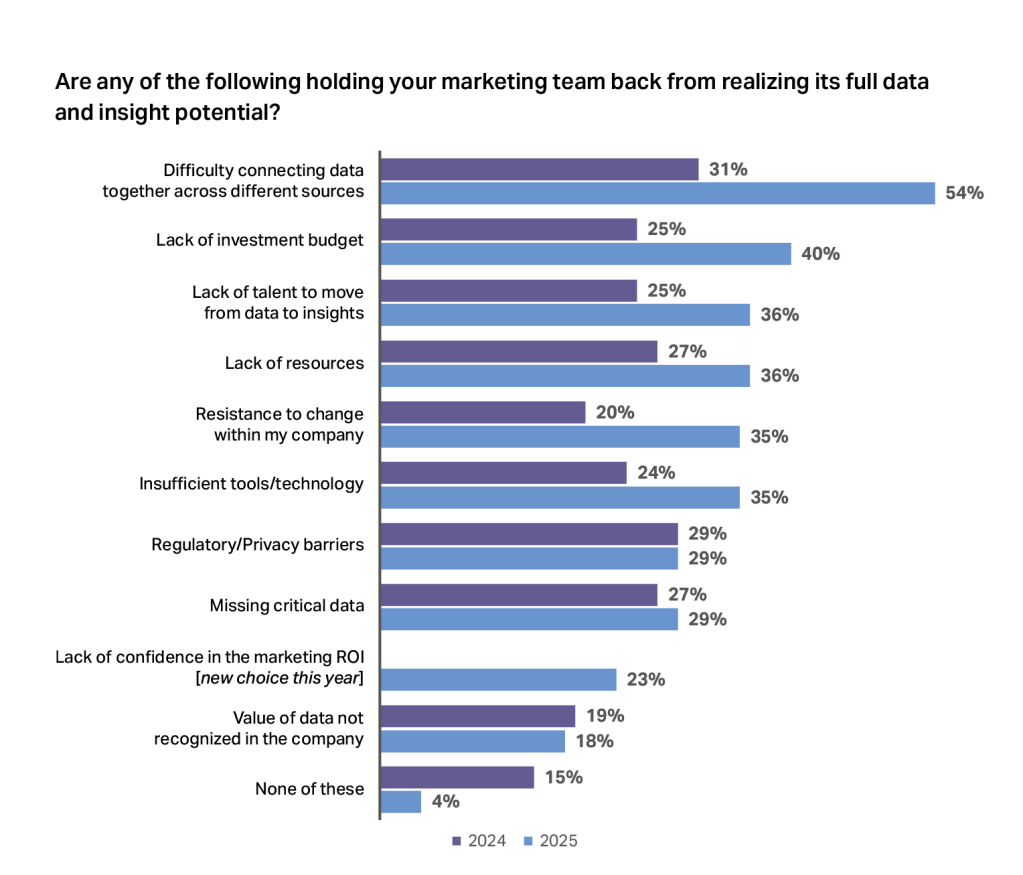

Further complicating the picture is an explosion of data: With more information at their fingertips than ever before—and the expanding mix of off-platform (social, programmatic) and on-platform (retail media networks, or RMNs) channels adding to the complexity—marketing leaders are tasked with integrating fragmented data sources into a singular, actionable view that delivers cross-functional value and optimizes investments toward the channels that perform best.

Are they rising to the challenge?

Data, decisions, and the drive for ROI

To answer that question, NIQ surveyed more than 250 CMOs and senior marketing decision-makers from influential companies across regions, industries, and organizational sizes—gaining insight into how they’re:

- adapting to consumer behavioral shifts

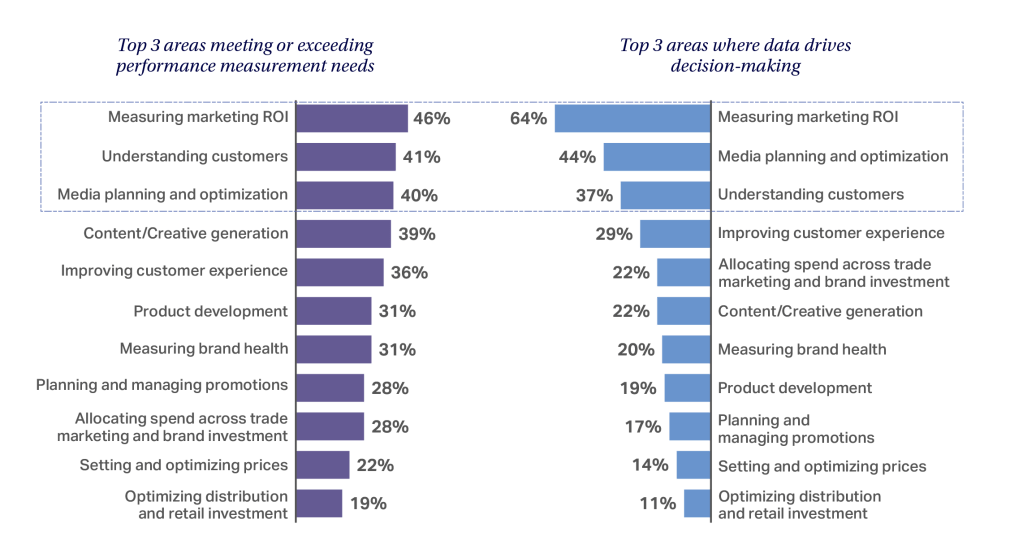

- navigating performance measurement and marketing return on investment (ROI)/return on ad spend (ROAS)

- managing increasingly complex channel ecosystems with leaner teams

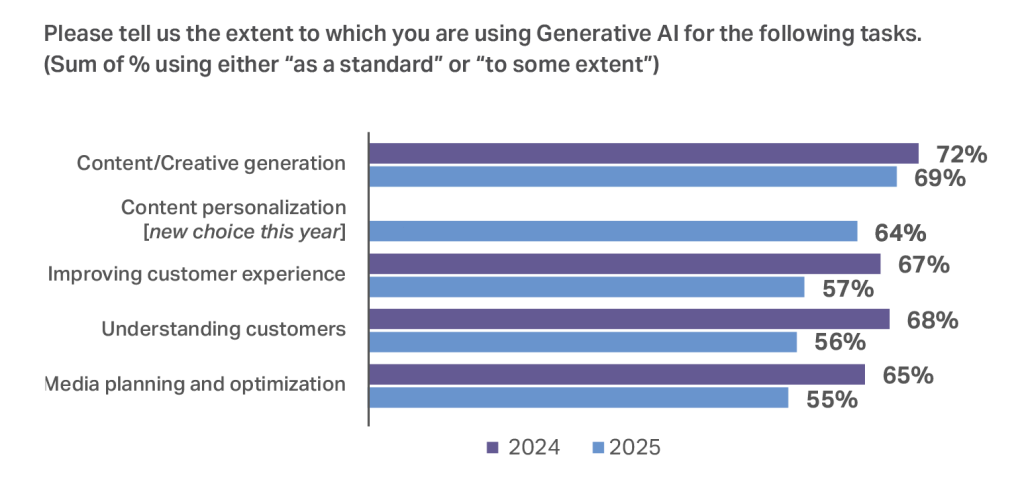

- evaluating AI integration to drive more efficiencies

Drawing on insights from survey responses and qualitative interviews, we found that marketing leaders are navigating a landscape full of contradictions.

- CMOs are confident but have little margin for error. Despite headwinds, CMOs say they are optimistic about growth. But with pervasive budget reductions, their confidence is tempered by a mandate from peers and senior leaders to make every dollar count—and to prove that they delivered. This has resulted in a strong push toward digital, but omnichannel is also a must.

- CMOs have no shortage of data but lack full connectivity. The proliferation of media channels has created unprecedented opportunities to engage with consumers, but walled gardens, privacy regulations, and disconnected platforms have exacerbated data fragmentation—the primary barrier CMOs attribute to keeping them from maximizing the potential of insights and translating it to teams, colleagues, and senior leadership.

- CMOs are confronting a growing tension: Defend and grow brand position or seek the most efficient conversion. With consumers demanding more value and private label pressure increasing, it has never been more important for brands to defend their premium position. Yet there is growing pressure for CMOs to allocate their budgets to the bottom of the funnel, risking long-term brand equity.

- CMOs must prove they’re AI innovators—when the technology has been in their stacks for years. AI has long been quietly powering marketing optimization, targeting, and automation. But CMOs are now under increased pressure to demonstrate usage and impact. The next frontier isn’t AI adoption per se; it’s making strategic investments in AI that augment their current marketing tech stack, accelerate insights, and directly connect to ROI.

As leaders navigate these collective challenges, NIQ’s CMO Outlook: Guide to 2026 serves as a strategic compass—providing clarity, benchmarks, and foresight to guide smarter investment decisions and unlock growth in the coming year and beyond.

Chapter 2:

When brand value meets growth pressure

In this increasingly complex landscape, CMOs’ contributions to both brand and volume growth are often the clearest signal of whether their strategy is working. With consumers scrutinizing prices and claims in search of value and quality—and with private label continuing to maintain its elevated share—marketing teams are retooling everything from claims on pack to promotional and channel strategies, all while weighing how to maximize engagement.

This complexity is reflected in how CMOs feel about their brands: Last year, 83% expressed confidence in their brand’s mission and purpose beyond commercial goals. This year, that number has dropped to 71%.

Part of this decline likely stems from the external pressures CMOs are facing. But survey data also strongly suggests an internal tension might be growing between CMOs and their executive counterparts when it comes to long-term brand investment: 69% of CMOs say their CEO and chief financial officer (CFO) believe in the value of long-term brand building—down sharply from 80% last year. And when we asked about their budget allocation between long- and short-term goals, only 55% said they were allocating 60% or more to long-term brand-building—down slightly from last year’s 59%.

Yet amid declining confidence, CMOs appear to be rising to the challenge. Despite the percentage dip of leaders who say company performance has grown over the past three years (down from 70% to 61%), their outlook for future growth remains steady, at 75%. This optimism suggests a shift in mindset similar to that of consumers: Disruption isn’t a temporary condition; it’s the new operating environment.

There’s also resilience in the numbers. A strong majority—83%—continue to view their brand as a commercial asset, consistent with last year’s findings. That confidence, even amid uncertainty, suggests that while strategies may be in flux, the foundational equity built over time is still delivering value—at least for now.

Value, visibility, and the new rules of loyalty

- NIQ’s Expanded Omnishopper US data shows that private label (+5.5%) and national brands (+6%) are growing at similar rates compared with last year, but national brands still lead in revenue per occasion—earning more than twice as much per occasion ($31.60 per occasion, compared with $14.90 per occasion for private labels).

- Brand loyalty is still possible for brands that deliver compelling value. Still, price will always remain a key variable in that equation, with only 12% of global consumers in our recent Consumer Outlook survey saying they’d stick to their regular brand regardless of cost. This means CMOs must demonstrate what makes their offerings valuable to retain that loyalty.

- Discovery and purchase are increasingly omni, with shoppers moving among social platforms, search engines, messaging apps, retail media networks, and stores. This fluidity changes how brands must think about visibility and conversion. However, NIQ’s Expanded Omnishopper US data shows that nearly three-quarters of FMCG sales still occur offline, with household spend almost three times higher in physical retail than online. This is counterbalanced, however, by the fact that across many categories, purchasing occasions tend to be higher across digital shelves than in-store. To capture this potential, CMOs must deliver a seamless cross-channel experience to meet shoppers where they prefer to engage.

Key Takeaways

Brands aren’t in crisis—but they could be approaching a crossroads.

As pressure mounts to deliver more with less, the ability to articulate and defend the strategic importance of a full-funnel marketing strategy to build brands will be more critical than ever.