2025 total T&D full-year projection (value growth):

Western Europe: +1%

2026 home appliance projections (value growth):

- MDA: +1.5%

- SDA: +5% to 7%

Western Europe market overview

Macroeconomic disruption in Western Europe continues to challenge manufacturers and retailers. There are widespread expectations, too, that Chinese brands will continue to increase their impact within key markets, with high-functionality appliances at competitive prices taking additional MDA and SDA market share from established brands.

Price will drive consumer choice in many markets, while brand quality, reliability, and performance are important in encouraging more premium purchases from specific segments of buyers.

Growth in online sales will continue to dominate small home appliance sales, with social commerce presenting opportunities for products with obvious visual appeal or that lend themselves to influencer reviews, such as multifunctional hair dryer/stylers, portable wet-dry shavers, frozen dessert makers, and so on.

What will drive Western Europe sales growth in 2026?

By appliance type

In large household appliances, key replacement cycles from pandemic-era purchases will not kick in until 2028–2030. Built-in appliances may benefit from house building rates rising slightly in Portual and Spain. Entry-level dishwashers and tumble dryers will see growth from first-time buyer sales, while short-depth washing machines with a higher load capacity continue to grow in France. Innovation around energy efficiency will be critical, given the cost- saving and eco aspirations of many Western European consumers, with capacity and smart washing functionality also prompting sales. We additionally expect growth in smart cooking appliances, such as ovens that monitor food as it cooks and automatically turn off or adjust temperature, or hoods that automatically adjust to the optimal steam extraction levels.

In small household appliances, we expect growth to be most prominent in France, Spain and Italy. Across the region, replacement cycles will kick in in 2026; however, there will be increasing competition from low price, high functionality Chinese products. These will be particularly of interest to younger consumers who are more influenced by price and features than by brand. Purchases of all products will increasingly be driven by multifunctionality that delivers clear benefits of convenience, such as robotic self-cleaning wet-and-dry vacuums; electric cooking pots that are also specialist rice cookers; multi-basket/multi-tray air fryers; and all-in-one hair stylers able to dry, straighten or curl using air only to protect hair from heat damage. Health aspirations will also matter, maintaining demand for products such as low-fat cookers and smartwatches, while climate change and awareness of pollution will increase demand for items such as air and water purifiers, electric fans, and frozen desert makers.

By channel

In-store remains an important channel for both MDA and SDA, particularly for premium purchases where consumers want to try before buying. However, online sales are increasing where there is retailer trust.

Online purchases accounted for 45% of small domestic appliance total sales value in the first half of 2025, and for 27% of major domestic appliance sales, with both categories seeing small but steady increases of the last three years. The online share of sales also increases during major annual promotional events, as consumers time their purchase to buy premium products at discount and maximize the value they get for their money.

Even for those buying in-store, online channels are critical touchpoints during shopper consideration and research phases: NIQ analysis shows that shoppers who interact with a brand both online and offline before making their purchase are the most likely to spend more than they intended, whichever channel they finally purchase on.

SDA online share has always been higher than for Consumer Tech and Durable Goods overall

It continues to grow—and it’s hitting almost 50% in some regions

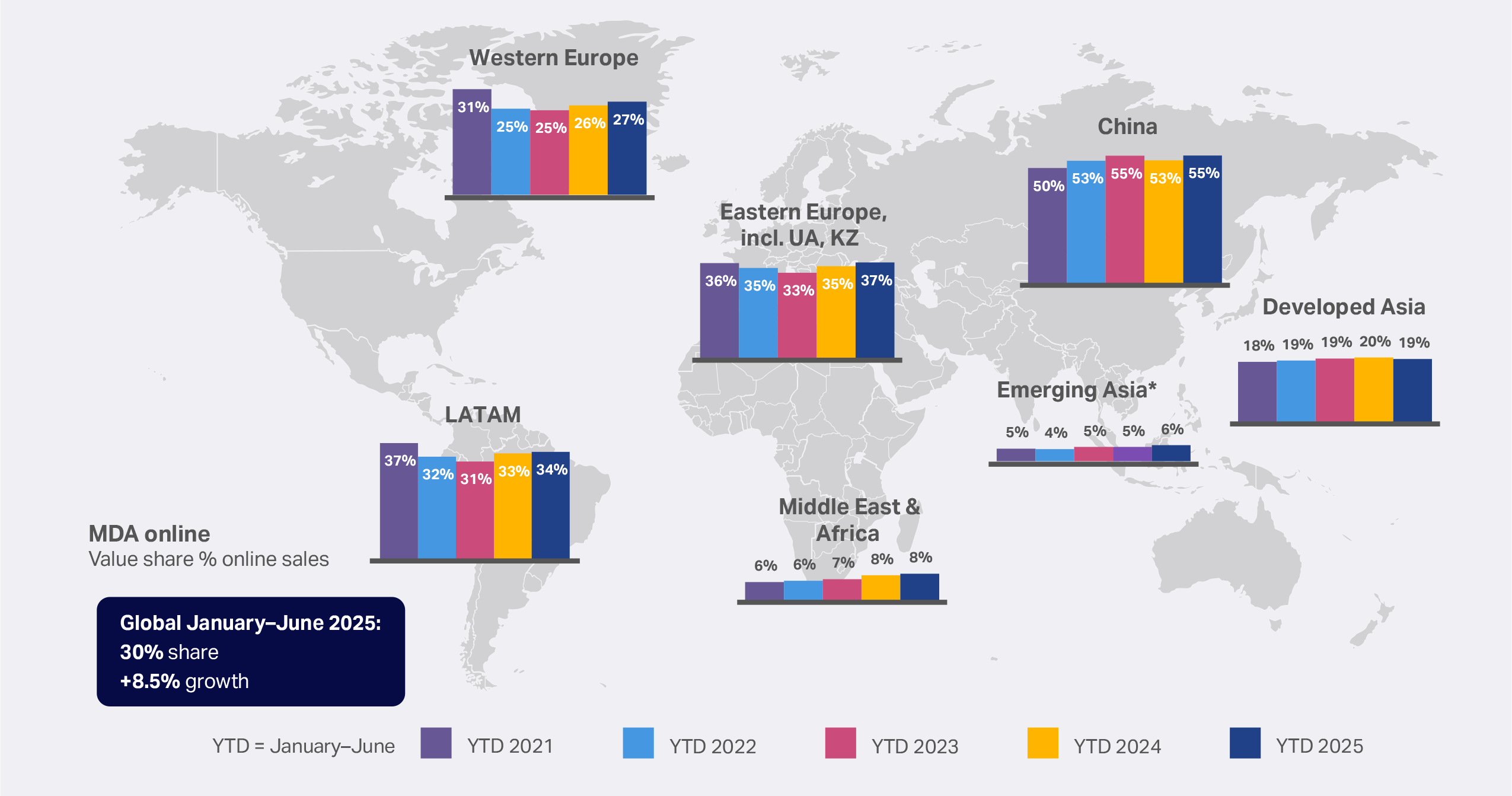

MDA e-commerce improves over 2025

Online share of total sales grows again in select regions.

Western Europe key takeaways for 2026

- Demand for major domestic appliances will grow slightly, driven mainly by replacements of broken appliances and by first-time buyer sales.

- Small domestic appliance sales will grow more strongly, bolstered by replacement cycles and consumers upgrading to get higher convenience, performance, or health features.

- With more brand competition, small appliance innovation must focus on design and timely convenience-based features, while large appliance innovation should focus on clear premium propositions around resource savings (e.g., energy, water) and convenience (e.g., automation, timesaving, self-cleaning).

- Retailers will continue to face stiff competition. The focus must be on enhancing how they explain compelling product benefits in line with consumers lifestyle wants, as well as on creating personalized service ecosystems that unify the online and offline experience for shoppers.

Get the full global picture

Go to our Home Appliances Outlook 2026: What consumers want report.

NIQ’s home appliances market experts, Western Europe

Paul Mitchell

Regional Consulting Lead, Western Europe

Thilo Heyder

Regional Director, SDA, Western Europe

Rachel Gilbey

Senior Regional Insights Manager, MDA, Western Europe

Markus Wagenhäuser

Customer Success Director, MDA, Western Europe

Forward-Looking Statements Disclaimer

This report may contain forward-looking statements regarding anticipated consumer behaviors, market trends, and industry developments. These statements reflect current expectations and projections based on available data, historical patterns, and various assumptions. Words such as “expects,” “anticipates,” “projects,” “believes,” “forecasts,” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future outcomes and are subject to inherent uncertainties, including changes in consumer preferences, economic conditions, technological advancements, and competitive dynamics. Actual results may differ materially from those expressed or implied in these statements. While we strive to base our insights on reliable data and sound methodologies, we undertake no obligation to update any forward-looking statements to reflect future events or circumstances, except to the extent required by applicable law.