Disparities across Western Europe highlight opportunity

With a wide range of e-commerce solutions, banners, and backgrounds, the current landscape remains highly varied across Western Europe. From pure players to brick and mortar, from home delivery to click & collect or drive-thru, European shoppers can have very different e-commerce experiences.

Unsurprisingly, the percentage of European households that have purchased groceries online in the past 12 months still varies per country, with basket sizes and expenditures differing across markets. In the U.K. and France, e-commerce penetration measured approximately 48% in late 2020, while Spain and Germany saw penetration rates of just over 20%. The potential to bring these penetration levels up to mirror the rest of Western Europe’s leaves immense opportunity for e-commerce growth.

NielsenIQ acquires Foxintelligence

By adding billions of new consumer data points to our gold-standard retail measurement core services, our clients will get a unique omni-sales view across all major categories in Europe – all in one place.

Evaluating the impact of e-commerce both on- and offline

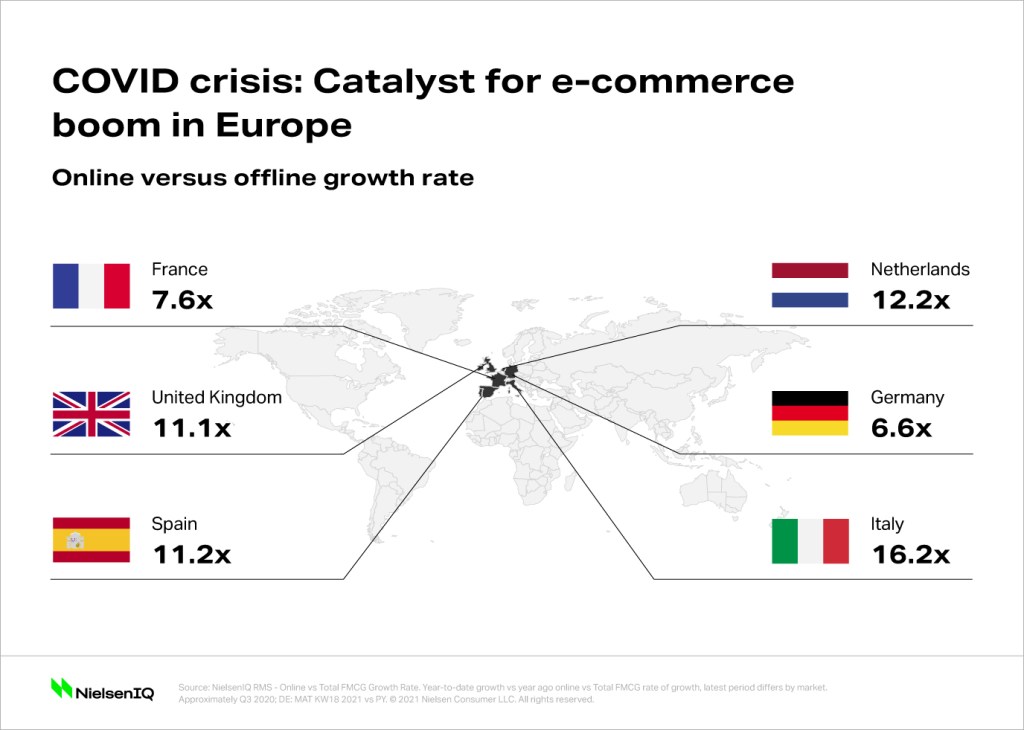

When examining the pace of growth online versus offline, the numbers speak for themselves. The e-commerce value growth rate in France is, at its lowest, 7 times higher than the offline growth rate—and up to 16 times higher in Italy.

E-commerce was always destined to transform retail, but without question COVID-19 accelerated this trajectory. While in past years digital access was expanded and business models tested, 2020 proved both the necessity and viability of e-commerce. But this is just the tip of the iceberg.

According to Jens Ohlig, NielsenIQ’s Managing Director for Western Europe, e-commerce accounted for more than €30 billion in the big five European countries alone in 2020. “The growth in online channels for retailers who get the formula right is more than making up for lower in-store growth rates,” says Ohlig. “As we’ve seen in other regions around the world, while online sales are skyrocketing, there’s still room for growth—particularly in food. Issues we used to see as barriers, like the ability to select fresh foods yourself, have eased since COVID-19 pushed us into restricted living. Things that used to be barriers to entry aren’t as strong anymore, and we’re seeing that in our e-commerce measurement.”

1 NielsenIQ Scantrack/NielsenIQ Homescan/Convert Group/NielsenIQ Directory DE, ES, FR, GB, IT.

Insights on e-commerce in Europe

Get insights on how selected European e-commerce markets have evolved pre- and post-COVID, using the most comprehensive e-commerce measurement available.

Preparing for the next phase of e-commerce growth

As e-commerce matures quickly in Europe, now is the time to prepare for the next phase of online growth. Here are some ways that retailers and manufacturers can prepare for success in the near term:

Understand the playing field. Using the most granular data available, understand how e-commerce is developing in the markets you’re active in. Find out which categories and channels are performing best, compare online vs. offline assortment, and how pricing and promotional tactics differ in the online space compared with brick and mortar.

Understand your e-commerce maturity stage, and how to take it up to the next level. As more retailers progress along the e-commerce maturity continuum, we’re seeing many finding great ways to differentiate themselves.

Streamline your omnichannel experience to win on- and offline. Consumers will continue to visit physical stores, but if the game is about making people spend more in their store, or bringing in new buyers, they need to go digital and play strongly on their trusted image or the relationship that was built over the years. Adding experiential and social engagement in the mix can help beat e-retailers at their own game.

Fight for attention. Online promotions are markedly different from having promo displays in-aisle or at the checkout counter. Online allows for better shopper targeting, personalized offers, and dynamic pricing to better exploit e-commerce sales opportunities. Research shows that 14.3% of online users engage with personalization features, resulting in an increase of 3.6 times the number of suitable products displayed to shoppers, and a 6.6% increase in basket size for engaged shoppers. Find out how better data analytics can lead to better targeting on what your customers want and need, increasing both your sales and loyalty.

Last Mile Fulfillment Frenzy. The expectation for convenience and fast delivery is growing steeper. It is no longer about what is feasible but how to meet and feed the appetite for faster delivery services. With new players such as Gorillas and Instacart popping up in markets, both retailers and manufacturers should consider how to fulfill these needs quickly, before their customer buys elsewhere.

“It’s really one of the most exciting times for e-commerce in Europe,” says Ohlig. “And we’re very pleased to help retailers and manufacturers navigate this next stage, using a deep understanding of how the e-commerce channel is developing. We’re just at the beginning of the next stage of e-commerce in Western Europe—the time to make critical decisions confidently is now.”

2 Foodmaestro study on the impact of extended attributes on shopper behavior, 2019-2020

Methodology:

NielsenIQ Retail Measurement & Consumer Panel data