The U.S. consumer outlook for 2022

Inflation has Americans digging deeper in their wallets every month to pay for essentials. At the grocery store, they’re buying less but spending more to get it; during the last 26 weeks (ending July 2) CPG dollar sales grew 7.5% compared to the previous year, fueled by rising prices that resulted in soft unit sales (-2.5%). At the gas pump, consumers are spending upwards of $95 more a month per car.

Against this stressful economic backdrop, 97% of consumers reported some level of concern over rising prices on everyday items, with 45% identifying as “extremely concerned.”

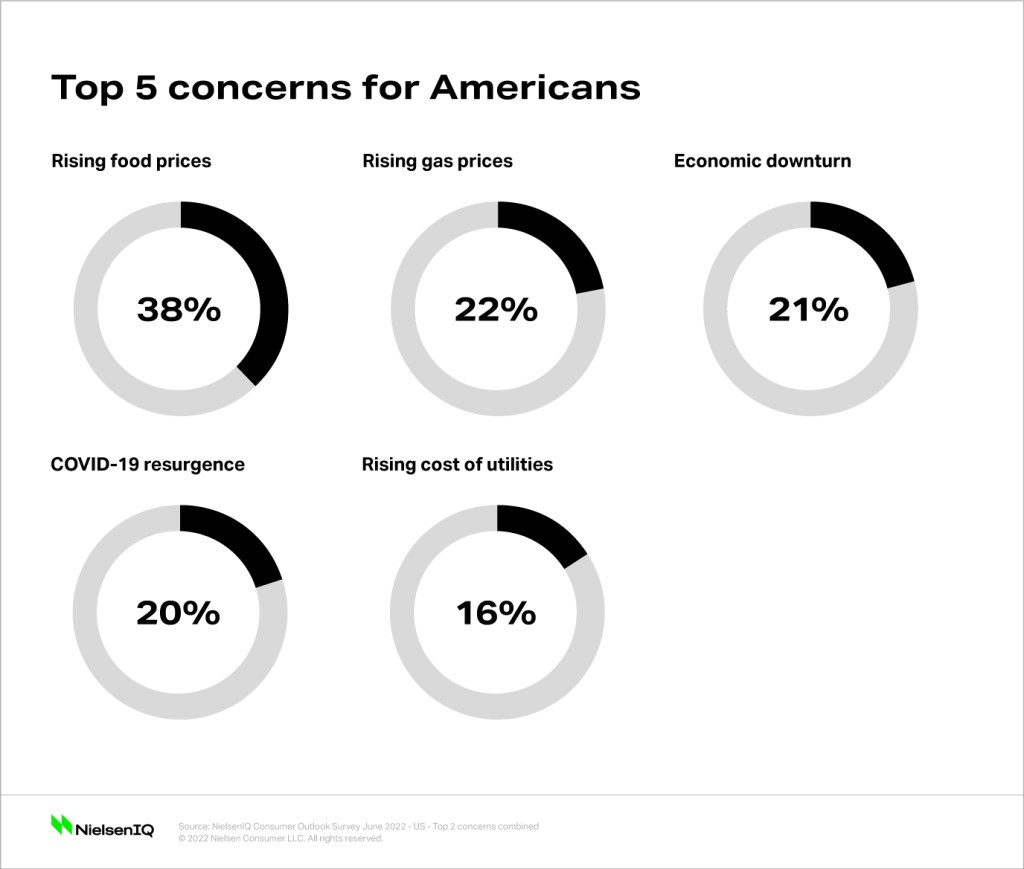

In fact, when we asked Americans about their concerns in June 2022, four out of the top five were related to inflation and rising prices, outranking even global challenges like climate change and environmentalism.

As their spending power decreases, 81% of consumers report changing the way they shop to manage expenses, and a growing number now identify as “not impacted financially, but cautious with spending.” This percentage is up from 33% in December 2021 to 42% in June.

What’s next: Consumer expectations for 2022

Many Americans are bracing themselves for more disruption in the second half of 2022—53% think the U.S. is already in a recession and most agree that disruptions related to COVID-19 and rising prices will last beyond 2022.

Given their fears about recession and expectations of more long-term disruption, over half (52%) of the consumers surveyed by NielsenIQ report feeling less secure in terms of economic stability than they did six months ago; 25% feel less secure in their household income level, and 29% feel less secure in their ability to meet daily expenses. Less than 15% felt more secure in these areas.

To offset growing insecurity, U.S. consumers are using different cost saving strategies that will inevitably alter the landscape in the grocery, foodservice, and entertainment industries. To manage high gas prices, roughly one third (34%) of consumers surveyed are driving less, while up to 25% are shopping online or closer to home.

Many consumers (42%) plan to reduce out-of-home spending and increase grocery spend in the future.

At the grocery store, U.S. consumers report that they’re already using as many as four strategies on average to save money, including stocking up when items are on sale, using coupons, seeking out stores with lower prices, and buying store brands.

We can expect these cost-saving strategies to carry into the second half of the year as consumers shift spend back to the grocery store. However, if Americans continue to struggle on multiple fronts, the list could evolve, from trading down or out of certain categories to visiting food banks and buying less food.

About the insights

The full NielsenIQ Consumer Outlook 2022 mid-year report combines global consumer survey insights with expert retail measurement data analysis to understand how consumers around the world are analyzing what will matter most to them as they look ahead at 2022.

Global inflation hub

Review our monthly updates on the latest pricing trends, consumer behavior changes, and more.