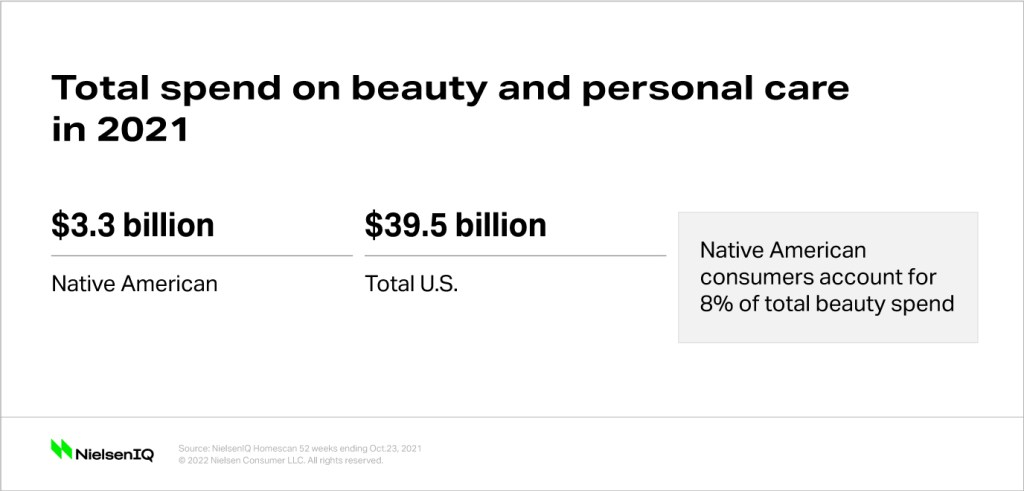

There is an increasing focus on embracing diversity across all facets of the consumer packaged goods industry, but especially in beauty and personal care. Native American consumers represent a growth opportunity in this category. Seven percent of U.S. households identify as Native American or as having Native American ancestry. These households spend $351 on beauty products annually, $35 more than the average U.S. household.

“Native American consumers are a small, but powerful, force in the beauty and personal care industry. When developing marketing and business strategies, retailers and manufacturers would be wise to consider how Native American beauty buyers spend their money,” said Anna Mayo, NielsenIQ Beauty Vertical Client Director.

Native American beauty-buying patterns

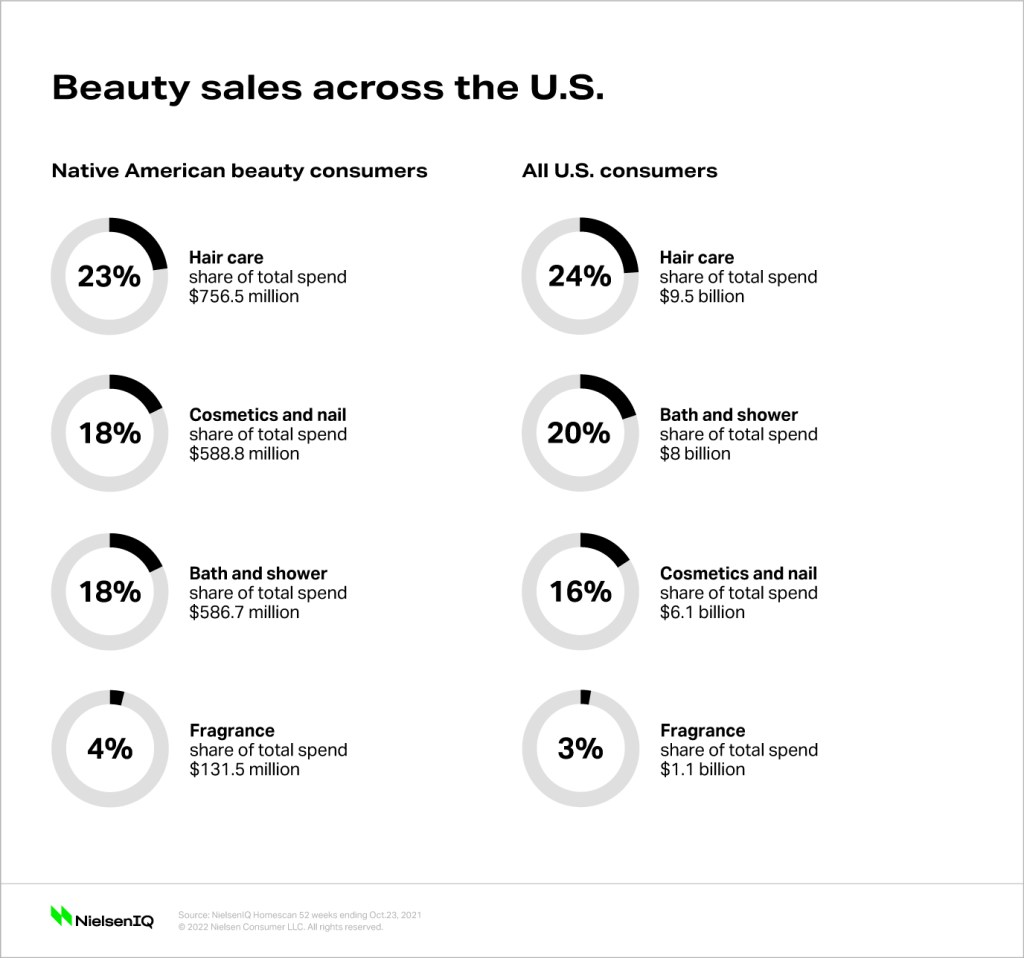

Across beauty and personal care, all U.S. consumers, including Native Americans, spend the most on hair care, cosmetics and nail, and bath and shower. However, there are some categories where Native American consumers are spending a greater share than the general market, including fragrances (47%), and cosmetics and nail (16%). Conversely, Native American consumers are spending less than the general market on hair removal products (10%), hand and body lotion (8% less), and sunscreen (7% less).

Considering lifestyles of Native American consumers

When evaluating opportunities to market to Native American beauty-buying households, it is important to take lifestyle into account. Native American beauty consumers are more likely to:

- Have a lower income

- Be younger

- Have children at home

- Live in rural areas

- Have less than a high school education

- Live in the west

Even though they are more likely to live in rural areas, Native American consumers make 29 beauty shopping trips per year, one more than the average U.S. household. Not only do they shop more, they spend more, with an average basket size of $12.15 versus $11.29 for total U.S. consumers.

“Beauty and personal care are both important to Native American consumers. They may be more likely to face financial and geographic barriers to purchase, but our data shows that some of those obstacles may not have a significant impact on how often they shop and how much they spend on beauty and personal care products,” Mayo said.

Insights source: NielsenIQ Homescan 52 weeks ended October 23, 2021