Stay ahead in your understanding of market dynamics

The JTI Global Tracking Program is designed to provide you with unparalleled insights into market and consumer trends. It helps you:

- Monitor overall market and consumer trends.

- Understand category dynamics.

- Evaluate consumer responses to new product launches or market changes within the tobacco industry.

- Utilize this information to create effective marketing and communication strategies.

Key Findings from the Netherlands:

Situation:

In the ever-dynamic world of tobacco, the Dutch RMC market has witnessed significant brand switching behavior in the full-year 2023. One in six smokers has switched away from their regular brand, with Marlboro leading the pack in net switching performance.

Camel and Winston both show a neutral switching pattern. Camel, despite being the second choice for new-to-category users, loses many to Marlboro. Winston, on the other hand, faces stiff competition from L&M in the Value segment.

Challenges:

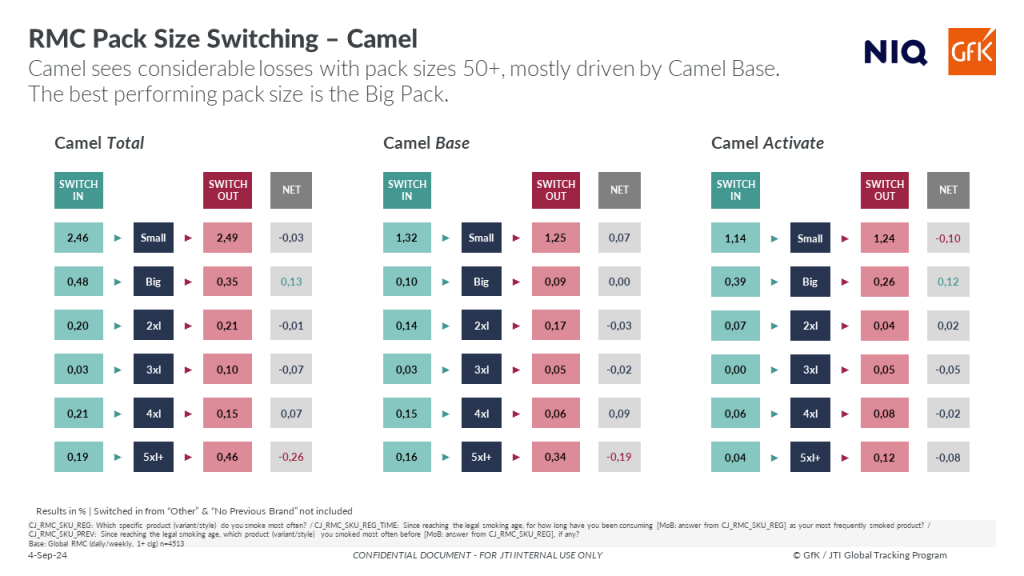

- Camel: Camel is a popular brand among new-to-category users and gains most newcomers from Marlboro. However, it experiences negative net switching with Marlboro, which is also its top destination brand for switchers leaving Camel. Camel’s losses are particularly pronounced in the 5xl+ pack size segment.

- Winston: Winston’s neutral net switching indicates a need for a stronger strategy to attract and retain new joiners. L&M emerges as Winston’s top destination brand, highlighting its competition within the Value segment.

Actions:

- Camel: Focus on retaining switchers from Marlboro and improving the 5xl+ pack size portfolio.

- Winston: Enhance appeal to switchers and improve performance among new joiners.

Net Switching Analysis

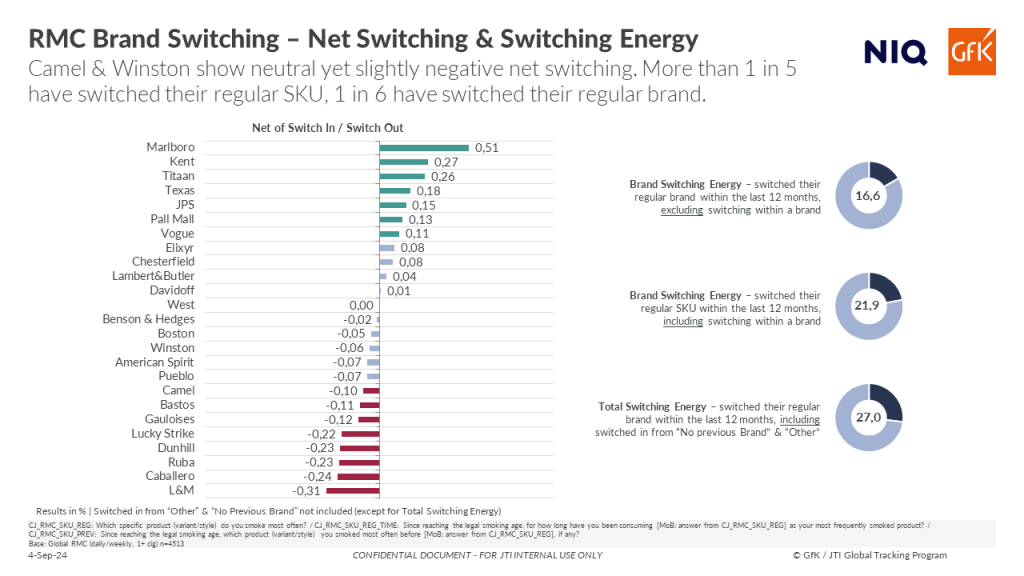

Marlboro shows the strongest performance in the Dutch RMC market. Camel and Winston find themselves in the middle of the pack. 1 in 6 smokers have switched their regular brand within the last 12 months, more than 1 in 5 have switched their regular SKU, including those who switched within the same brand (e.g., Camel Base to Camel Activate).

Switchers Profile

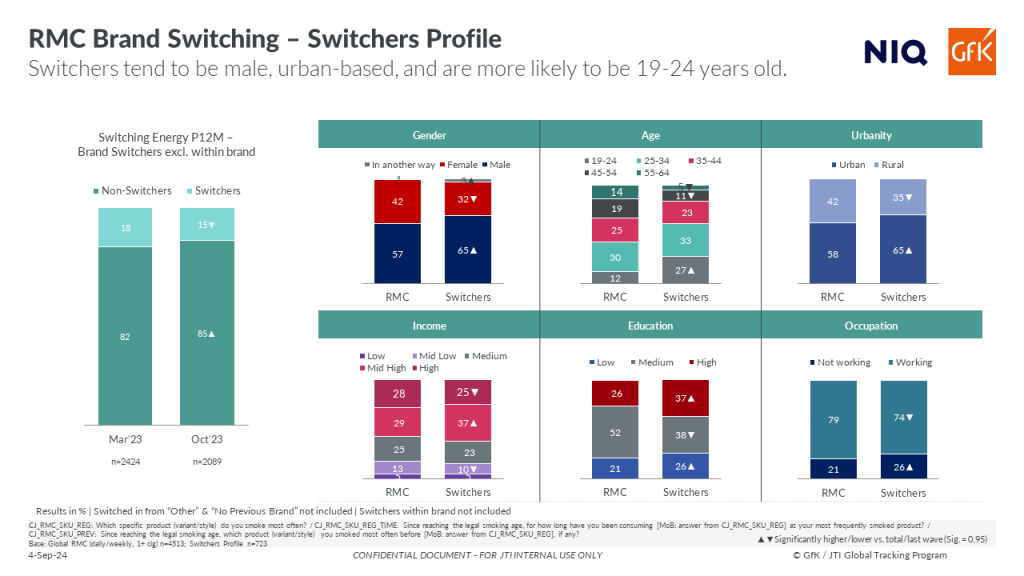

Switchers tend to be urban-based males, predominantly aged 19-24, and are more likely to have mid-high income and high education levels. These demographic insights are crucial for tailoring marketing strategies.

Brand Switching decreased by 3 percentage points between March and October. Future waves will reveal if this downwards trend is seasonally driven and will bounce back or if there is a general trend towards less switching.

Camel Base Insights

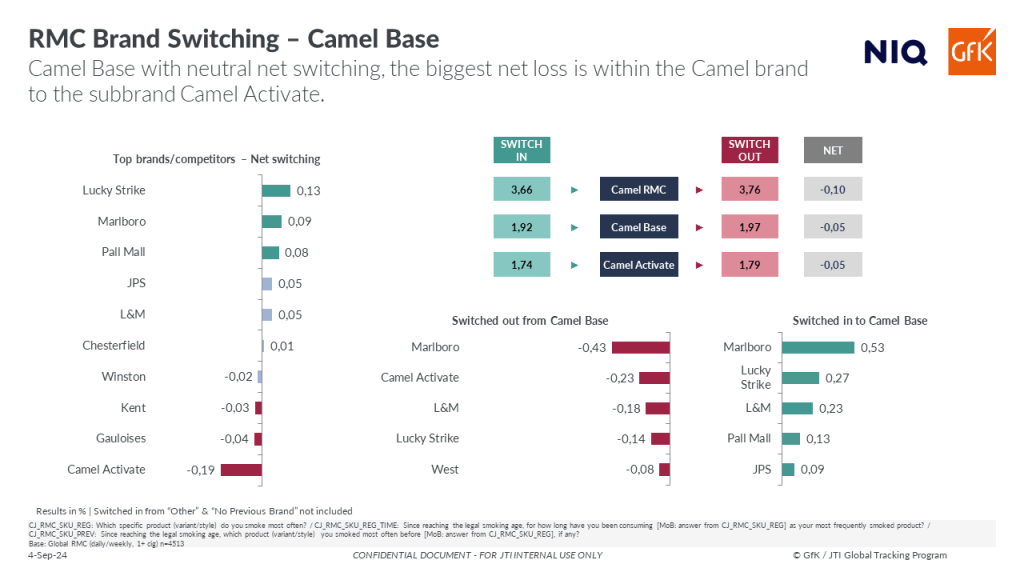

Camel Base loses most consumers to its flavored capsules subbrand Camel Activate. Conversely, Camel Base gains consumers from Lucky Strike, Marlboro, and Pall Mall.

There is a high volume of switching between Camel Base and Marlboro with Camel Base coming out on top and partly offsetting the overall losses to Marlboro.

New-to-Category Consumers

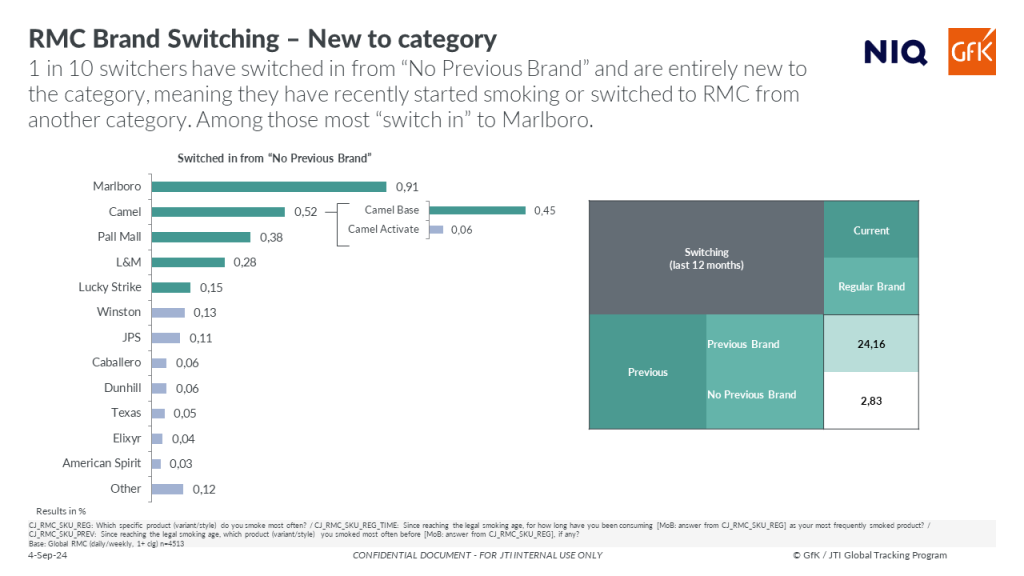

New-to-category users make up around 3% of all RMC smokers. They consist of consumer who have switched to RMC from another category like MYO, or consumers who have only recently started smoking.

Camel is the second most chosen brand by new-to-category users, with Winston ranking sixth. Among Camel’s newcomers, most chose the safer option with Camel Base and a smaller amount switch into the more adventurous Camel Activate.

Pack Size Switching

While the standard small packs still make up the majority of the volume, they register the biggest net loss. In contrast, packs containing 50 or more cigarettes record the highest net gain.

Around half of the switchers changed their regularly used product but stayed with their previous pack size, whereas almost 1 in 3 switchers have changed to bigger pack size within the last 12 months.

Bigger packs give consumers the option to stay with their favorite brand and still save money. Further analyses show that Camel suffered particularly in the 5xl+ pack size segment, indicating the need to strengthen Camel’s portfolio in this segment to mitigate future losses.

Key Conclusions

- Brand Switching: Marlboro leads the market with the highest net switching gains, while Camel and Winston show moderate performance. A significant portion of smokers (16.6%) have switched their regular brand within the last year.

- Switchers Demographics: Brand switchers are predominantly urban males aged 19-24, with mixed trends in education and income levels.

- Product Preferences: Camel Base is a popular choice among new-to-category consumers, although it faces competition from Marlboro and other brands like Pall Mall and L&M.

- Pack Size Trends: There is a notable shift towards larger pack sizes as consumers seek cost-saving options, with 5xl+ packs showing the biggest net gain.