A welcome from Julian Baldwin

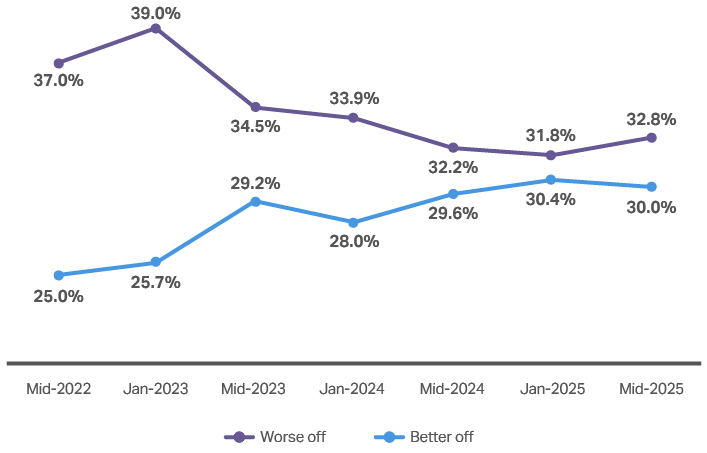

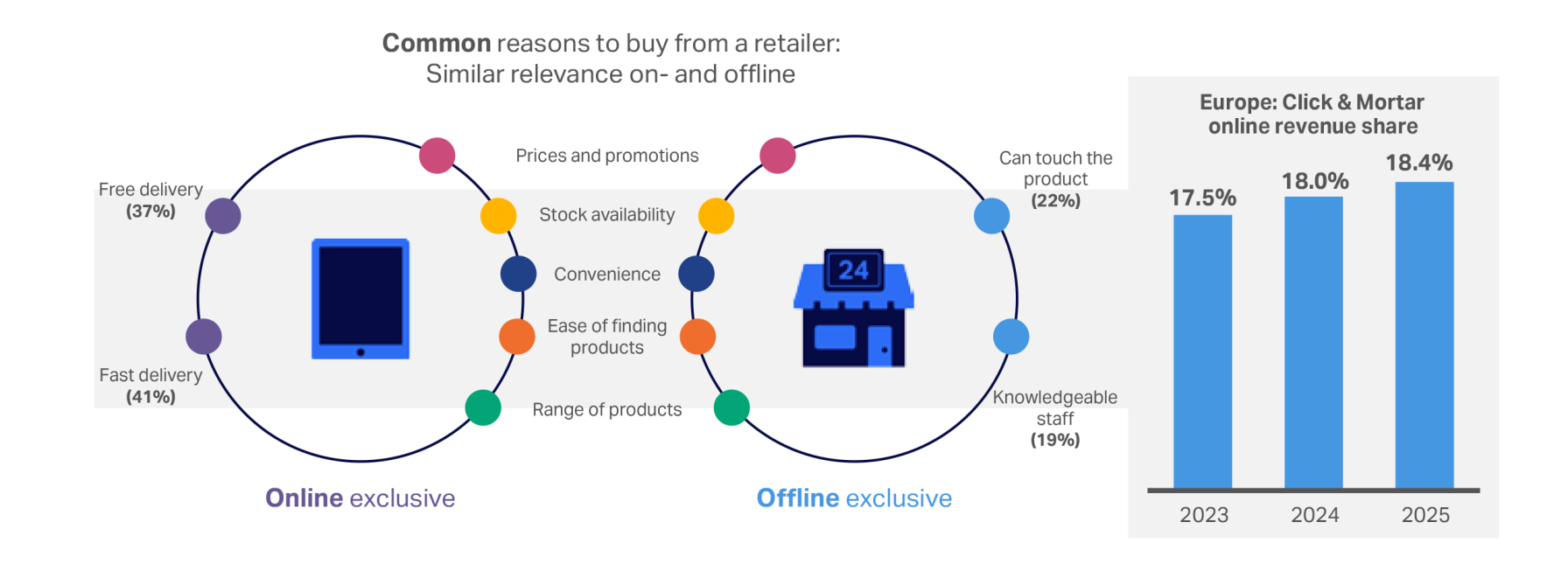

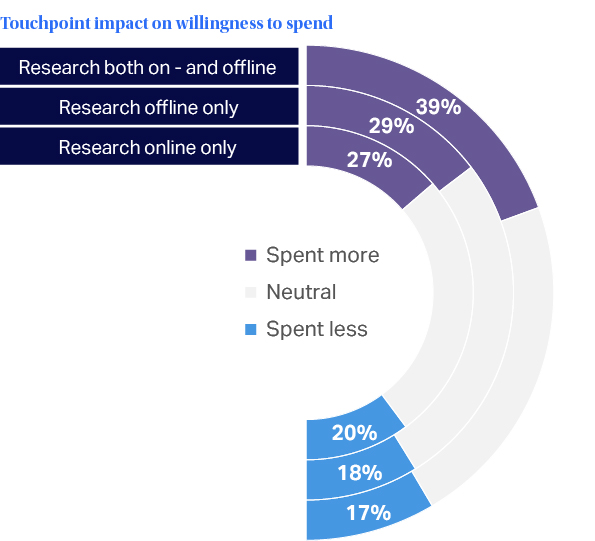

Consumers are at a juncture. They’re still cautious about their spending amid lingering economic uncertainty, but they are spending on certain technology products. What they want is compelling value for their money.

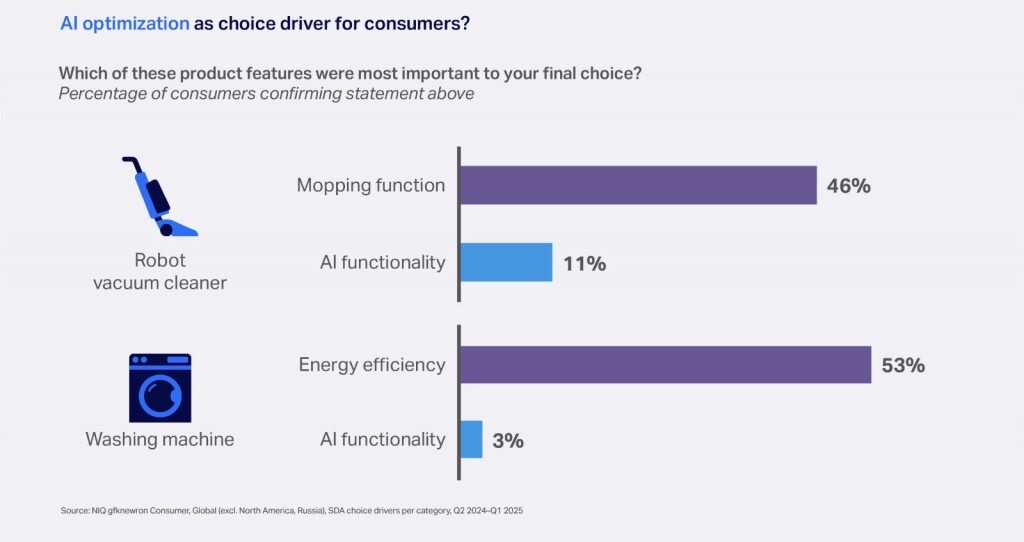

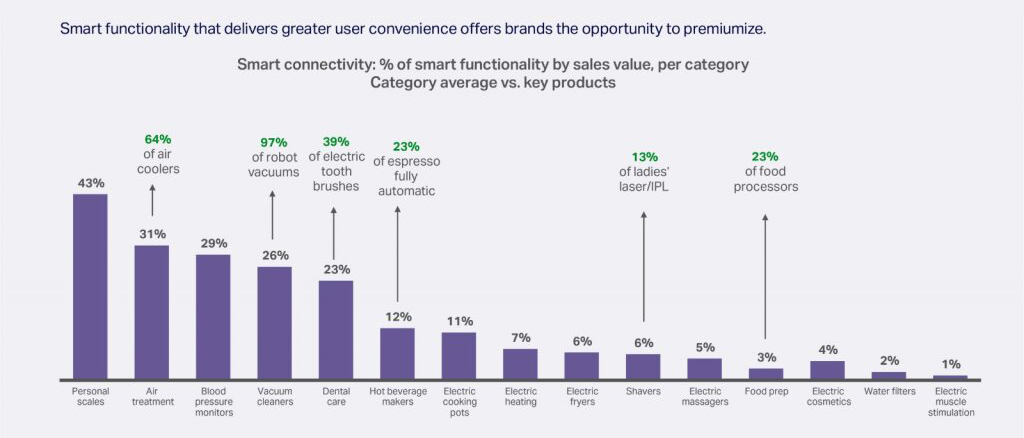

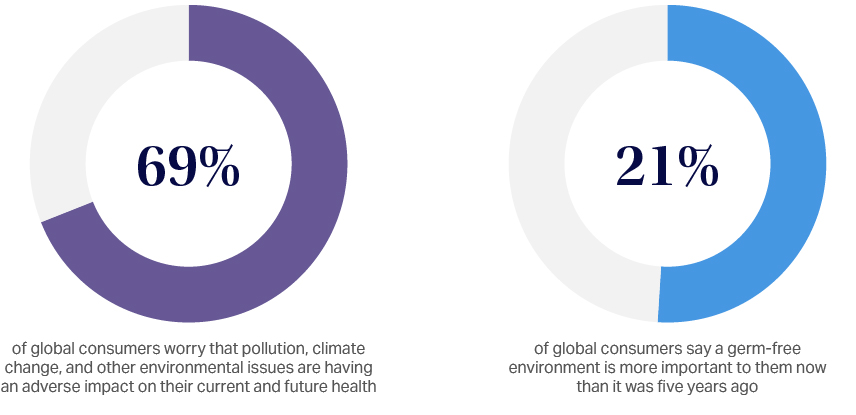

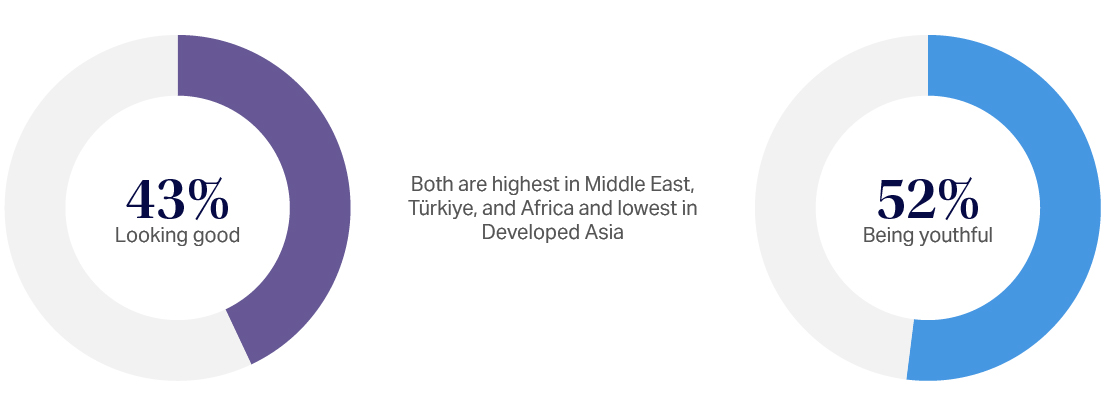

So what is this value? When it comes to household appliances, our research shows that consumers are interested in durable products that make their lives easier. They’re looking for appliances that deliver increased convenience, multifunctionality, energy and water savings, and/or enhanced health and well-being benefits. They notice the value when these benefits are clear.

For the Household Appliances sector in 2026, there are strong opportunities for manufacturers and retailers to meet these consumer needs—even amid slow economies. They must get the feature sets and pricing right, especially as challenger brands drive assertive market expansion.

This report looks at the most lucrative home appliance market trends in 2026, analyzing where manufacturers and retailers should focus their product assortment, innovation, and marketing investments. Throughout, we draw from NIQ’s in-depth analysis of Consumer Technology and Durable Goods (T&D) sales data, as well as trends in consumer behavior and aspirations—revealing strategic, actionable insights.

We hope that these insights strongly enhance your view of the buyer journeys and sector purchasing behaviors that lie ahead.

President, Global Tech & Durables, NIQ

President, Tech & Durables, and Head of Global Commercial Negotiations

Julian Baldwin leads NIQ’s Global Tech & Durables business, managing the world’s most robust point of sale (POS) tracking network, and global, long-term panel studies. His team partners with clients to deliver the data-driven insights needed to help them understand their market, brand, and consumer better than ever. In addition, Julian leads NIQ’s Global Commercial organization, managing commercial negotiations and pricing for NIQ’s largest global clients.

Want to read later?

Chapter 1: 2025 full-year projection

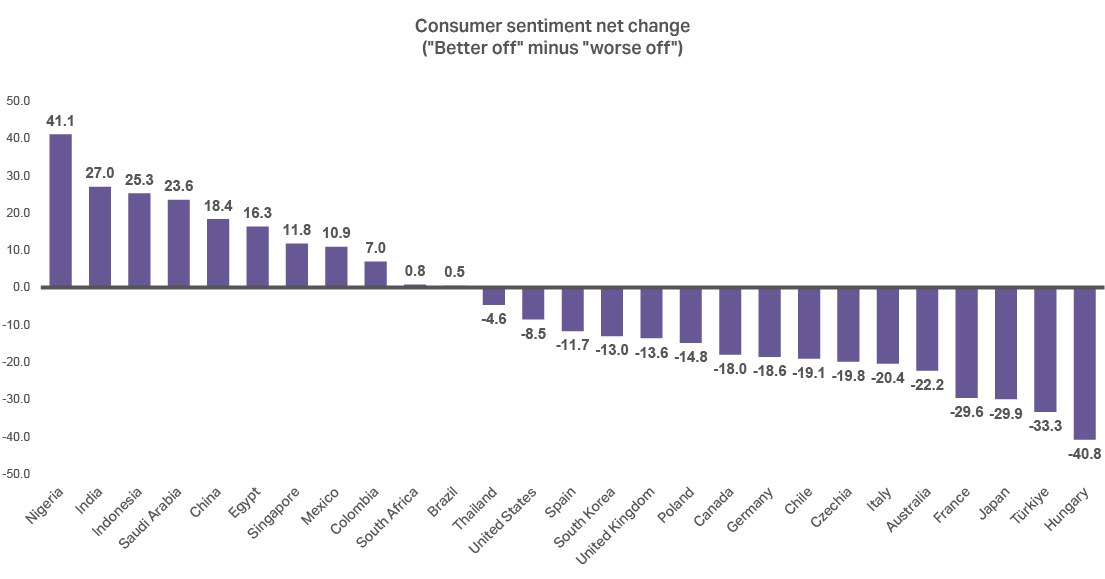

Manufacturers and retailers are still facing headwinds with changes to US tariffs during 2025 disrupting planning, on top of still-fragile consumer confidence across many markets.

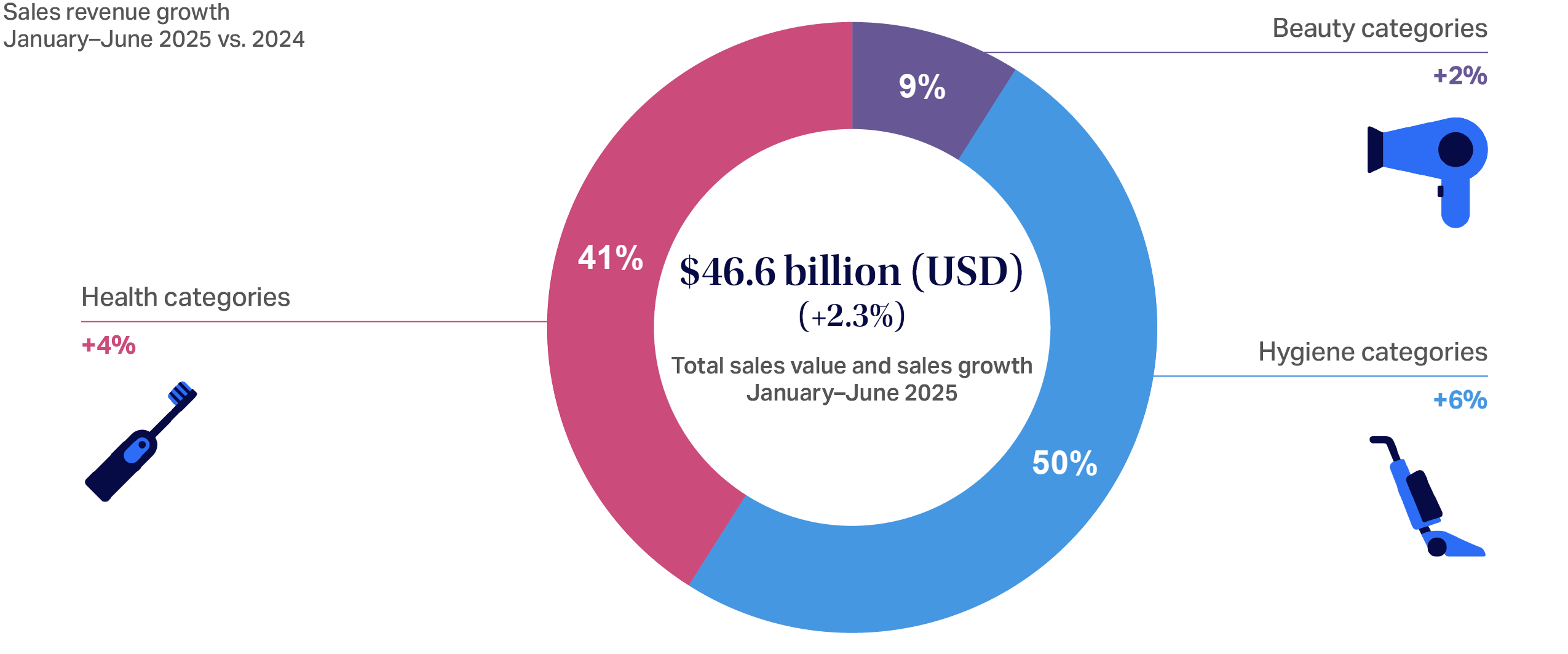

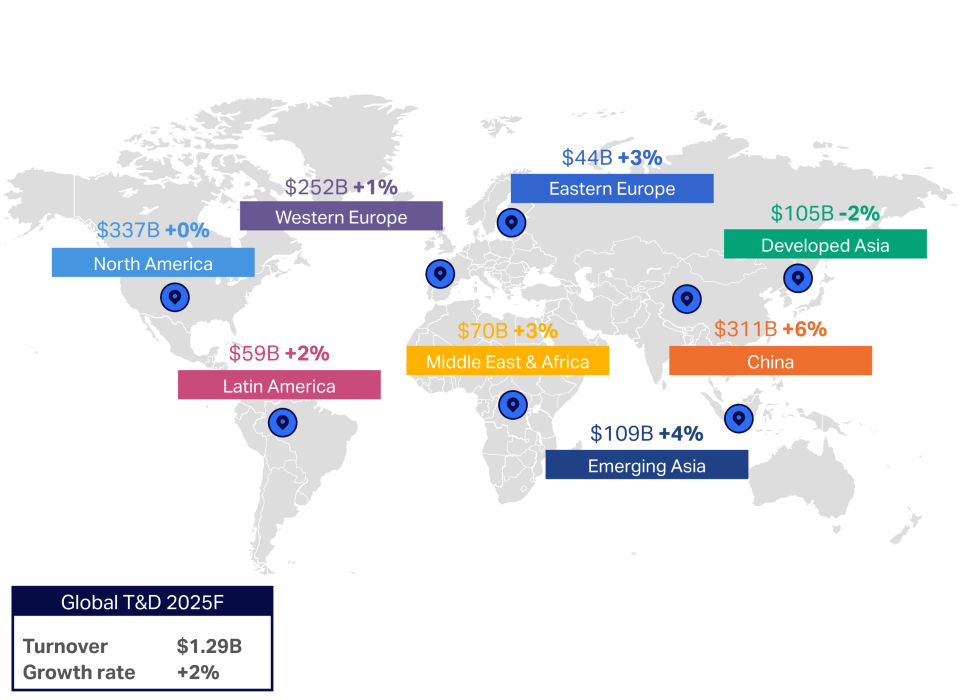

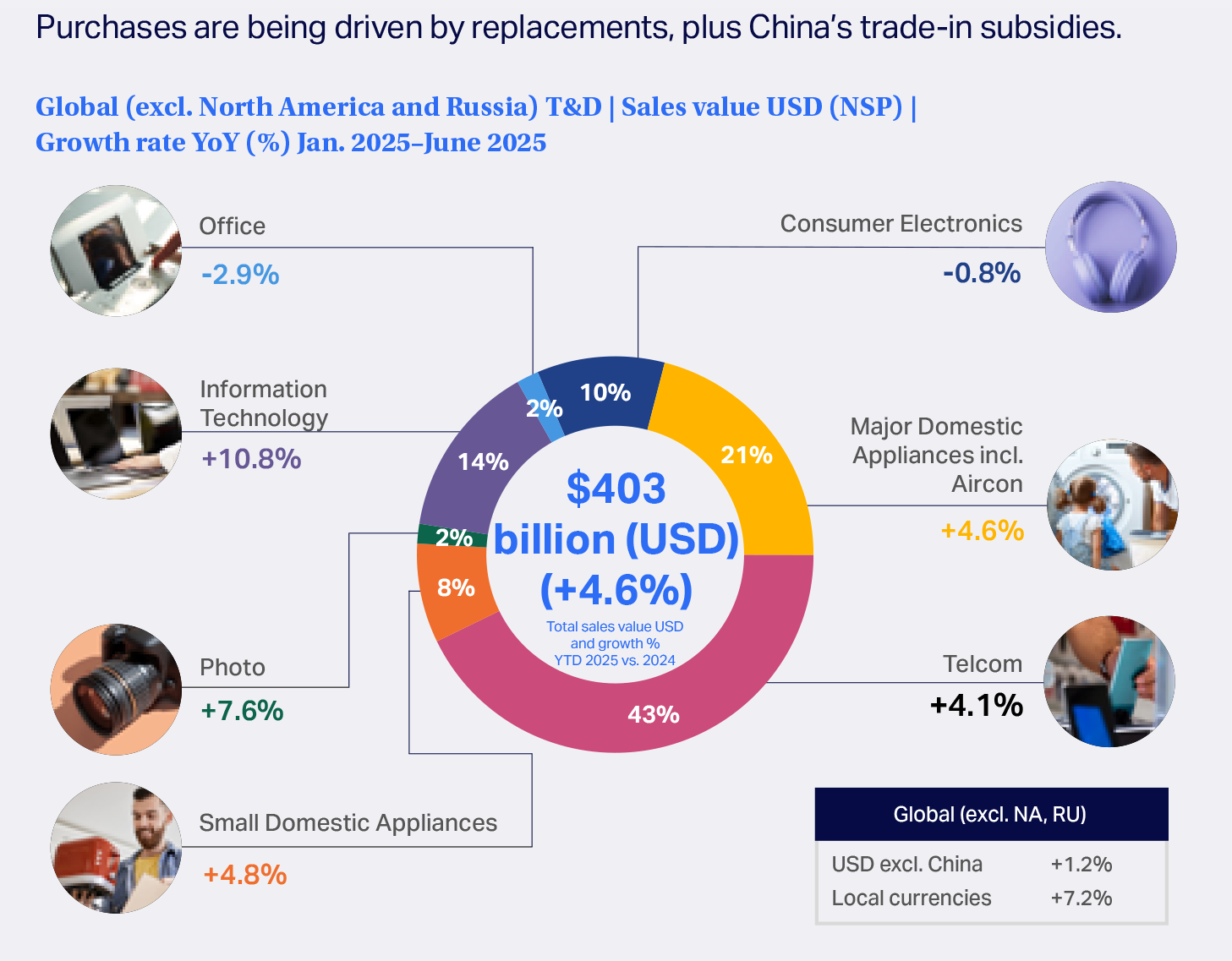

Nevertheless, in the first half of 2025 (H1 2025), sales of Consumer Technology and Durable Goods (T&D) grew 4.6% in value year over year. That increase—to $403 billion (US dollars)—was largely driven by activity in China due to retail “trade-in” policies that cut replacement costs for consumers in key product groups. With China removed from the analysis, global sales increased by a more gradual 1.2%.

Consumer Tech and Durables Goods global market returns to growth

Electronics includes Multifunctional Technical Devices, Small Domestic Appliances includes Personal Diagnostics)

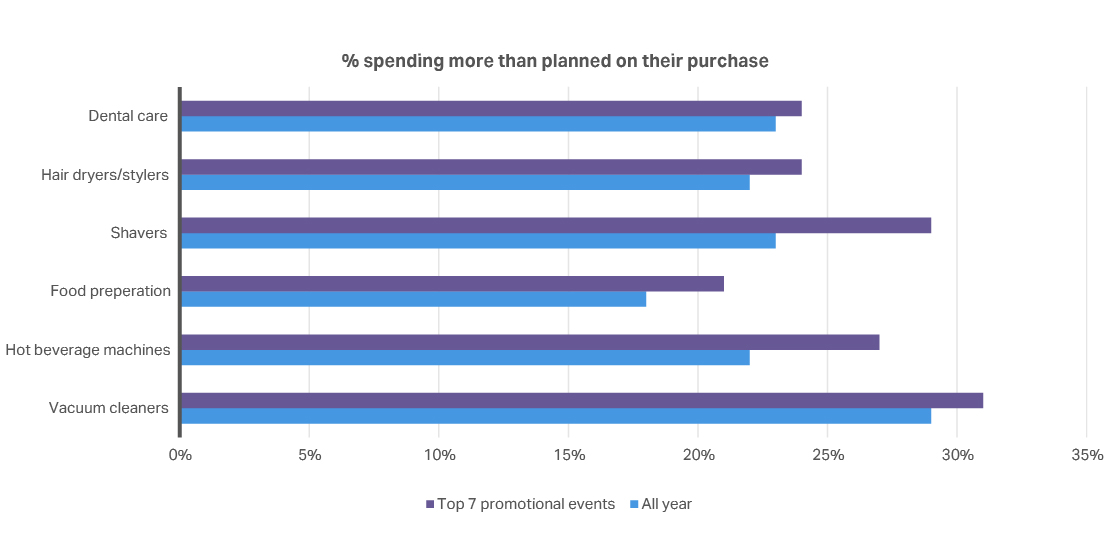

Our analysis shows that global sales volume remains relatively flat so far (+1%), but sales value is up 5%. This shows a landscape where consumers aren’t buying more T&D goods than before, but they are spending more per item, where they see compelling offers.

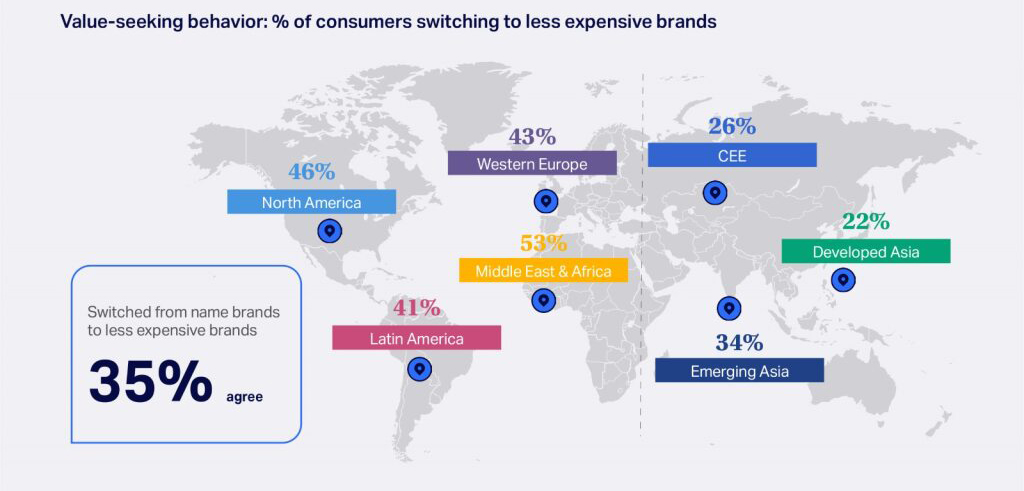

This holds true for small domestic appliances (SDA); however, major domestic appliance (MDA) categories are the exception. Here, price pressure is still strong in many categories and markets (especially developed markets, like Europe). When it comes to MDA purchases, consumers are still focused on saving money and are leaning toward products that offer core features (e.g., energy efficiency, capacity, and convenience) at the most attractive price—even if it requires switching brands.

“Relevant features—from convenience to smart energy efficiency—and savvy pricing will be critical to sales growth in home appliances. It must be positioned so consumers can clearly see the benefit that a product’s features bring to their lives.”

—Frank Landeck, Global Tech & Durables Lead, NIQ Next

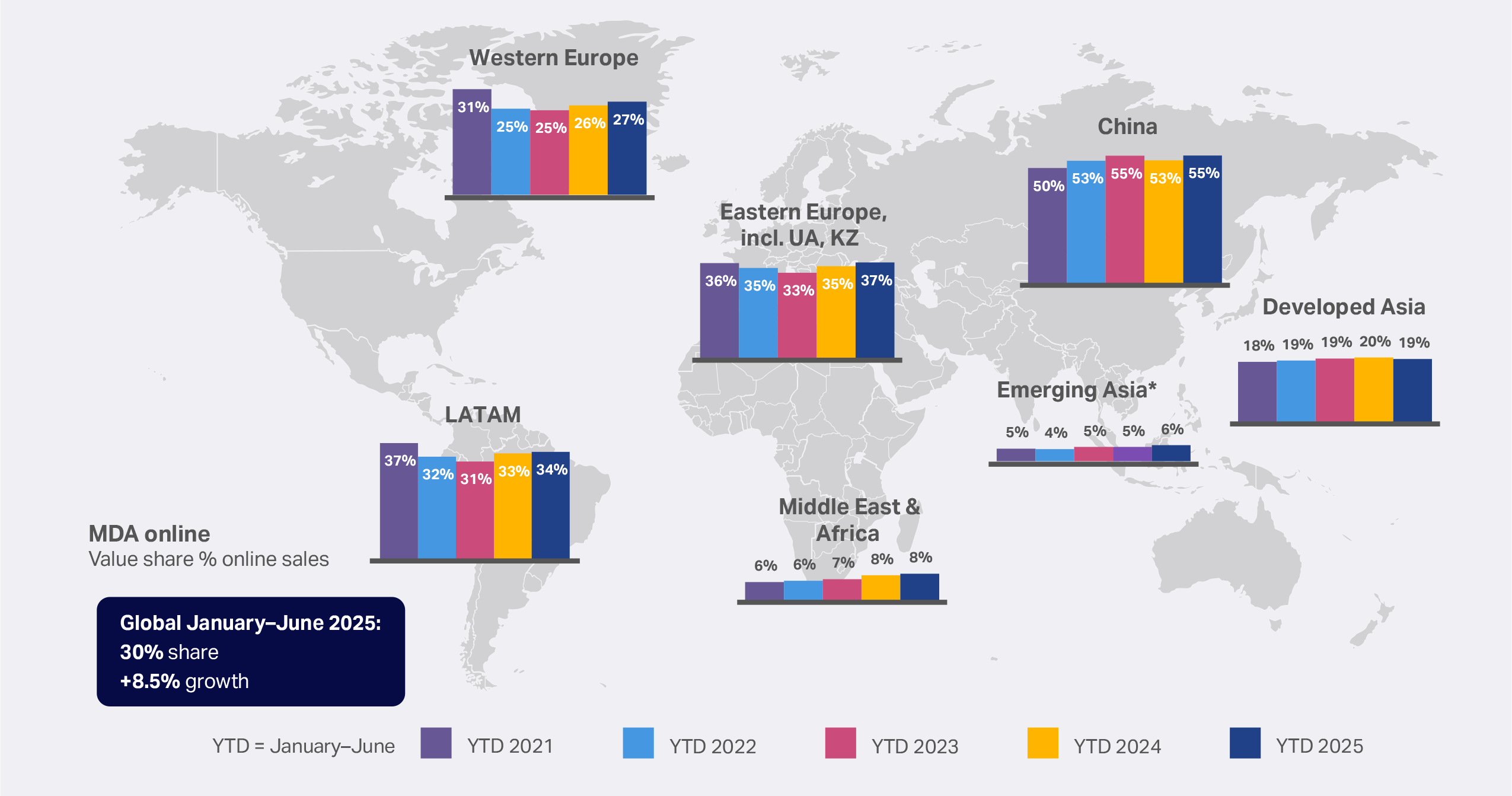

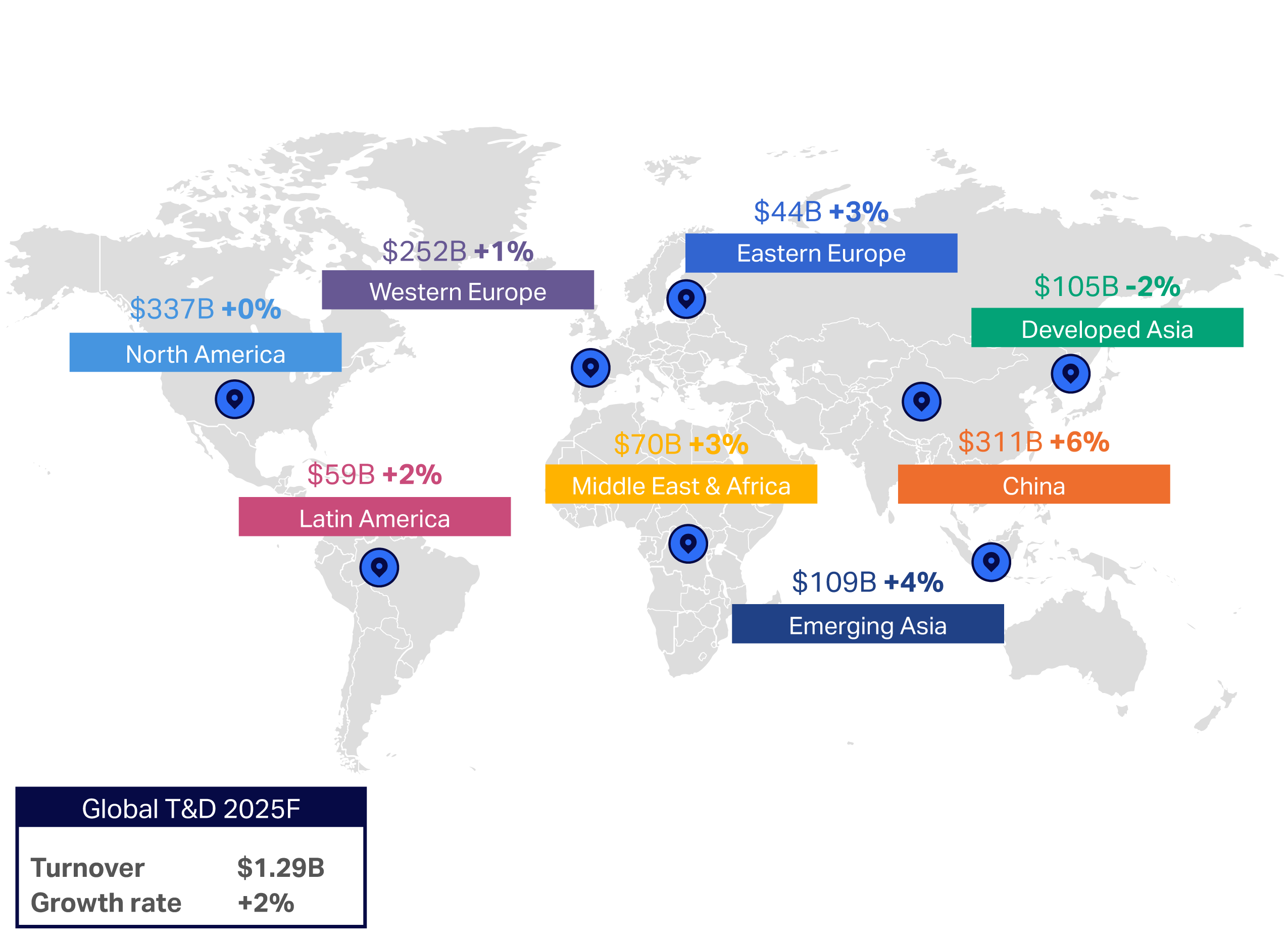

By the end of 2025, NIQ projects 2% year-over-year value growth for global Consumer Tech and Durable Goods (T&D) sales, driven by China, Emerging Asia, Eastern Europe, and the Middle East & Africa—and with household appliances playing a significant part in that growth.

Key takeaways

- Global sales of Consumer Tech and Durable Goods (T&D) grew 4.6% in H1 2025, year over year.

- For full-year 2025, NIQ predicts value growth of 2% globally, bolstered by replacements, China’s trade-in policies, some improvement in global macroeconomics, and demand in emerging markets and Eastern Europe.

- Price remains important but is not the only factor. Consumers are choosing products that present value for money—and manufacturers and retailers can capitalize on that.

Chapter 2: Macro forces shaping home appliances 2026

Six key macroeconomic and business-related forces will impact the household appliances sector in 2026:

- Chinese brand growth outside China

- Evolving US tariffs

- Chinese trade-in program

- Replacement cycles

- Gen X purchasing behavior

- Home country manufacturing

This chapter examines the scope and implications of each.

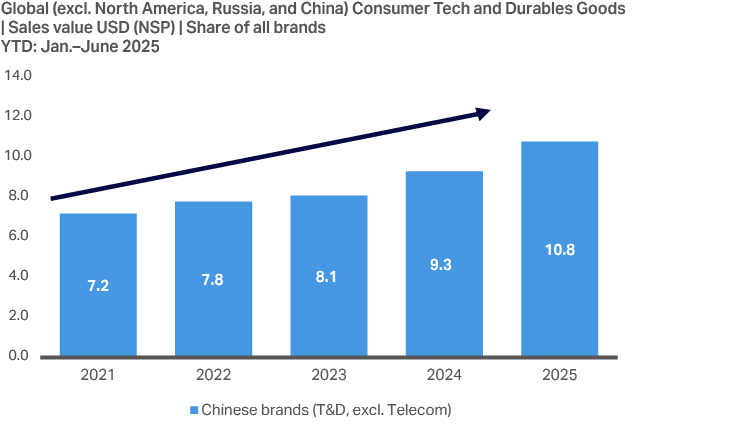

Force #1: Chinese brand growth outside China

China has been investing in establishing stronger distribution in markets such as Saudi Arabia, the United Arab Emirates (UAE), Southeast Asia, Latin America (LATAM), and Europe. A prime example is China’s investment in the Chancay port in Peru, opening a faster, cheaper trade route for Chinese goods to enter LATAM countries.

Their ability to present products with strong feature sets at attractive prices, and the fact that they lead the market in SDA innovation and R&D investments, means Chinese brands have increased their share of sales across consumer tech, including household appliances.

In 2026, this expansion will grow as Chinese brands look to replace revenue lost in the US market due to tariffs.

Chinese brands are steadily expanding their market share internationally

In the small home appliances sector, Chinese brands have been leading the market in terms of product innovation, and thereby commanding premium prices—especially in areas such as vacuum cleaners, electric fans, and air treatment.

Within major home appliances, Chinese brands have quietly been growing brand recognition in key markets via attractive pricing. Having used this approach to build overseas consumer trust in the quality of their products, Chinese brands are now expanding into more premium price ranges. Overall, Chinese MDA brands are outperforming others in terms of growth—especially in Central and Eastern Europe, LATAM, and Western Europe.

Chinese brands have quietly been growing brand recognition in key markets via attractive pricing.

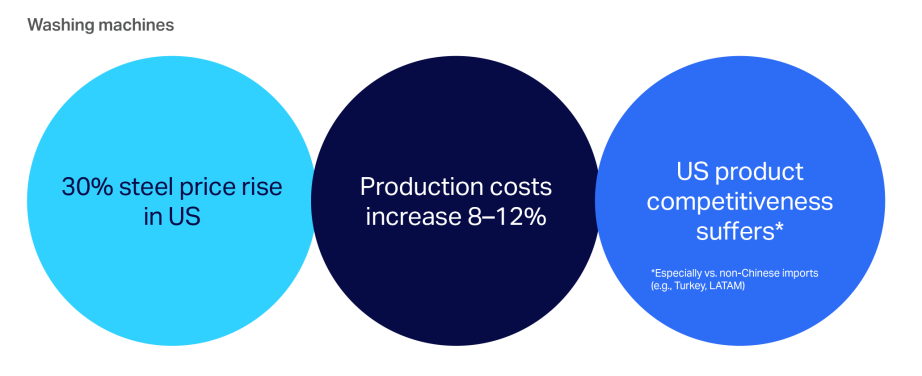

Force #2: Evolving US tariffs

As retailers clear the stock that they brought in ahead of US tariffs coming into effect, we will start seeing the impact of those tariffs on manufacturers and retailers really taking hold.

The major household appliances sector will feel the greatest impact due to the deepening of steel-related tariffs. Before June 23, 2025, US levies included a tariff of 50% on the import of raw steel. However, this had a negative impact on production costs for American-made MDA, such as washing machines, dishwashers, and ovens.

Impact of US steel tariff on US manufacturing

In late June 2025, the scope of the steel levies expanded to include a 50% tariff on the “steel equivalent” contained within imported appliances, including freezers, fridge-freezers, washing machines, dryers, dishwashers, and ovens.

In the remainder of 2025 and throughout 2026, these changes will provide a more level playing field for US manufacturing, eliminating disadvantages to US manufacturers versus MDA imports. However, as a result, US consumers will have to pay extra for these products—whether US made or imported—as happened when US steel tariffs were introduced in 2018. In a recent interview, the CEO of Michigan-based manufacturer Whirlpool estimated the new tariffs could increase the retail price of imported appliances by $50 to $70, potentially swaying consumer purchasing decisions.

Tariffs are especially challenging for brands that have a high proportion of US sales within their total revenues. These manufacturers and retailers are likely to rethink their supply chains, although these efforts can be complex, take a long time to set up, and be quickly negated by subsequent policy changes. Because the US market is too big for brands to simply deprioritize it, all major overseas brands will continue to sell in the US—despite the decreased demand that will likely result from rising prices. However, these brands will also look to expand their reach in other markets to offset the likely fall in US revenue. We will therefore see increased competition in markets such as Europe, Southeast Asia (SEA), and LATAM in 2026 and beyond.

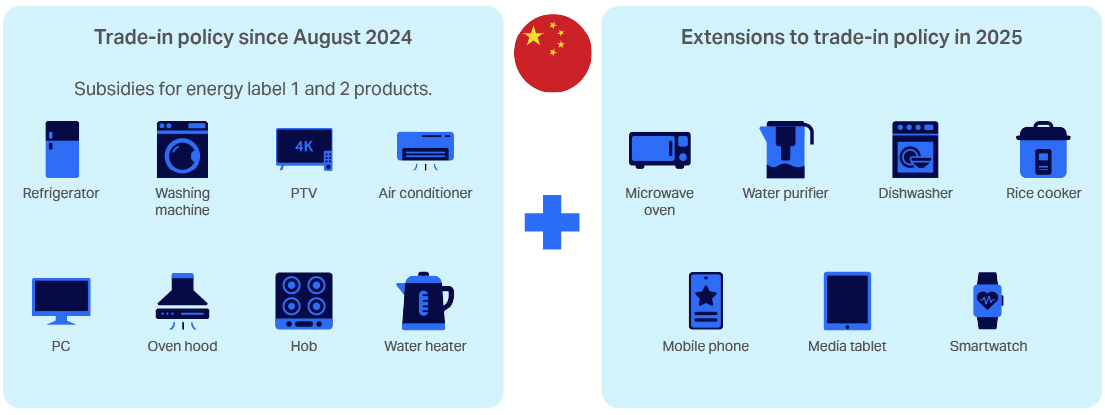

Force #3: Chinese trade-in program

China’s trade-in program for consumers’ household appliances is expected to have an ongoing impact in 2026.

China’s trade-in and subsidy policy: Categories included.

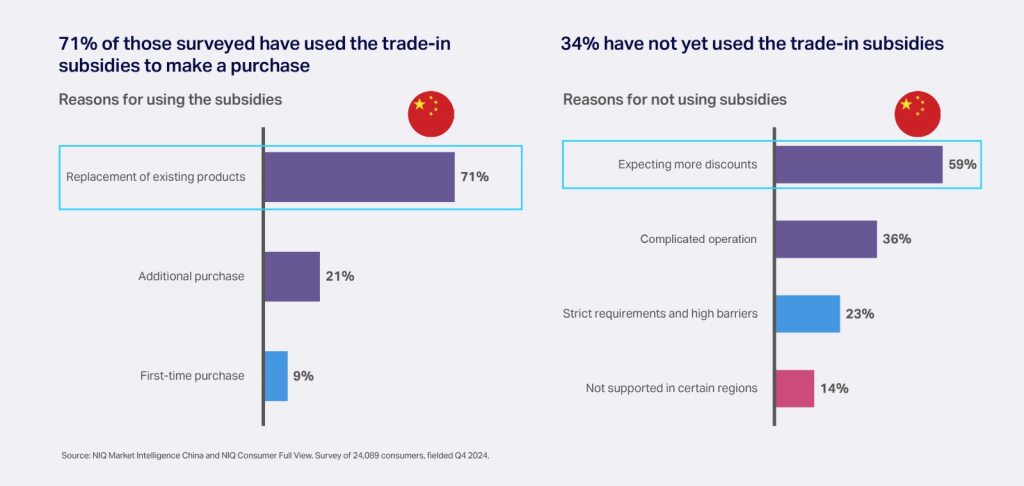

The subsidies boosted sales of key categories in China in H1 2025, but at a lower level than seen in H2 2024, when consumers first rushed to take advantage of the new offer. With the policy now expected to continue through the remainder of 2025, China’s consumers may not sense urgency. But there will likely be a purchasing spike in December 2025 as people rush to buy ahead of the speculated end date.

The end of this policy will have a substantial impact once it takes effect. If the policy concludes at the end of 2025, we believe sales of appliances within China will drop precipitously in 2026—with premium products being most affected. If the subsidies extend into 2026, we expect a very moderate sales impact since so many consumers have already replaced appliances that were most in need of an upgrade.

“Within China, awareness and take-up of the trade-in program is high, with the majority using it to replace existing products. However, one-third of those we surveyed have not yet made use of the program—either finding the process too complicated or hoping for greater discounts later in the year.”

—Nevin Francis, Senior Director, Global Strategic Insights, NIQ

Force #4: Replacement cycles

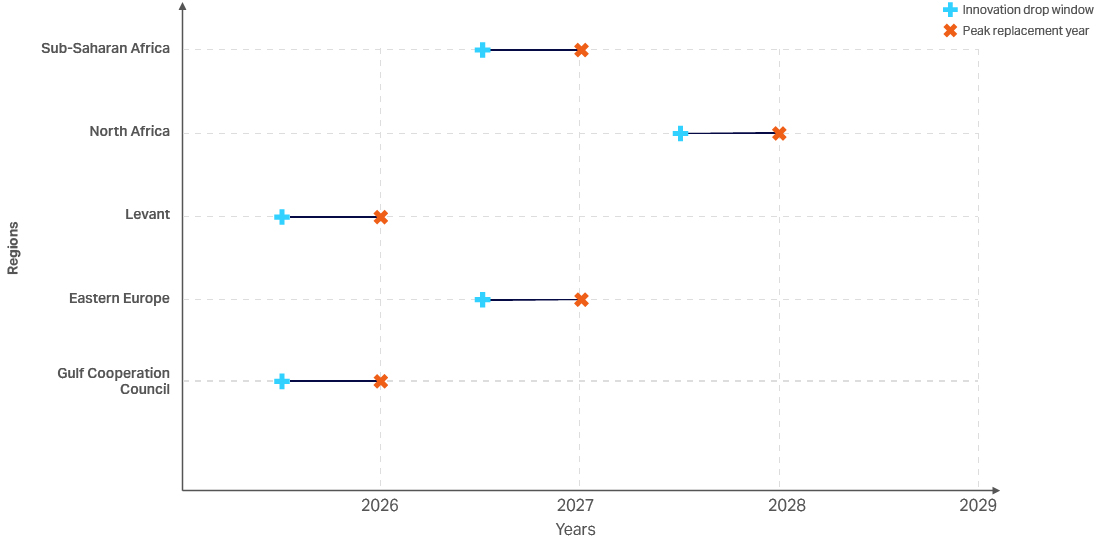

In 2026, there will be a contrasting picture for replacement cycles between major and small home appliances.

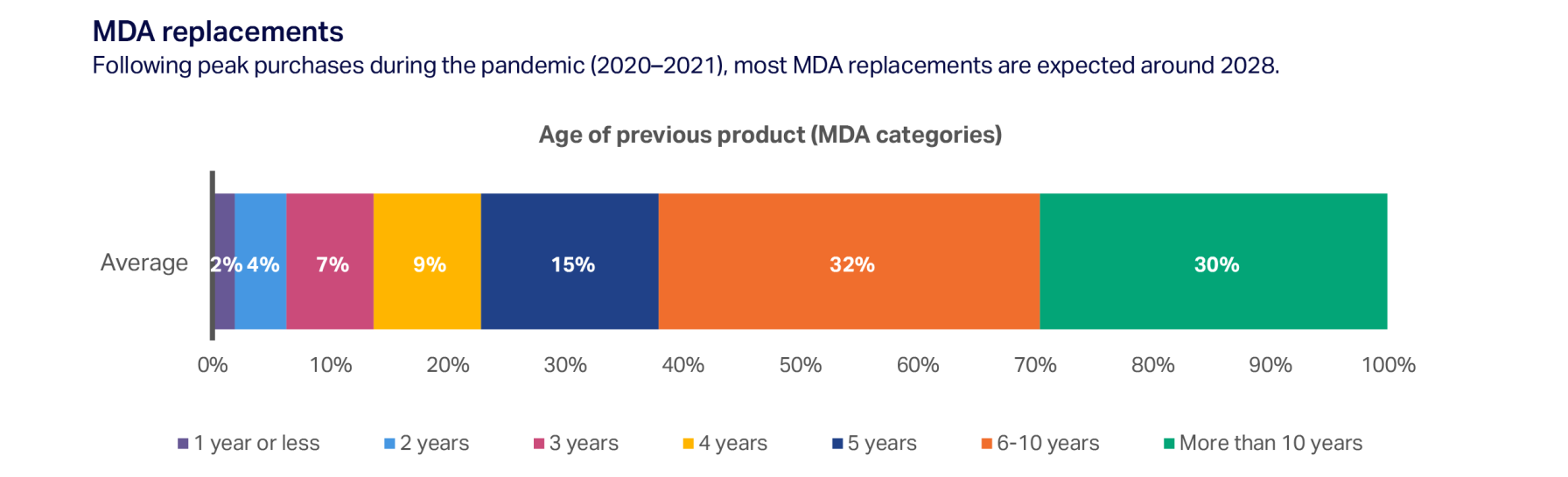

For major domestic appliances, the average replacement cycle is eight to 12 years, so peak replacements (following pandemic-era purchase spikes) aren’t expected before 2028. MDA purchase activity in 2026 will instead be driven by people replacing faulty products and by first-time buyers.

“Consumers are holding onto major appliances longer—driven by cautious spending and a lack of compelling innovation. Sales for upgrades are down, while replacements for broken units are up. Manufacturers and retailers must adapt their strategies to counter this shift.”

—Frank Landeck, Global Tech & Durables Lead, NIQ Next

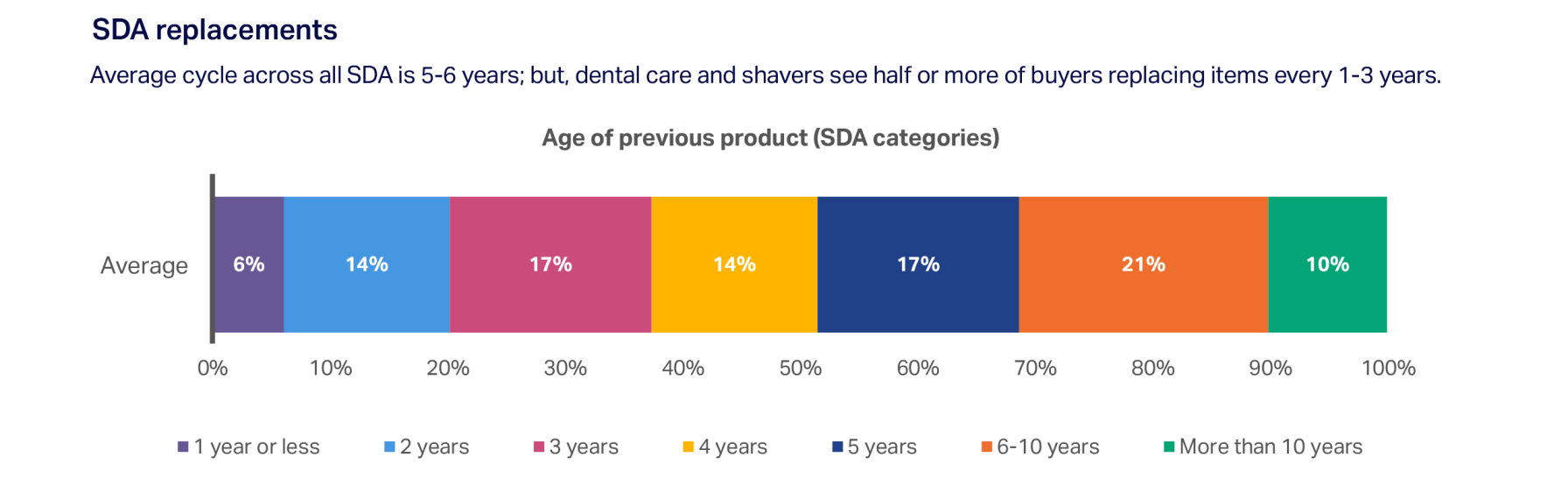

By contrast, replacement cycles are shorter (averaging five to six years) for small domestic appliances such as hair dryers/stylers, hot beverage makers, food preparation appliances, electric toothbrushes, and vacuum cleaners. Peak replacements of pandemic-era purchases are already kicking in. Demand has also been enhanced by the overall affordability of SDA products improving as recent innovations are commoditized. This is enabling more consumers to upgrade to more premium appliances—even before their current ones need replacing.

Force #5: Gen X purchasing behavior

Gen X (now ages 45–60) is the new highest-spending consumer segment, quietly driving trillions in consumer purchases. In 2025 alone, Gen X is set to spend $15.2 trillion globally on retail purchases—and, within a decade, their annual spending will reach $23 trillion.

Gen X is a prime audience for both major and small household appliances, with many members being time-pressed “caretaker consumers” who are responsible for—or heavily influencing—the home appliance purchases of aging parents and young-adult offspring, as well as their own household.

In terms of the appliances they buy, Gen Xers are more likely than others to place importance on products that are durable, high quality, and make their lives easier, as well as those offering energy savings. (NIQ’s Consumer Life 2025 survey reveals that 79% of Gen X consumers say they conserve energy at home all or most of the time.)

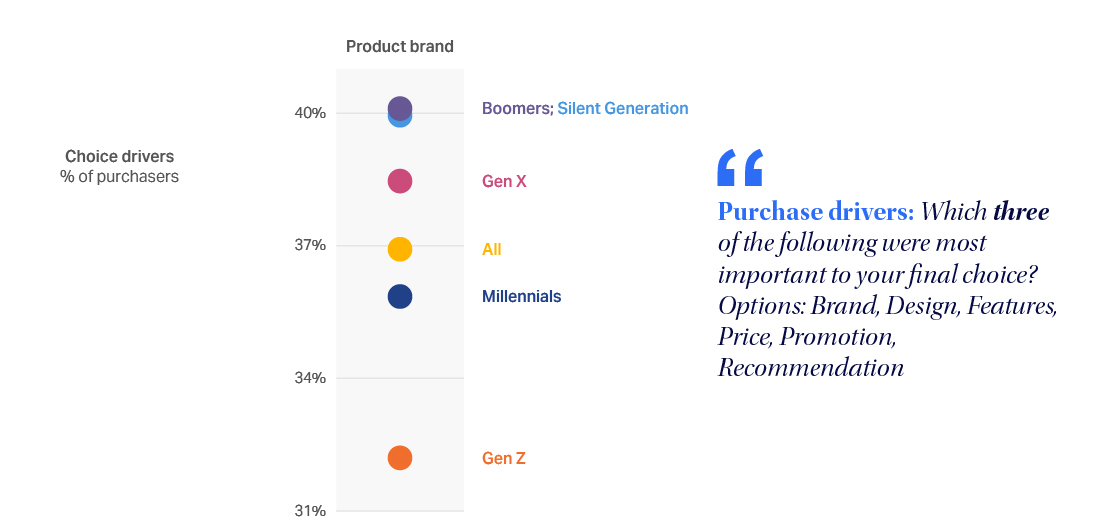

A key finding is that brand is more important with Gen Xers than it is with all younger generations—something that manufacturers should really focus on at a time when competition from new brand entrants is at an all-time high.

Manufacturers and retailers truly must have Gen X in mind when shaping their 2026 strategies, or they risk missing the mark with a highly profitable cohort.

25% of Gen X buyers in select markets spent over $650 on a washing machine, while only 17% of Gen Z did

Source: NIQ gfknewron Consumer: Austria, Belgium, Brazil, Chile, France, Germany, Great Britain, Italy, Japan, Netherlands, Poland, Spain, Türkiye, Washing machine sales, MAT Q125 (April 2024—March 2025)

Brand holds more influence on older generations in their MDA purchases; Gen Z is less brand-driven in their choices

Force #6: Home country manufacturing

Consumers’ focus on the “made in” label is increasing, pointing to an emerging opportunity for home appliance manufacturers.

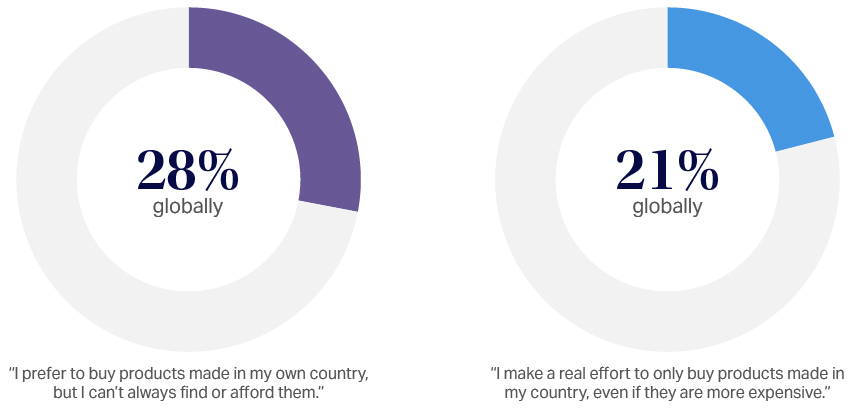

Globally, half of consumers state that they prefer to buy products made in their own country. However, a large percentage of those say they can’t always find or afford them, presenting an opportunity for brands. This opportunity is greatest in Western Europe and Developed Asia, where the number of consumers saying they prefer to buy products made in their own country (but can’t always find or afford them) jumps to nearly 40%, compared with the global average of 28%.

While this is currently more of a focus for groceries and fashion products, politicians and media in 2025 are increasingly highlighting the need to support domestic economies and jobs. Global home appliance brands that can market themselves as manufacturing items in the country of sale, while also offering good product features and price, can differentiate themselves in crowded landscapes in two ways—as supporting the local economy and as reducing delivery miles.

28% globally

“I prefer to buy products made in my own country, but I can’t always find or afford them.”

21% globally

“I make a real effort to only buy products made in my country, even if they are more expensive.”

Source: NIQ Consumer Life 2024, Global (18 core countries)

Key takeaways

- Domestically, China may see a significant sales drop for home appliances in 2026 unless trade-in subsidies are extended.

- Chinese manufacturers will continue to quickly enter global markets outside mainland China, capitalizing on the distribution they have built up over the past few years, as well as expanding into new and more premium sales channels.

- Globally, consumer replacement cycles won’t kick in until at least 2028 for most MDA. However, SDA sales will continue to experience an uplift, driven by commoditization of innovative features.

- Gen X has become a hugely valuable customer segment that’s willing to pay a premium for durability, quality, and convenience—and placing importance on brand.