Welcome to your strategic guide to 2026

Caution is the new normal

The global outlook for 2025 saw a shift from cautious to intentional consumption. For 2026, continued volatility has deeply ingrained a lingering caution into consumer psychology, which is impacting spending.

Still, areas of opportunity and growth remain amid this emotional battleground. In this analytical assessment of the state of consumers, we’ll help equip you to win with cautious yet hopeful consumers over the next 12 to 18 months—and beyond.

As always, NIQ’s Consumer Outlook report marries survey and purchase data to deliver the most comprehensive outlook possible. We uncover the divide between what consumers say and what they do, along with disruptions impacting the retail industry.

Caution may be the new normal, but our Consumer Outlook: Guide to 2026 gives manufacturers and retailers the insights and takeaways they need to not just keep pace with—but stay ahead of—whatever comes our way in the year ahead.

Chief Communications Officer & Head of Global Marketing COE, NIQ

Marta Cyhan-Bowles is Chief Communications Officer & Head of Global Marketing COE at NIQ. A proven marketing and communications leader, Marta specializes in guiding teams toward long-term customer success through data-driven rigor and a personal bias for innovative campaigns that captivate, engage, and ultimately drive measurable growth. As head of the Global Marketing COE, she leads the charge in unifying the global team at NIQ across communication and thought leadership efforts to unlock transformational value for C-suite leaders across the retail and manufacturing sectors.

Key takeaways

- Consumers are numb to volatility—confidence is misleading. Shoppers have adapted to constant shocks, which makes them feel more confident even though their financial realities haven’t changed. Inflation, everyday expenses, and borrowing costs still squeeze wallets, making volatility a semi-permanent condition leaders must plan around.

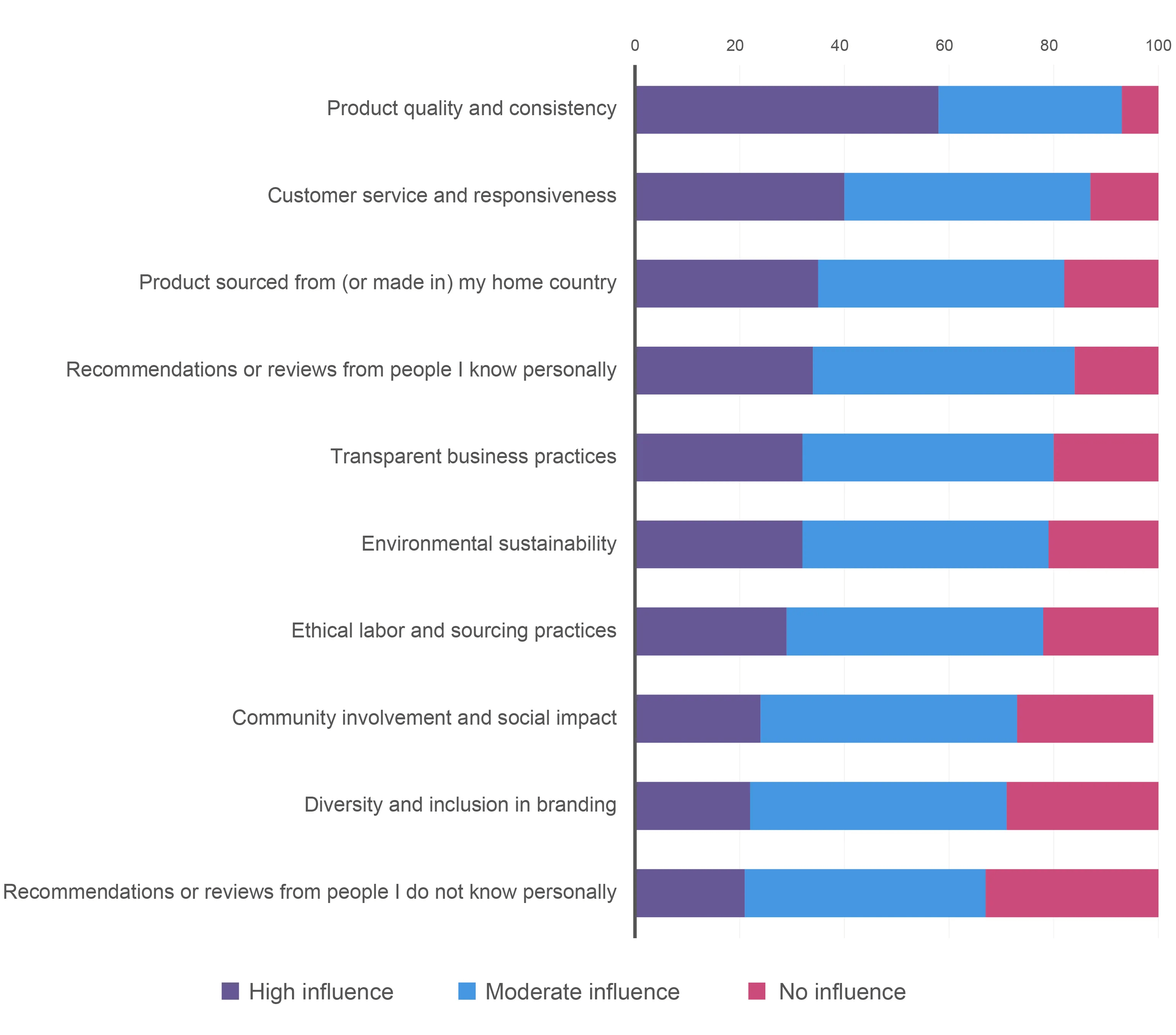

- Spending is intentional—every purchase has to earn its place. Shoppers reward retailers and brands that deliver trust, personalization, and convenience. ESG and sustainability are table stakes; today’s consumer wants tangible benefits that simplify their life and align with their values.

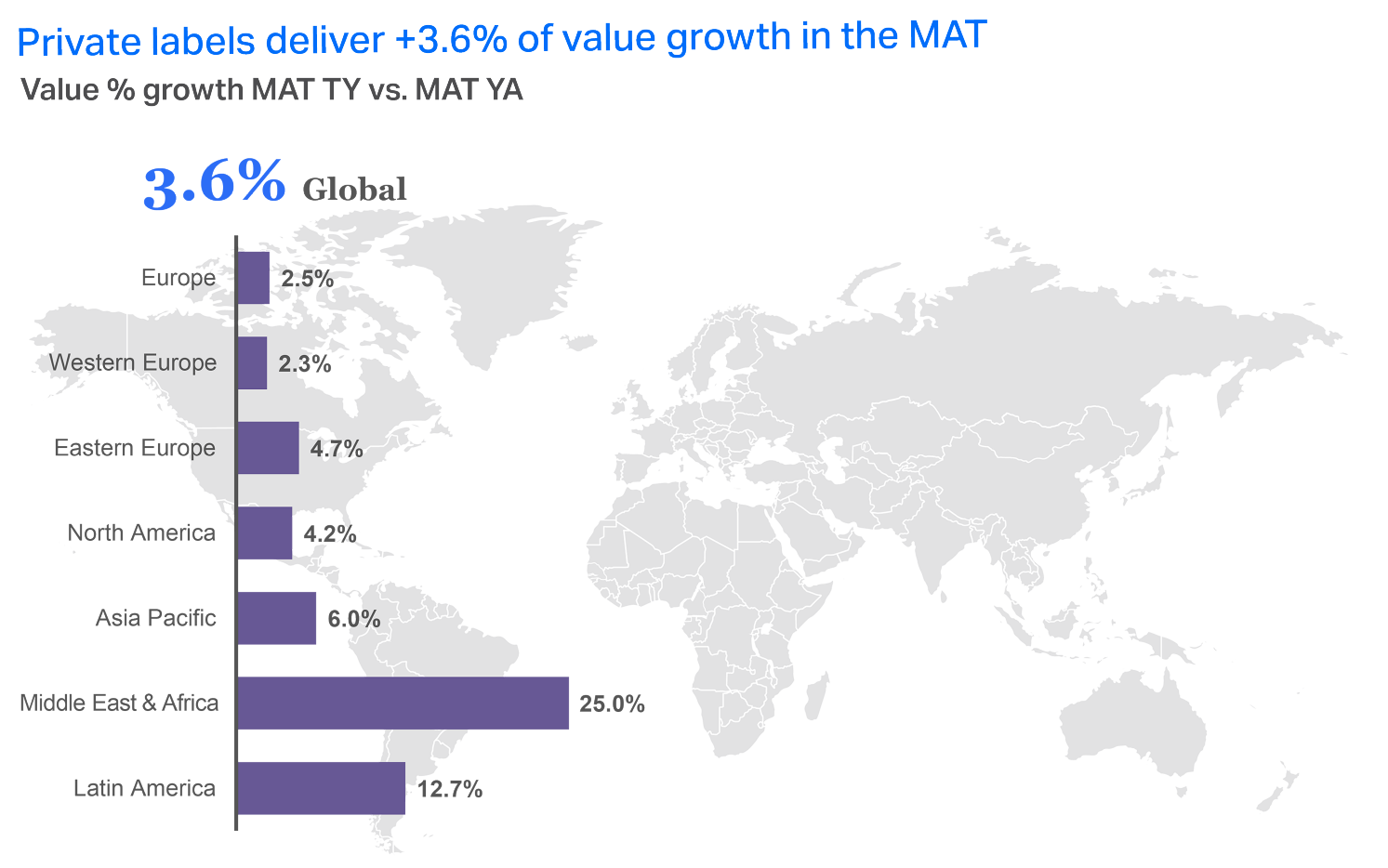

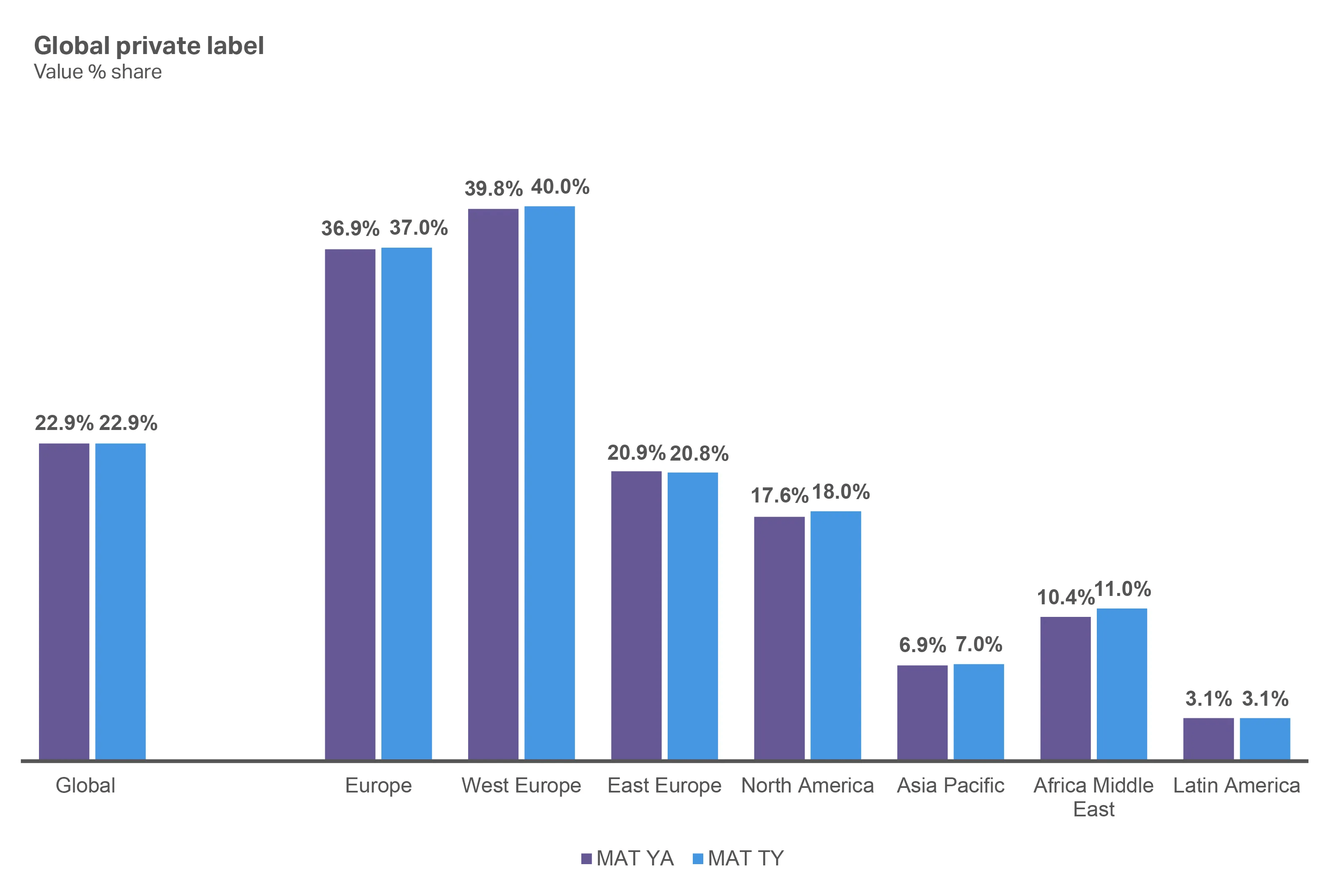

- The pricing playbook is over for now. Consumers are tapped out and won’t accept more price hikes. Growth depends on volume—capturing trips and baskets through sharper assortments, innovation, and private label strategies that stretch limited discretionary dollars further.

- Retailers are the new media moguls. Retail media networks (RMNs) are reshaping commerce, blending shopping with advertising at shelf, on apps, and across digital touchpoints. For consumers, RMNs deliver real benefits: personalization, convenience, and loyalty rewards, while forcing retailers and manufacturers to rethink how they scale.

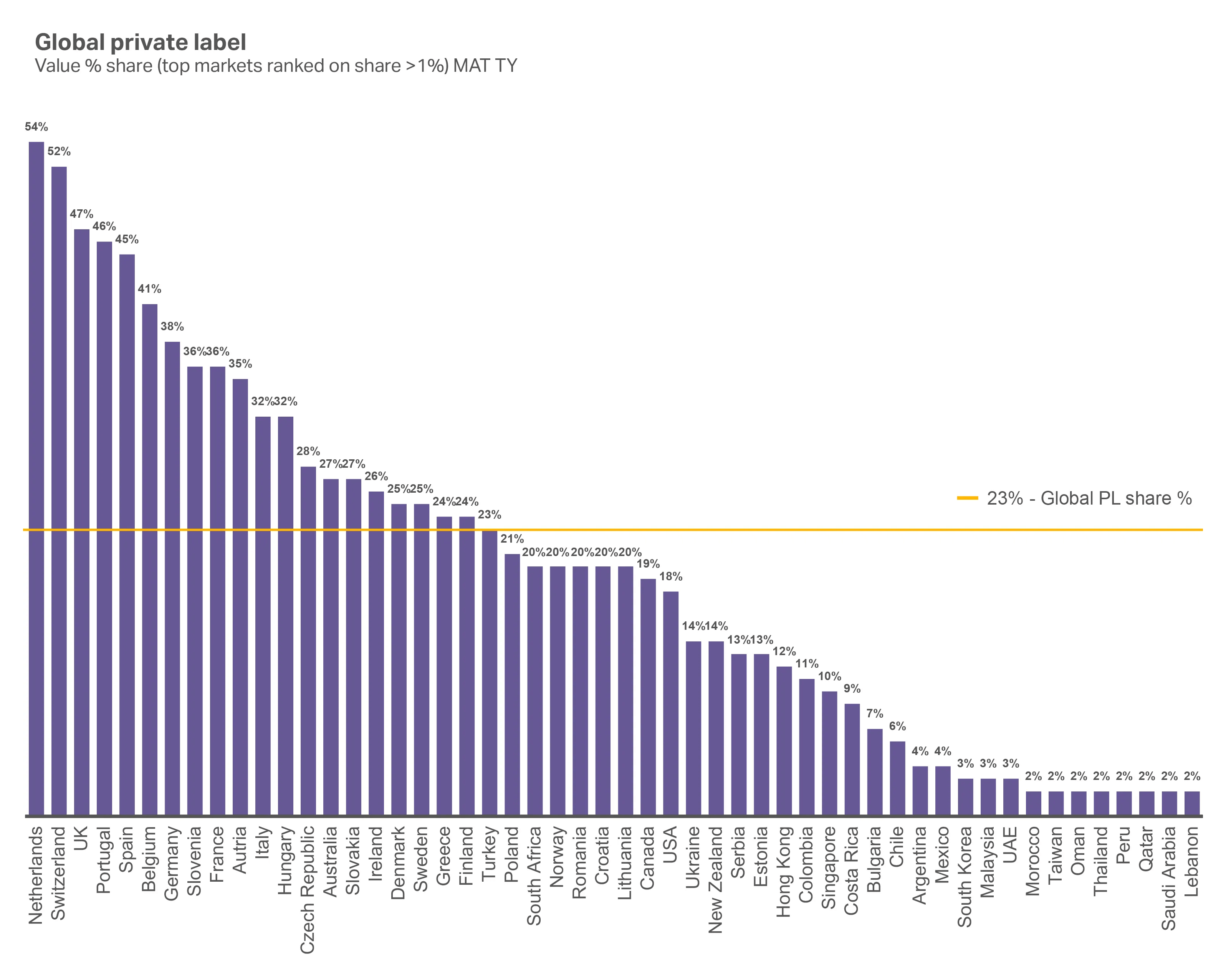

- Private label remains a loyalty lever. Store brands are no longer the “cheap option.” They’re often where shoppers see the best value without compromise, giving retailers margin while pressuring national brands to prove they still belong in consumers’ baskets.

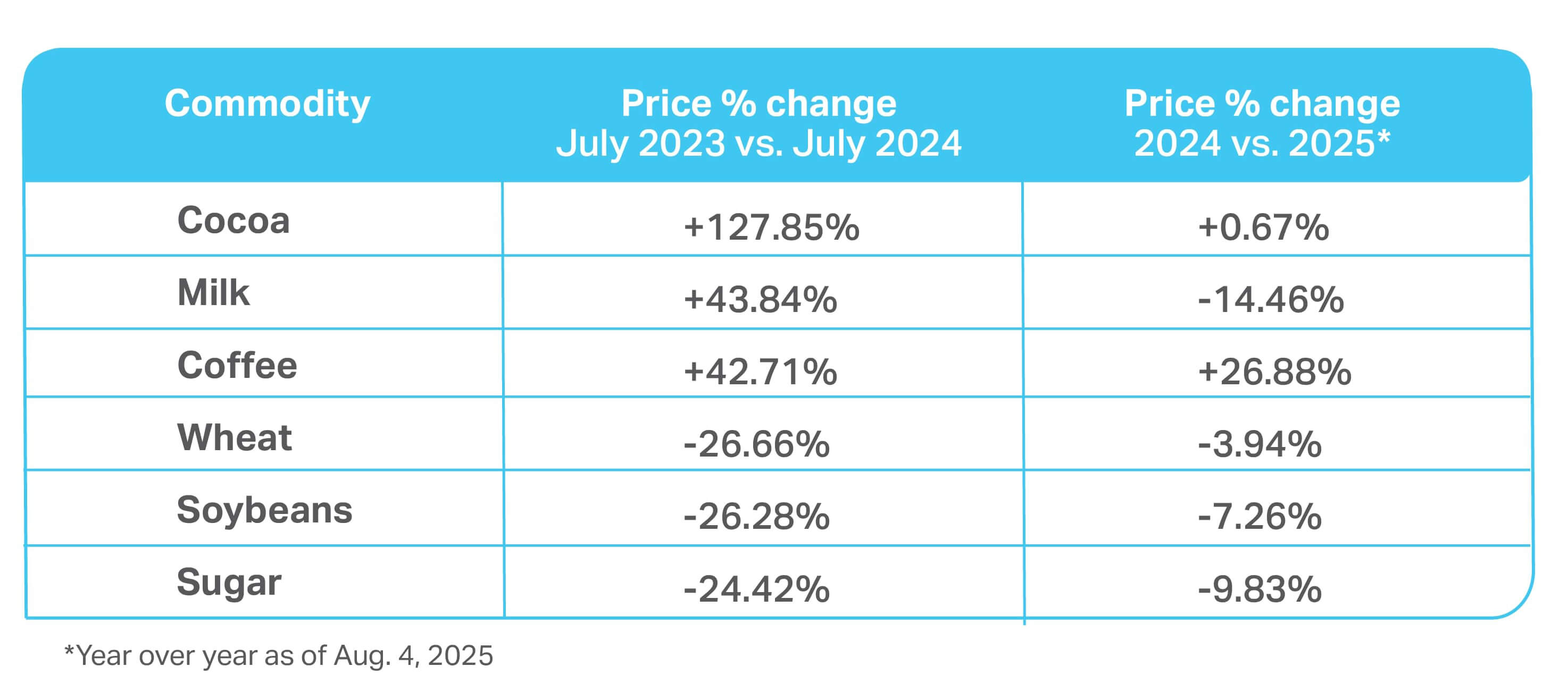

- Commodity volatility is fueling consumer-first innovation. Ingredient price swings—from cocoa to eggs to coffee beans—are forcing reformulation, but they’re also opening doors. Manufacturers that pivot fast with alternatives (e.g., vegan egg replacers that don’t sacrifice on taste or quality) can deliver affordability, functionality, and trust all at once.

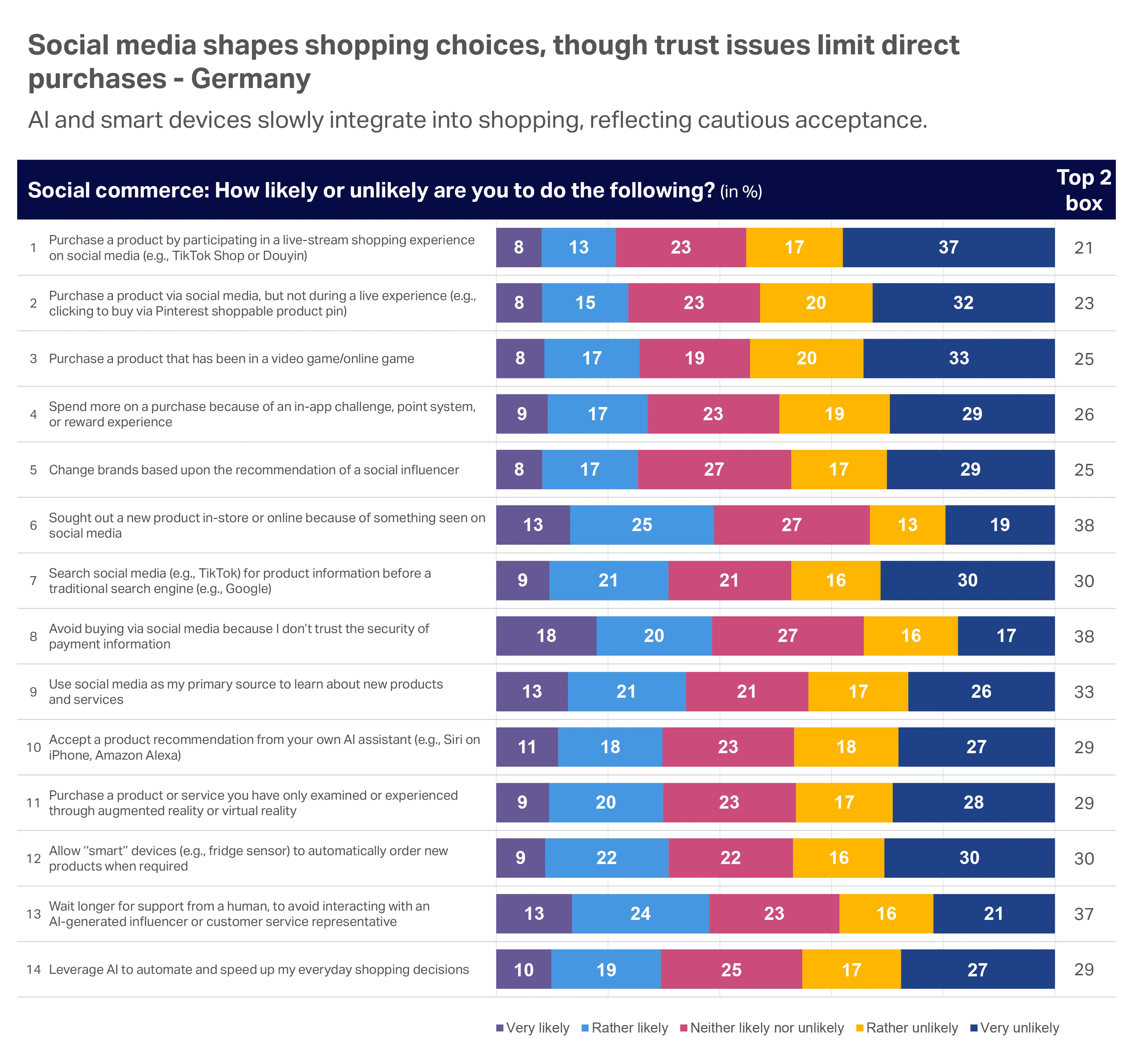

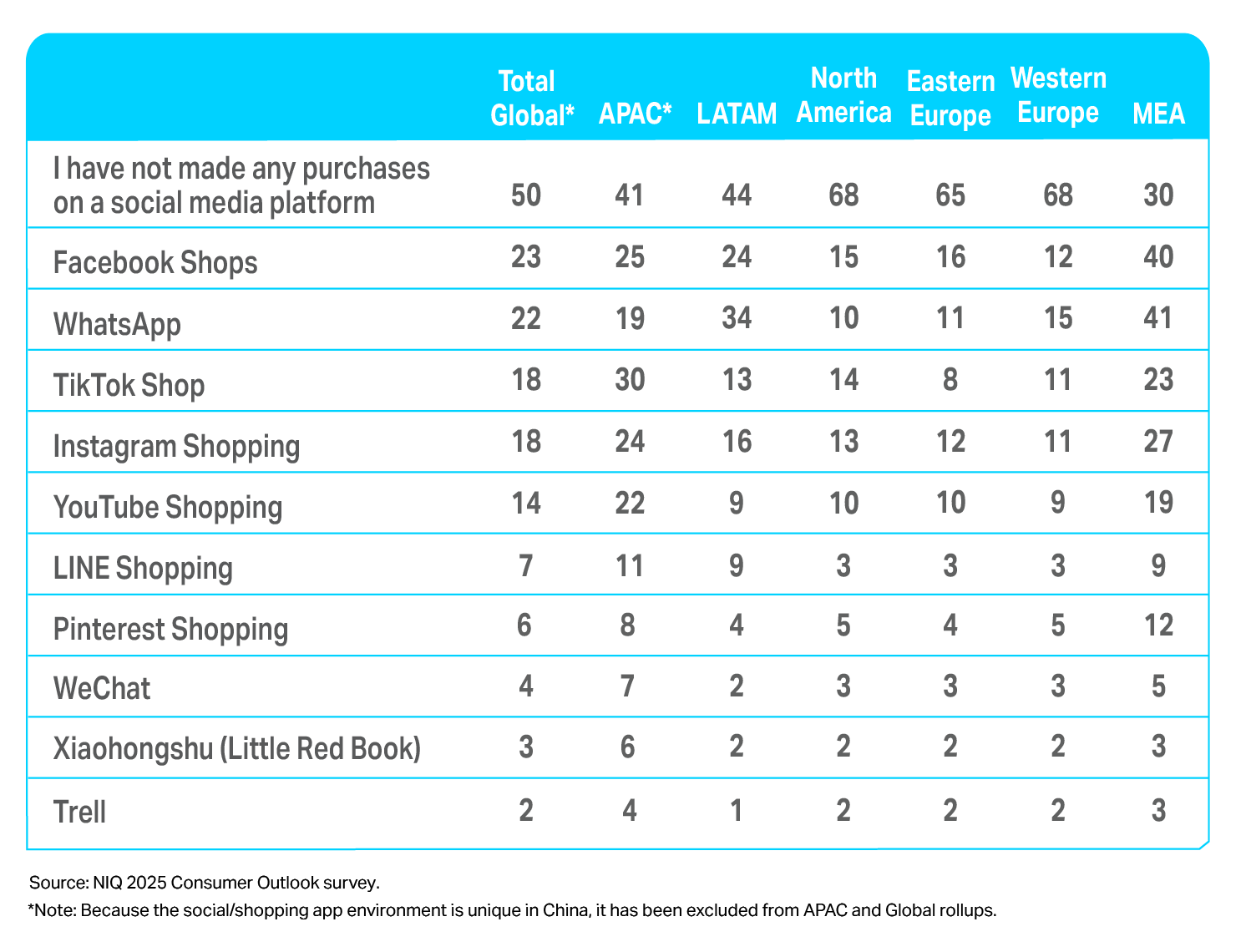

- Seamless commerce is the next frontier. Social commerce, quick commerce, and RMNs are converging into one ecosystem. Consumers expect frictionless, personalized, and instant shopping pathways—raising the bar for retailers and manufacturers to deliver everywhere, all at once.

Want to read later?

Chapter 1: State of consumers and economic uncertainty

Spending caution is now baked into household economics

Inflation-driven austerity is fading, but consumers are wary of another “rebalancing.” Across income brackets and geographies, economic and political volatility are driving caution among consumers.

With trust in long-term stability low, consumers are adapting to volatility as the new normal. They are looking to brands for emotional reassurance as much as they are for affordability.

While consumers are largely in the same financial position they were last year, they’re feeling much better about their positions.

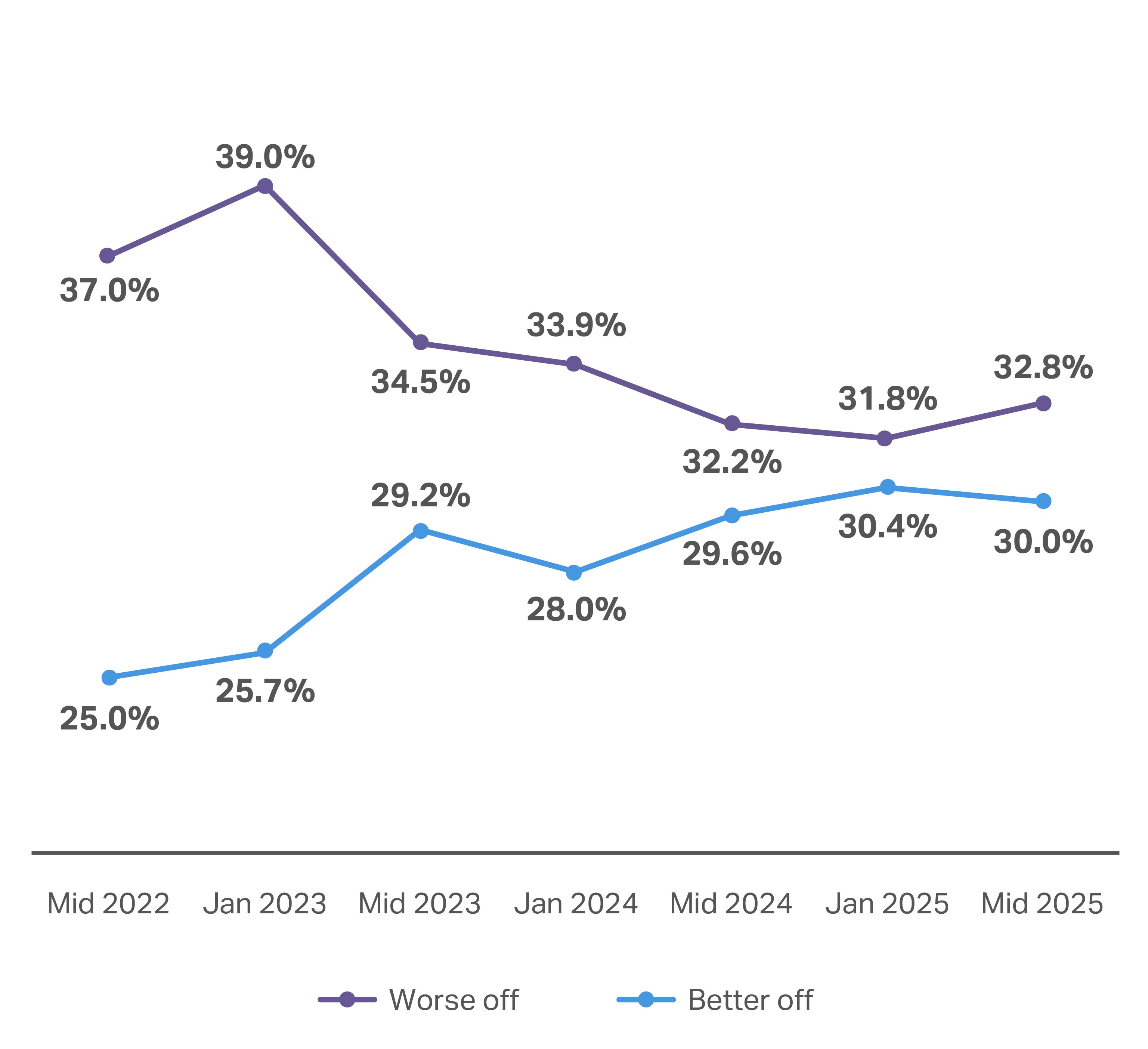

30% of global consumers say they’re in a better financial position than they were a year ago—up 0.4% from July 2024

32.8% say their financial position has worsened in the past year—up 0.6% from July 2024

+4% US dollars spent per trip ($36 per household per trip)

+1% US shopping occasions per household (roughly 294 trips per household per year)

Global consumer sentiment remains relatively unchanged year over year

Consumers who said in 2025 that they were “better off” than a year ago remained consistent with 2024’s mid-year survey results. There was a nominal uptick (0.6%) of global consumers reporting they were “worse off.”

Even in the US—a market that has shown lagging optimism—the number of respondents who said they were “much worse off than a year ago” dropped by over half, to just 8.5% between July 2024 and today. This shift in positivity in the US has resulted in a 4% increase in average spending on FMCG products. However, the average number of items purchased per trip remains largely flat.

Compared with a year ago, is your household better or worse off financially?

Of the consumers who report feeling “worse off,” most (73%) attribute their financial situation’s decline to increased costs of living. Economic slowdown (39%) and job insecurity (30%) are the other major factors influencing this consumer sentiment. Consumers report feeling slight relief from all these pressures (vs. last year), but the number concerned about the impact of “geopolitical conflict” rose from 12% to 14%.

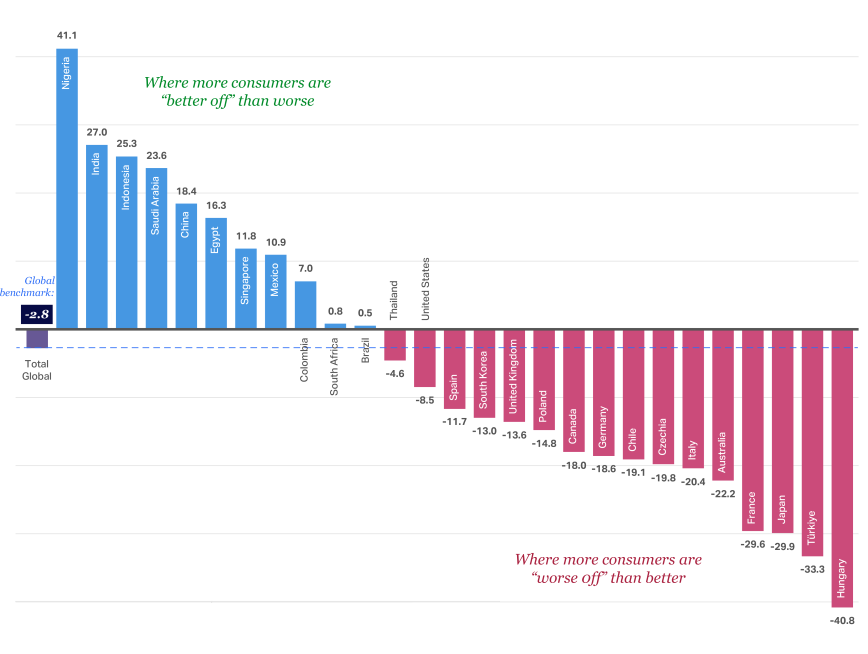

While optimism in many North American and European Union (EU) markets has risen over the past year, these markets still have more “worse off” consumers when compared with other large markets, such as India and China. Türkiye, Chile, and Australia also continue to struggle, with more consumers feeling “worse off” in 2025 (compared with 2024).

Optimism around financial situation varies widely by region and country

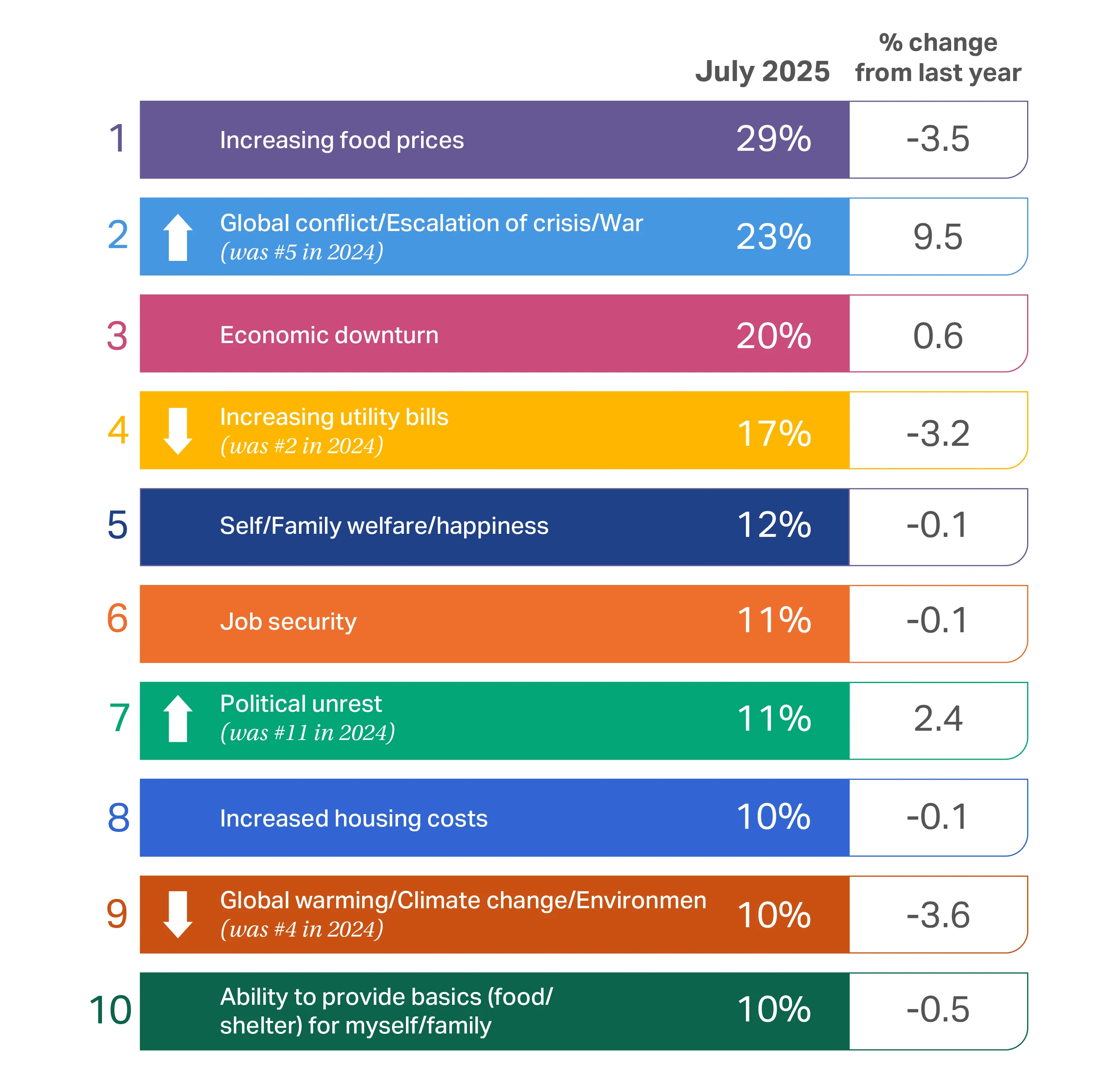

Top concerns setting the spending tone for 2026

Inflation continues to be an issue for global consumers, who remain deeply concerned about rising food prices and a potential economic downturn.

As reported last year, consumers are worried about the cost of utilities, their welfare, and job security. Though they continue to spend, lingering high prices, tariffs, and elevated interest rates mean consumers must continue to make hard choices.

While many consumer concerns remained relatively consistent year over year, we do see some notable shifts in the overall consumer rankings going into 2026. Last year, consumers reported increasing concern over global warming and the environment—landing this concern at #4. This year, it barely made the top 10, coming in at #9.

Conversely, global conflict and war has risen from #5 to #2, up 9% from just a year ago. Political unrest has also joined the top 10, at #7—up 2.4% from last year. With persisting, escalating geopolitical conflicts, it’s no surprise that these issues are top of mind, especially when said conflicts have had severe economic impacts.

A noteworthy potential source of relief for the global consumer is an International Monetary Fund (IMF) prediction that global inflation will cool from 4.2% in 2025 to 3.6% in 2026. IMF also forecasts that global GDP will grow to 3% in 2025 and 3.1% in 2026. These numbers are far from guaranteed, however, given the uncertainty across global markets, but they do show that financial conditions appear to be easing despite consumer trepidation.

Consumption drivers

The compounding effect of inflation

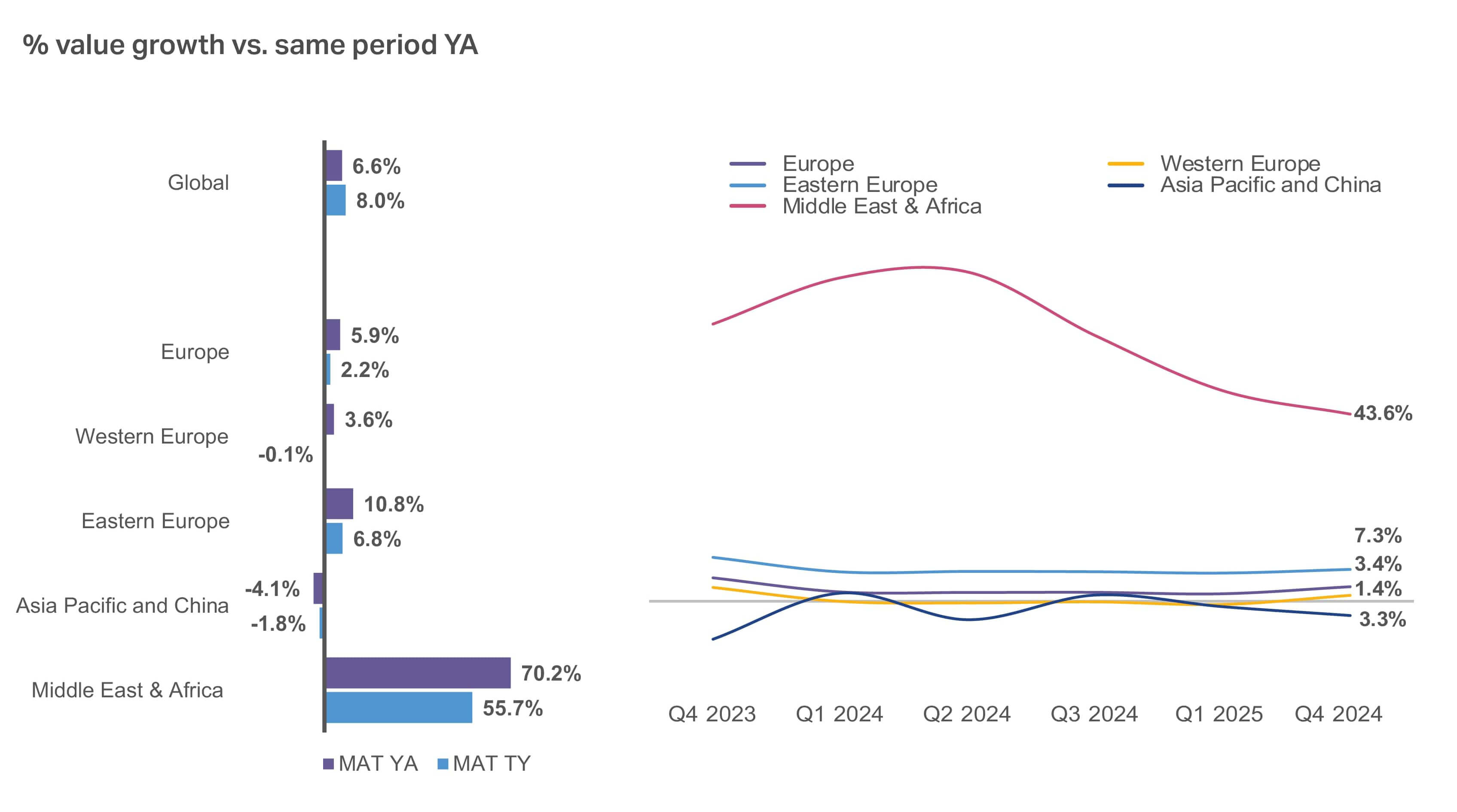

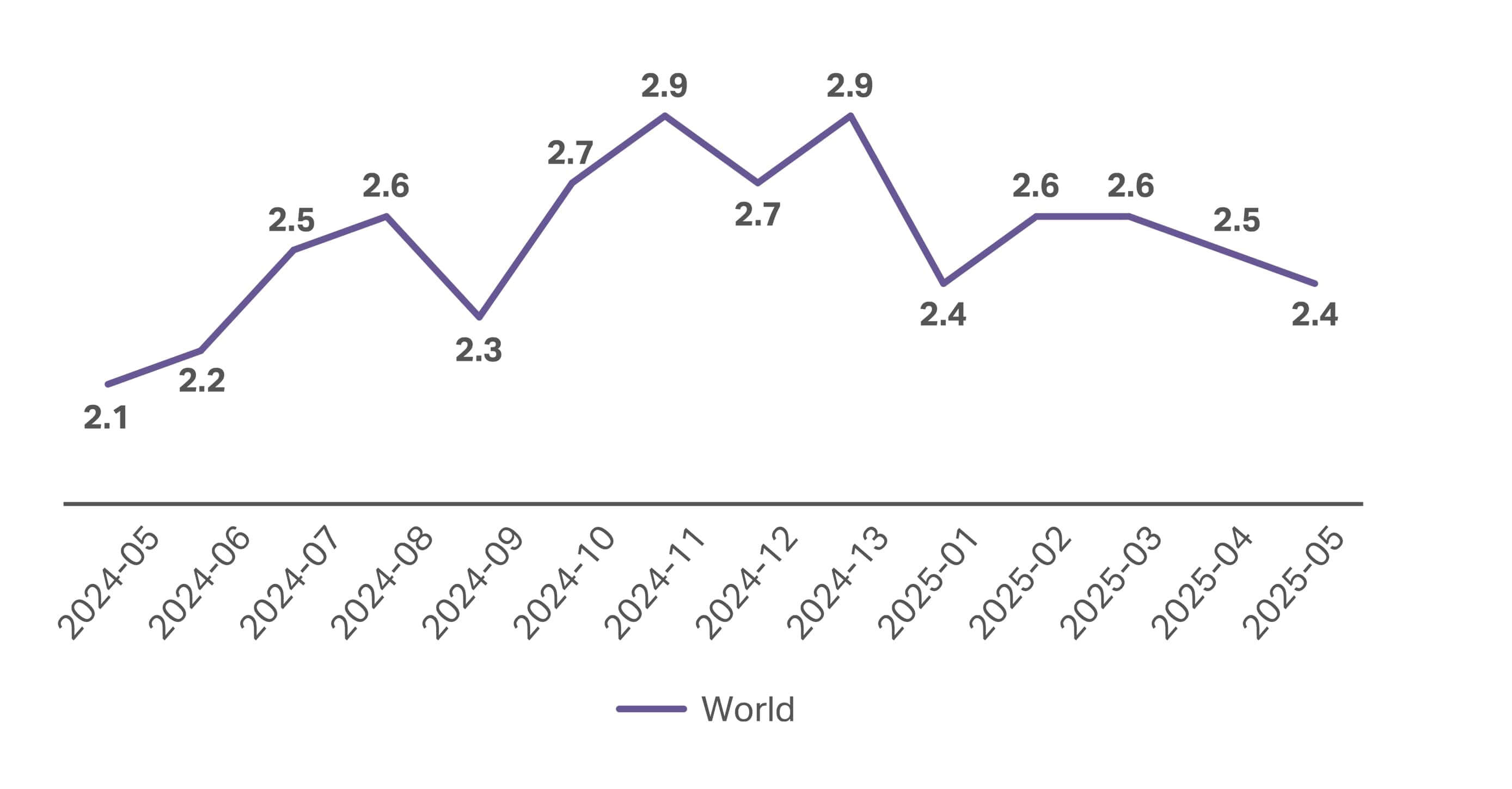

Consumer packaged goods (CPG) inflation cooled each month from early 2023 into 2024 but remained higher than the global average in some regions. Notably, from May 2024 to May 2025, it has begun creeping upward again—by 0.3%.

Taking a Full View™ into the state of the CPG industry

After declining ~8% last year, the pace of CPG inflation has begun to creep upward year over year.

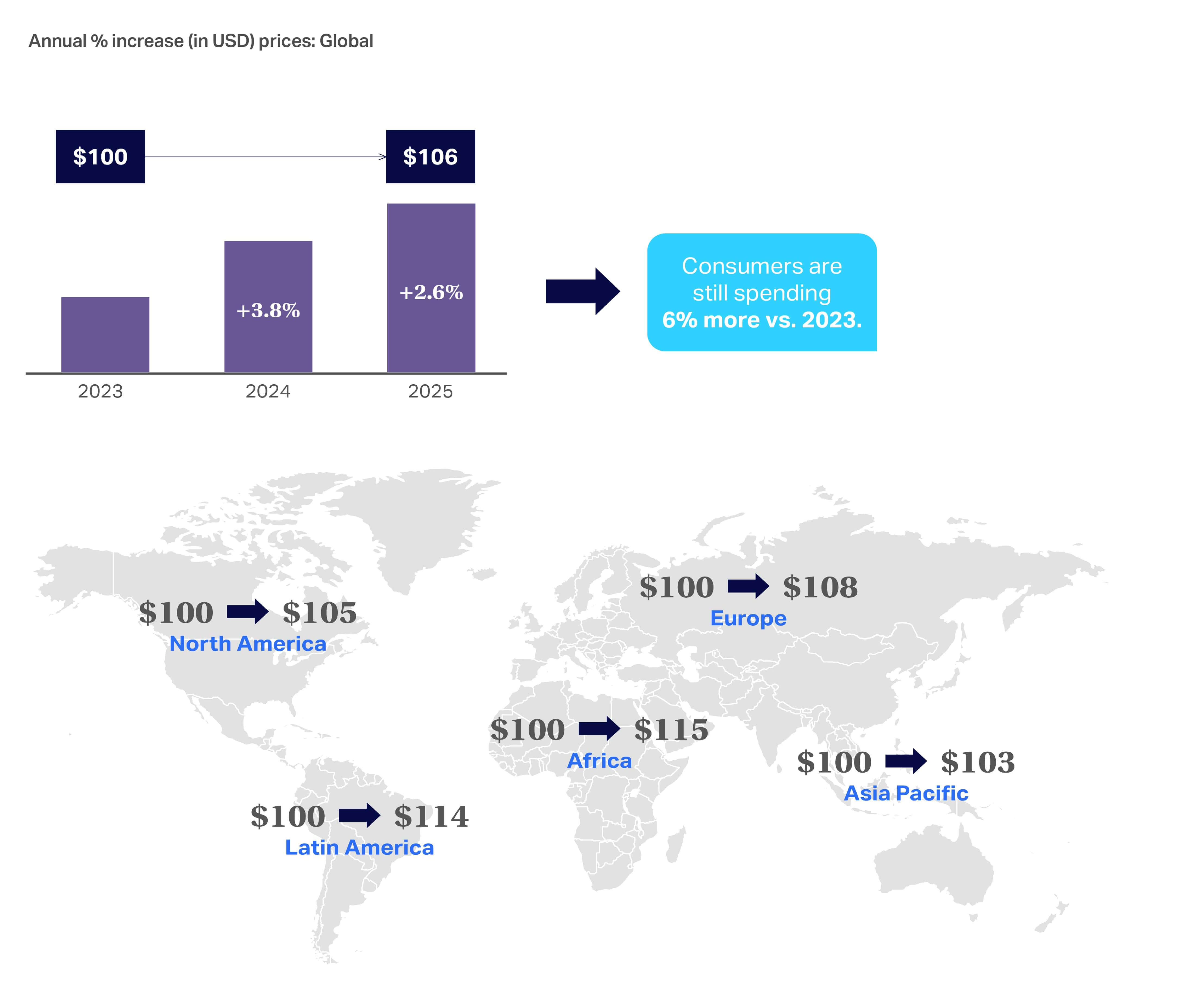

Consumers continue to feel the effects of inflation, spending $106 today for what would have cost them $100 in 2023. Although the rate of global inflation has dramatically declined since its 2022–2023 peak, in June 2025, regions such as Latin America were experiencing inflation of 6.6%—more than double the global average, which was below 3% at that time.

Elevated prices are squeezing consumer wallets and reinforcing that we are in a long-term recovery period

Though many indicators skew positive this year (vs. 2024), the lingering question of tariffs and their impacts on the cost of CPG items adds another level of uncertainty as we move into 2026.

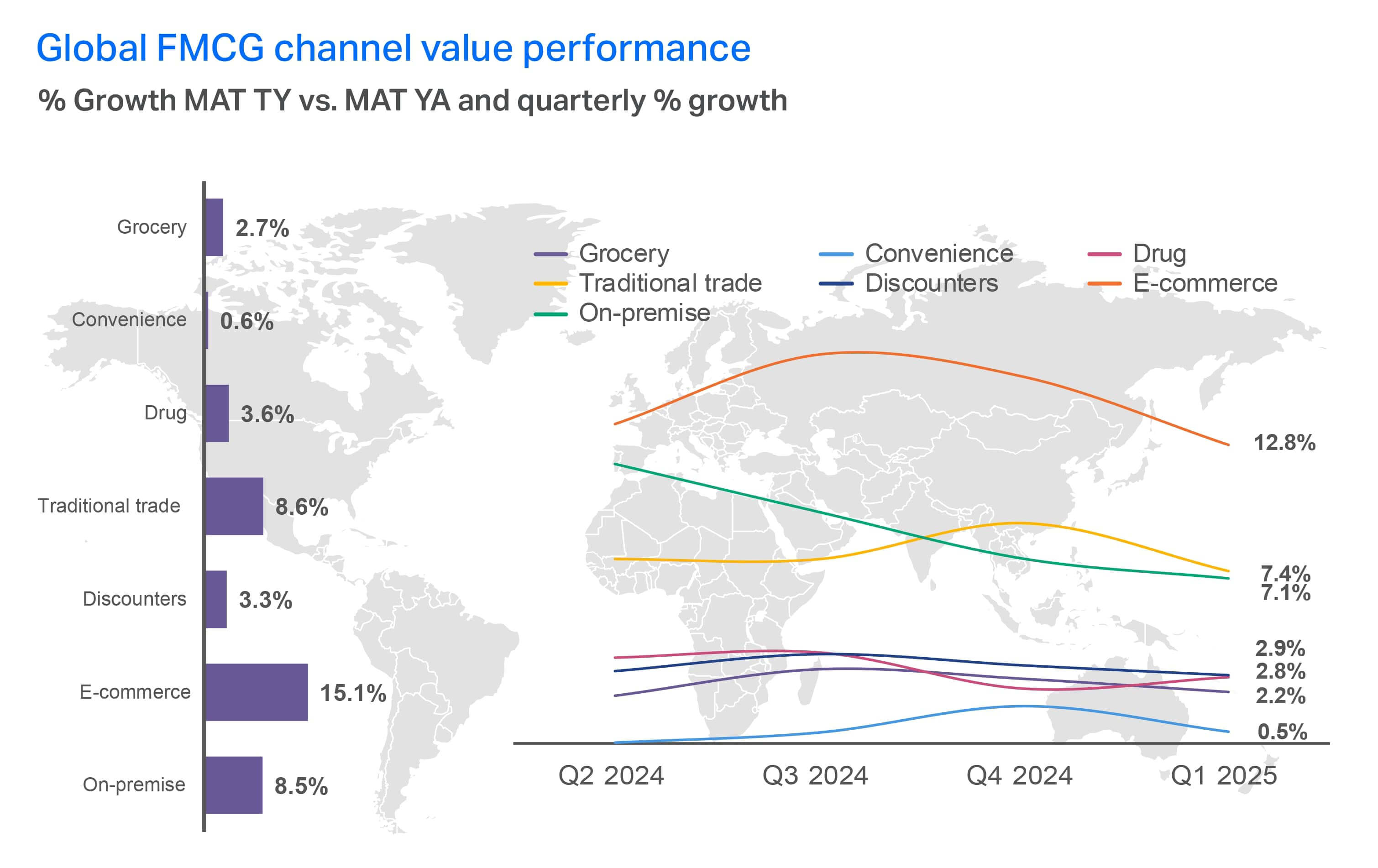

Global growth persists, but shows signs of softening heading into 2026

Global FMCG trends, 2024 vs. 2025:

- Value sales growth: +3.5%

- Volume growth: +0.9%

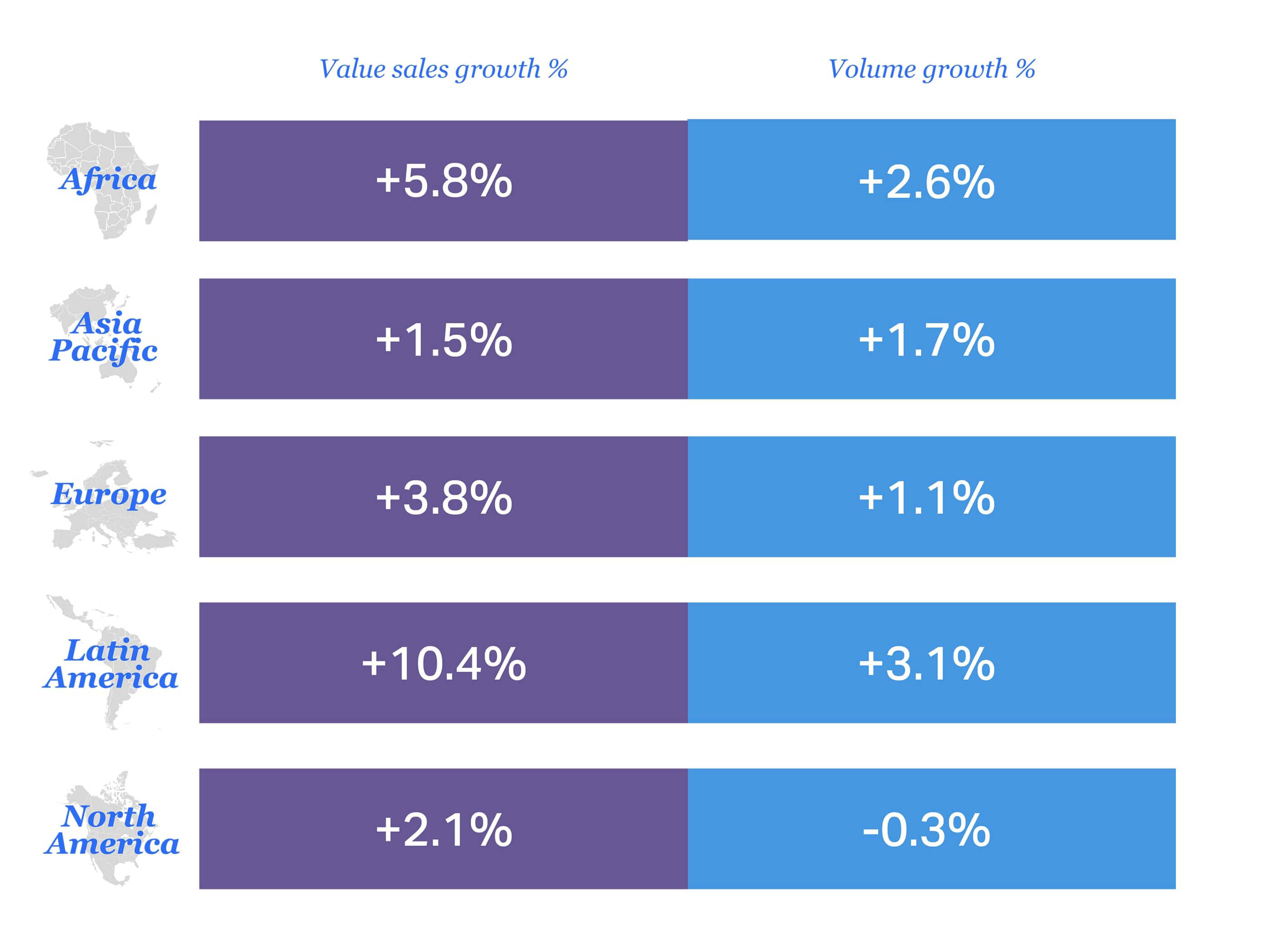

Looking across the global CPG landscape, value sales growth has slowed from 2024 to 2025 vs. the previous period. However, it still sits at 3.5%. Volume growth remains consistent with the previous 2023-to-2024 period.

Value growth in both Europe and Africa has slowed as inflationary pressures have eased, but high inflation in Latin America drives the market’s 10.4% value sales growth.

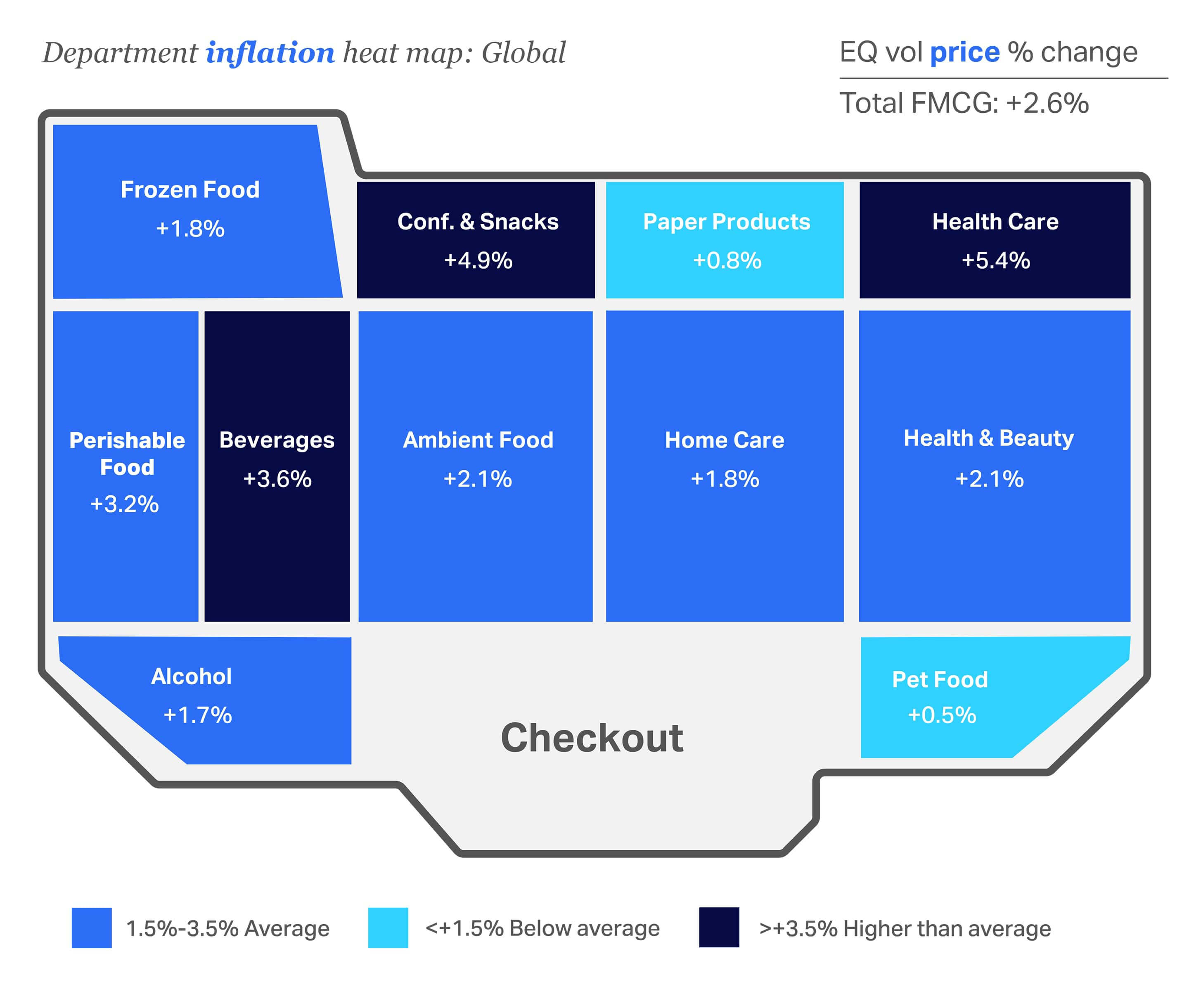

Global heat map of price growth by category

Prices remain elevated, but several categories saw inflation cool in 2025.

This global-level heat map of purchase categories confirms that inflation has cooled across the store for many categories but still lingers above this year’s total FMCG average of +2.6% in a few key areas of the store. Health Care (+5.4%), Confectionery & Snacks (+4.9%), and Non-alcoholic Beverages (+3.6%) saw the highest rates of inflation in 2025.

This year’s data only tells one part of the story, however, and it’s important to understand which categories saw the most relief from inflation over last year. Categories that saw the biggest positive impacts from cooling inflation in 2025 were Pet Food at 0.5% (down from 6.5% in 2024), Home Care at 1.8% (down from 7.6% in 2024), and Health & Beauty at 2.1% (down from 6.0% in 2024).

With average price growth for FMCG at 2.6% in 2025 (down from 4.1% in 2024), brands and retailers must execute strategically relative to selling higher volumes to offset declining value growth.

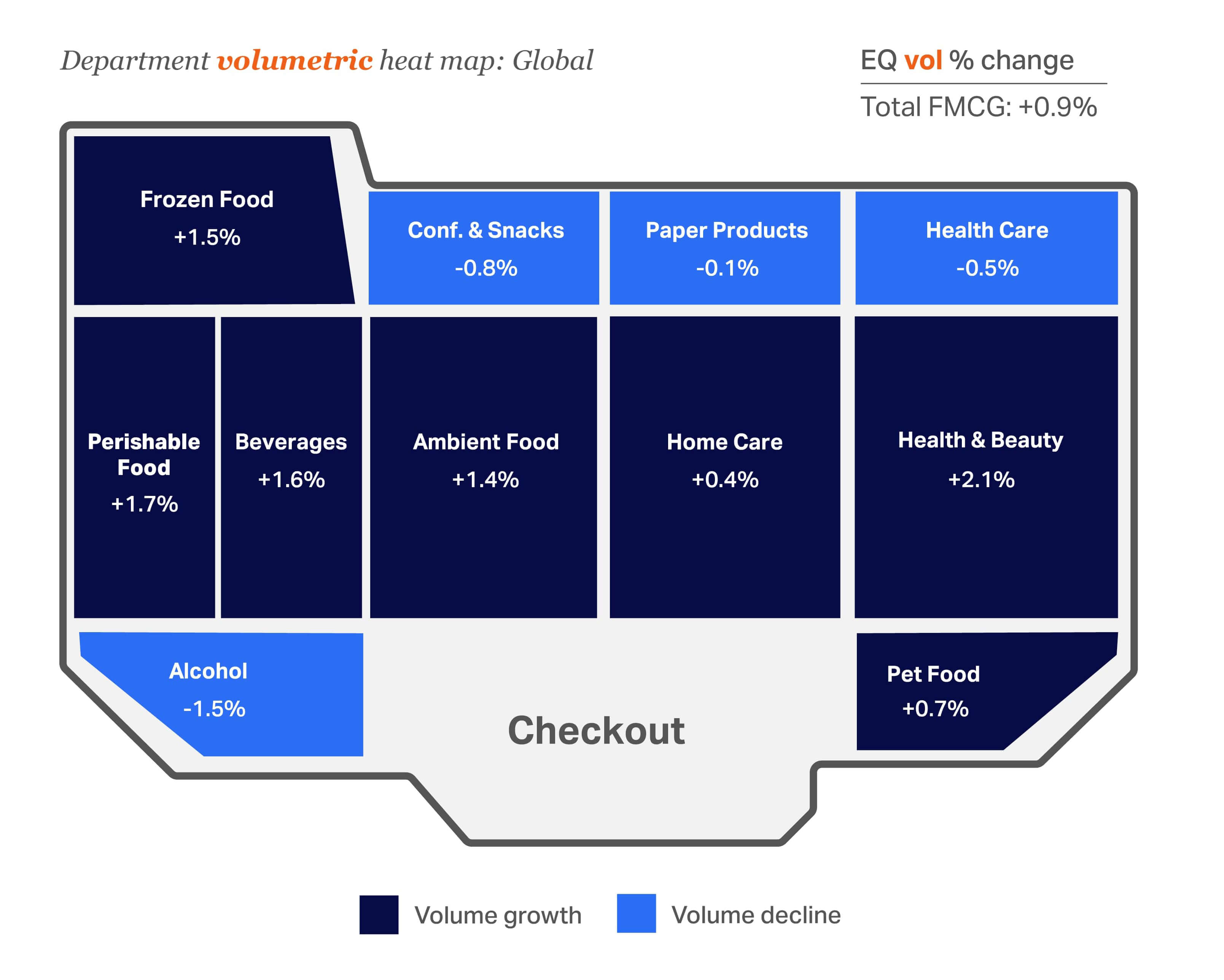

Global heat map of volume growth by category

Volume growth continues to favor Health & Beauty and Perishable Food

A look at volumetric growth compared with a year ago helps tell a fuller story. While total FMCG volume change (+0.9%) is consistent with last year (+0.8%), Paper Products and Alcohol continue to see negative growth. Health & Beauty (+2.1%) and Perishable Food (+1.7%) are the big winners with the largest volume growth in 2025.

Local nuances to inflation and volumetric updated highs and lows

This market-level view uncovers local nuances that can lead to growth opportunities. NIQ’s global Retail Measurement Services can help identify market gaps and growth opportunities at the category level. For instance, Health Care is seeing inflation-driven growth across Europe, Asia Pacific, and Africa. The only market where volume has increased significantly for this category is Latin America, where Health Care prices are down nearly 10%.

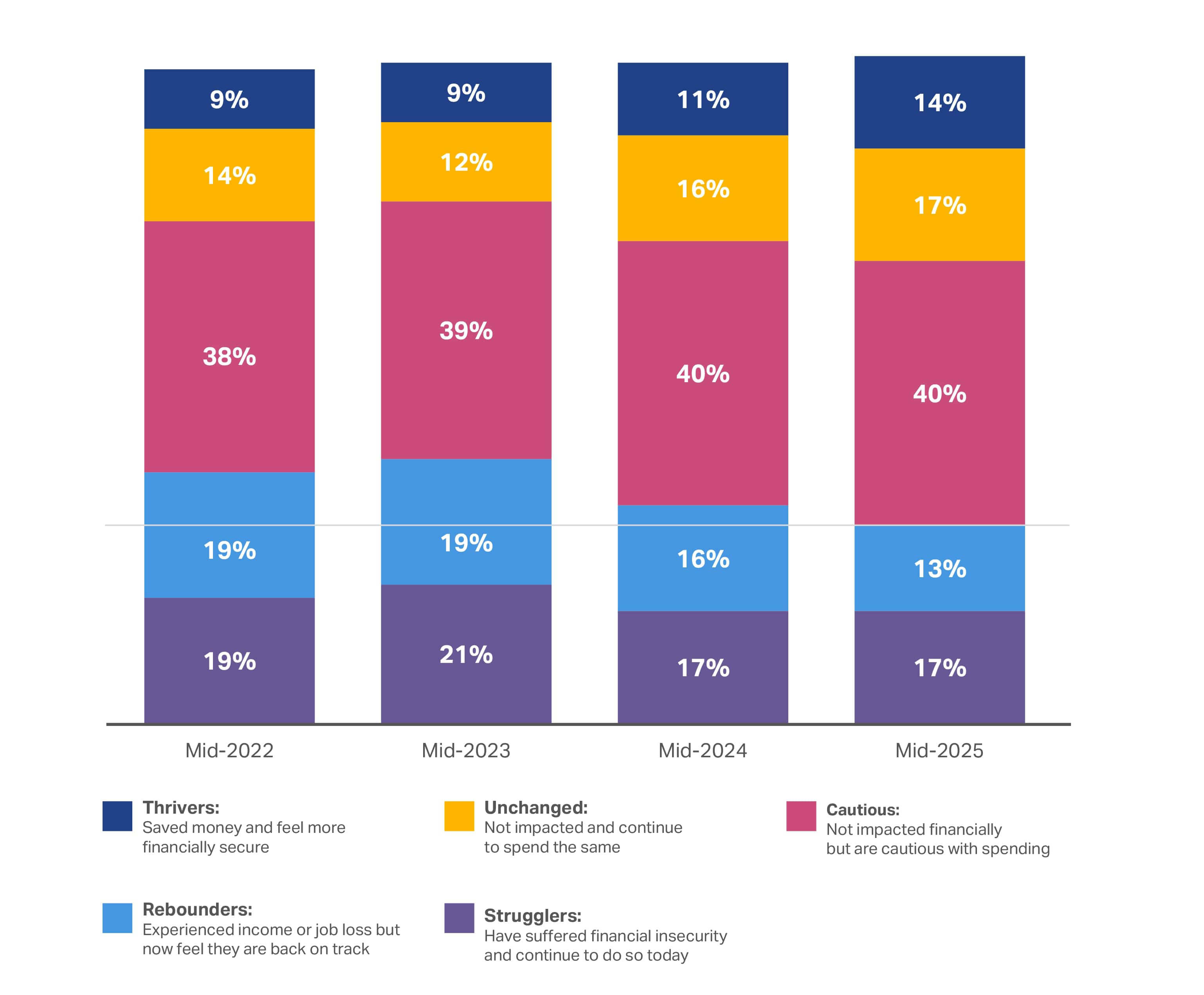

The 2025 economic divide

Consumers continue to feel more financially secure.

NIQ’s socioeconomic consumer segments continue to be a valuable tool for identifying how consumers perceive their financial security—including recent impacts to their income or ability to save money. Tracking changes in sentiment over time also offers a macro view for how global events are impacting the average consumer.

31%

of global consumers surveyed are either unimpacted financially or thriving in 2025 vs. 27% in 2024

The number of “confident” consumers continues to grow year over year, increasing 10% from 2023 to today. This shows that more consumers are feeling relatively financially secure and that they’re continuing to spend at consistent levels. However, the number of “cautious” consumers has stayed relatively steady—at around 40%.

Growing confidence is slowly changing behaviors

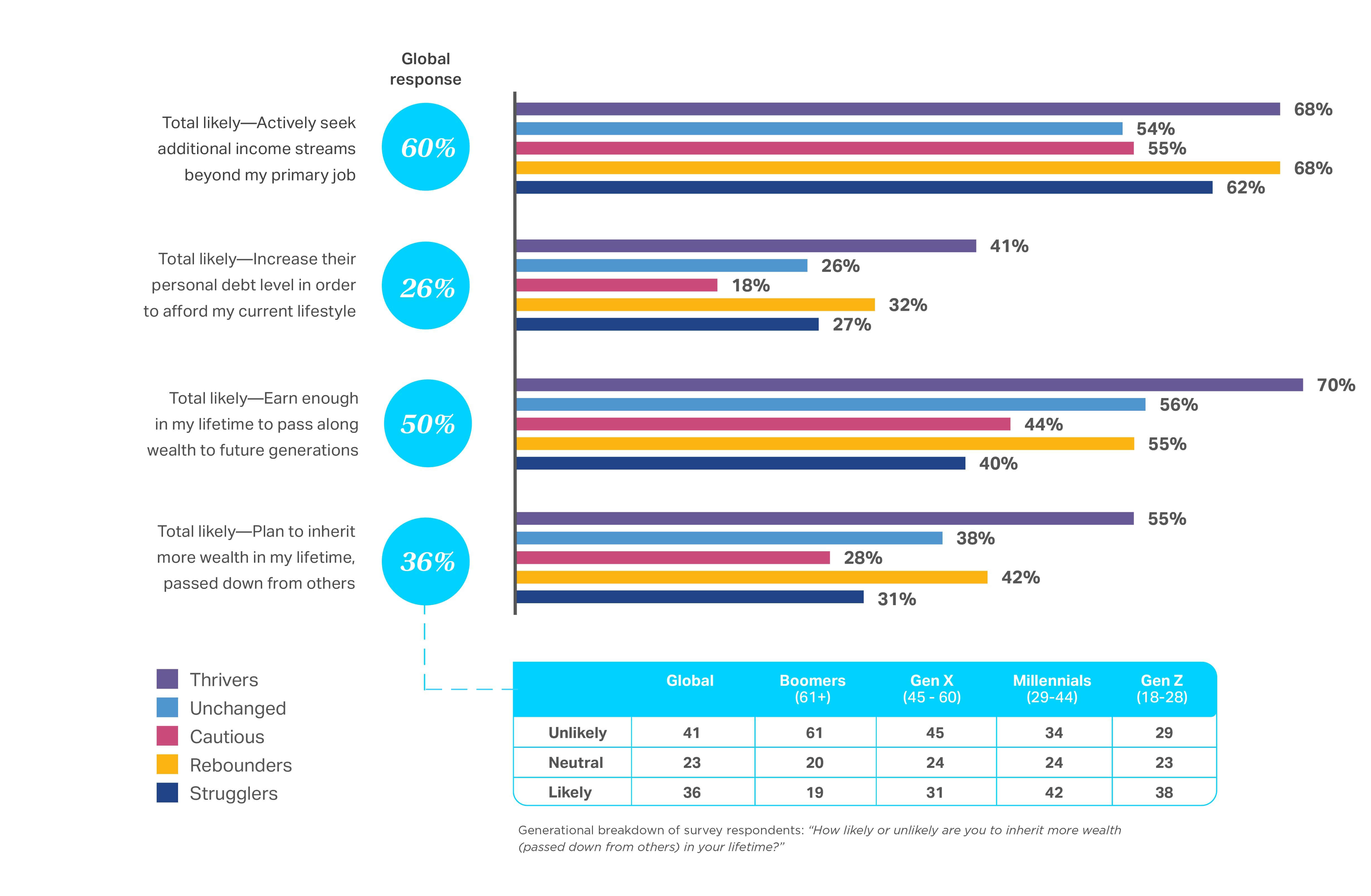

Consumers continue to hedge their bets with additional streams of income.

Cautious optimism continues across all the “economic divide” segments outlined above. Despite this optimism, consumers don’t feel secure yet: Wage growth remains flat, AI adoption is disrupting the job market, and prices are still elevated. Indeed, over half (60%) of respondents say they’re actively seeking additional income streams beyond their primary job. While this number is down 4% from last year, it reinforces the fact that a recovery in confidence is a slow-moving target. It’s also interesting that “Thrivers” are just as likely as “Rebounders” to look for other streams of income, signaling an underlying pessimism for even consumers who are “best off.”

Those likely to increase personal debt to afford their current lifestyle is down just 2%. The “Unchanged” and “Strugglers” groups saw the largest decrease in willingness to take on new debt. It’s possible many of these individuals, especially the “Strugglers,” feel wary of adding more debt while interest rates remain so high and/or they’ve exhausted their access to credit.

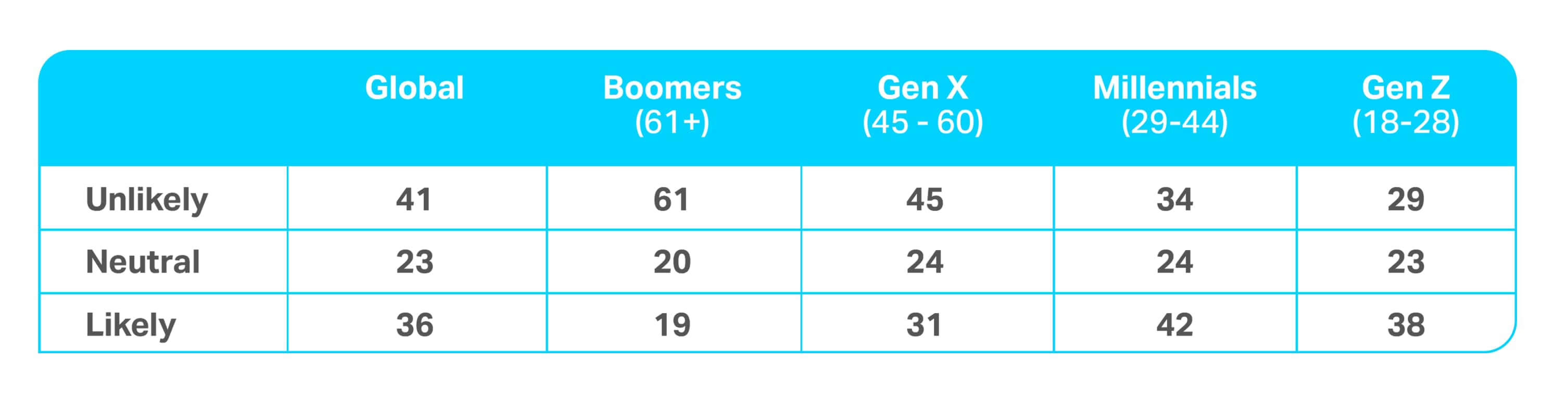

The same number of consumers (36%) as last year reported they’re likely to “inherit more wealth in their lifetime (passed down from others).” Perhaps not surprisingly, responses vary widely across generations: Older consumers think it’s unlikely they’ll inherit more wealth in their lifetimes (61% of Boomers, 45% of Gen Xers), while one-third of Millennials and 29% of Gen Zers feel that way.

How likely or unlikely are you to inherit more wealth (passed down from others) in your lifetime?

Looking for more generational insights?

Consumers to prioritize core expenses over many CPG items in 2026

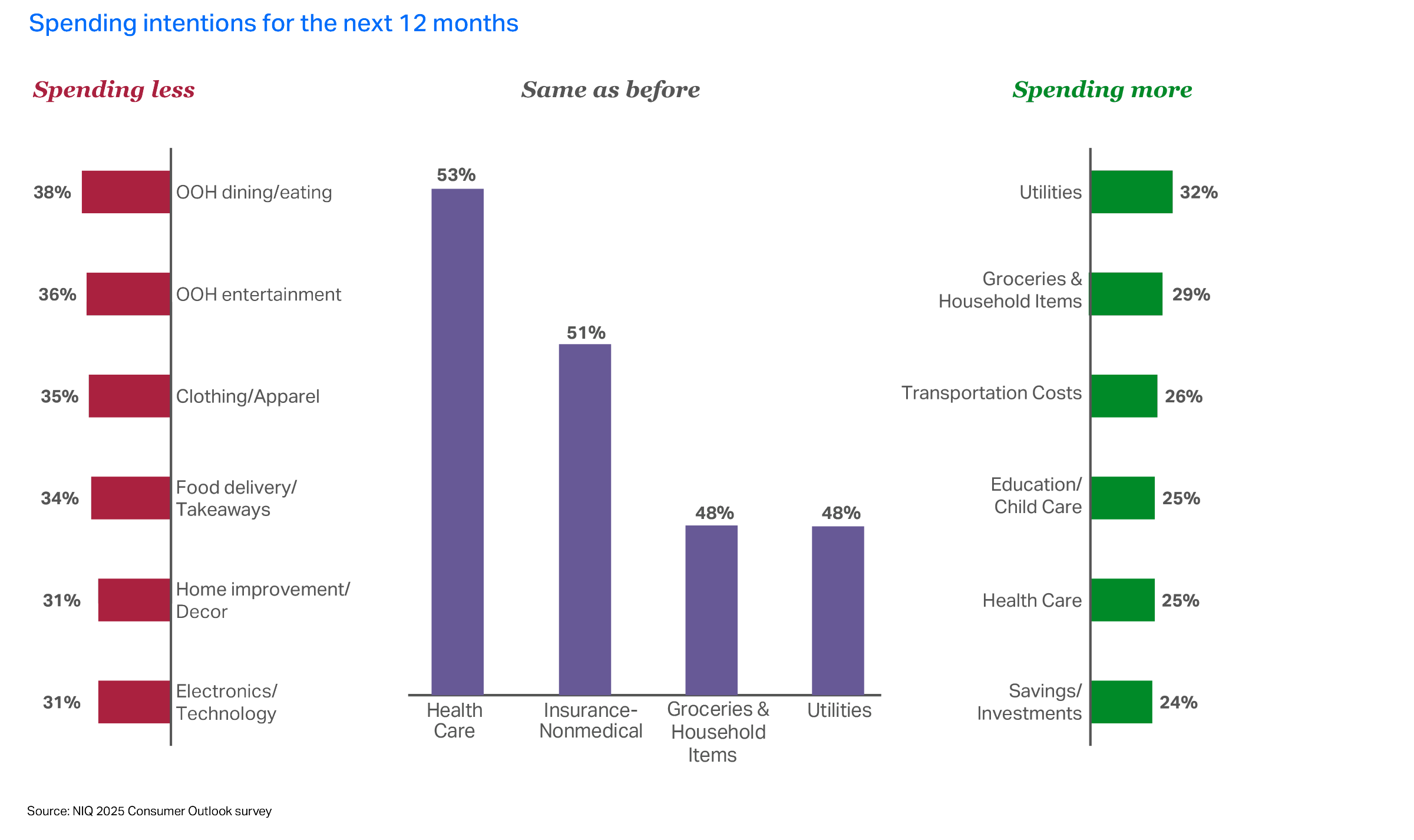

We also asked consumers to share their spending intentions going into 2026. The results are “share of wallet” data based on what (and where) consumers believe they’ll spend over the next 12 months.

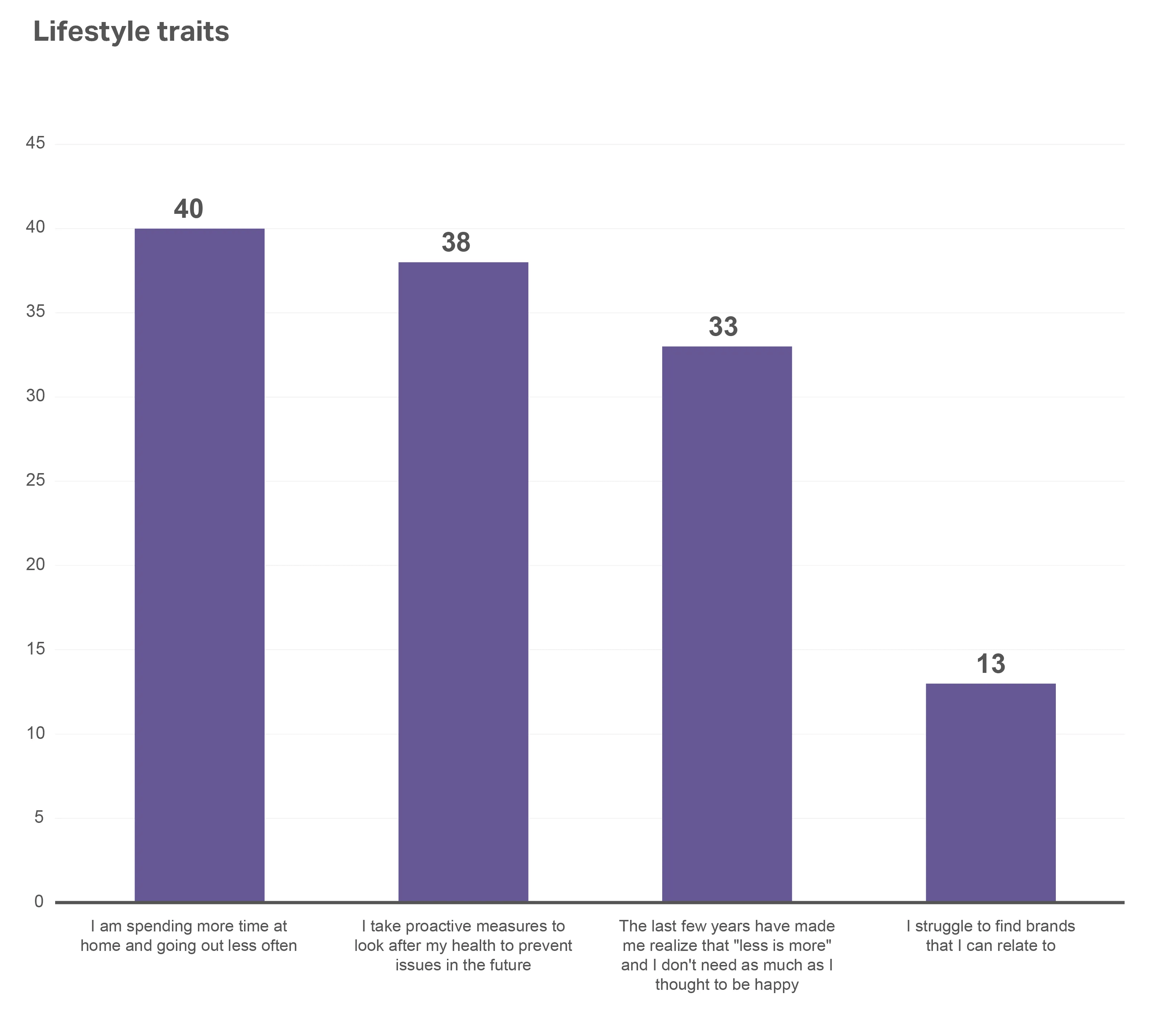

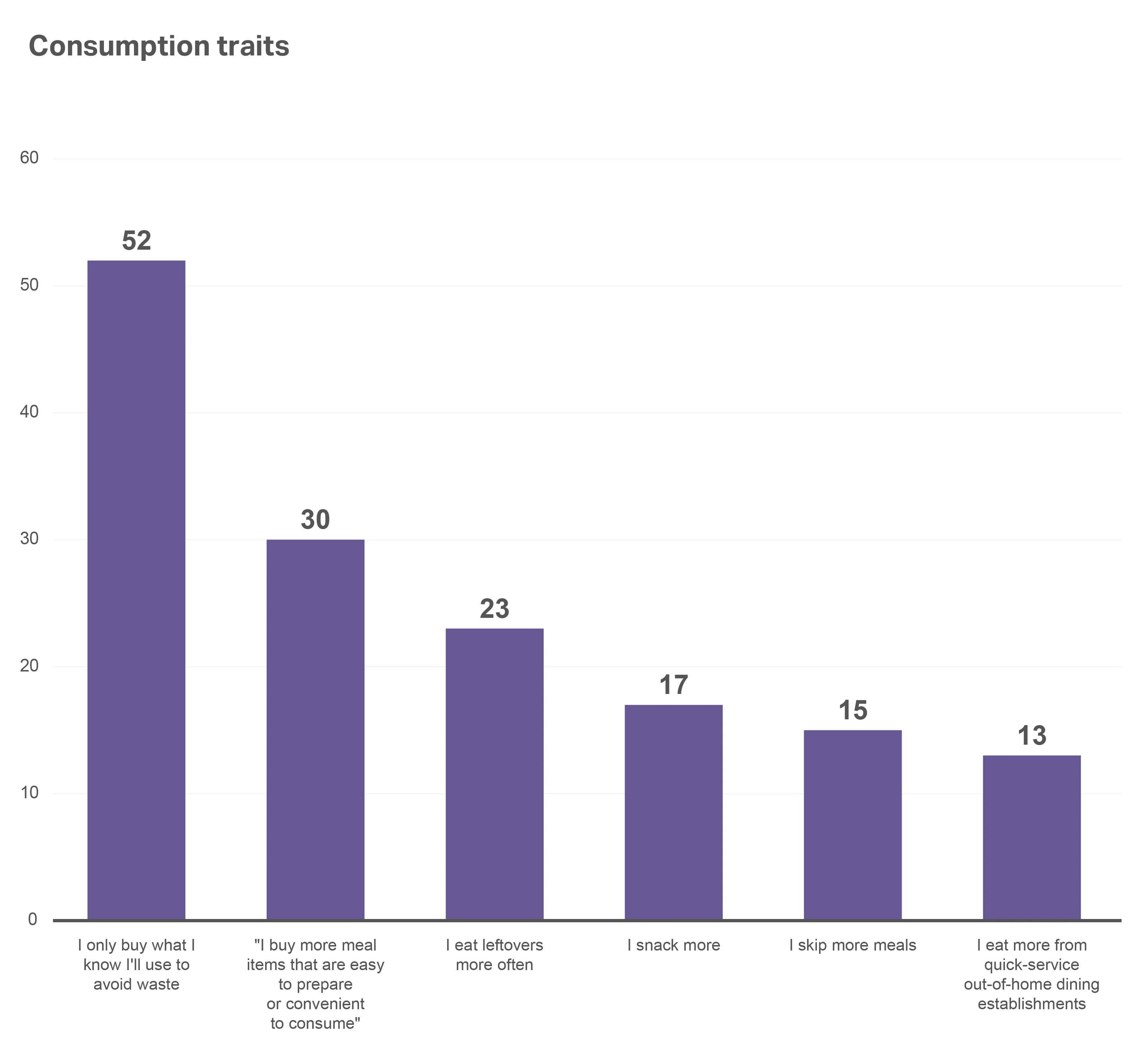

We found, for example, that global consumers will continue to spend less on eating out, entertainment outside the home, and food delivery—mirroring their behavior going into 2025. However, they plan to maintain similar spending on insurance, health care, in-home entertainment, and housing, which sends a clear signal to manufacturers and retailers that they shouldn’t expect growth to come from discretionary funds previously spent on essential (i.e., core life) expenses.

A notable change this year is the decrease in the number of consumers anticipating spending increases in categories like Utilities or Groceries & Household Items. This could be due to consumers believing that prices in these key areas are stabilizing or that organizations have exhausted the potential for near-term increases.

Spending intentions for the next 12 months

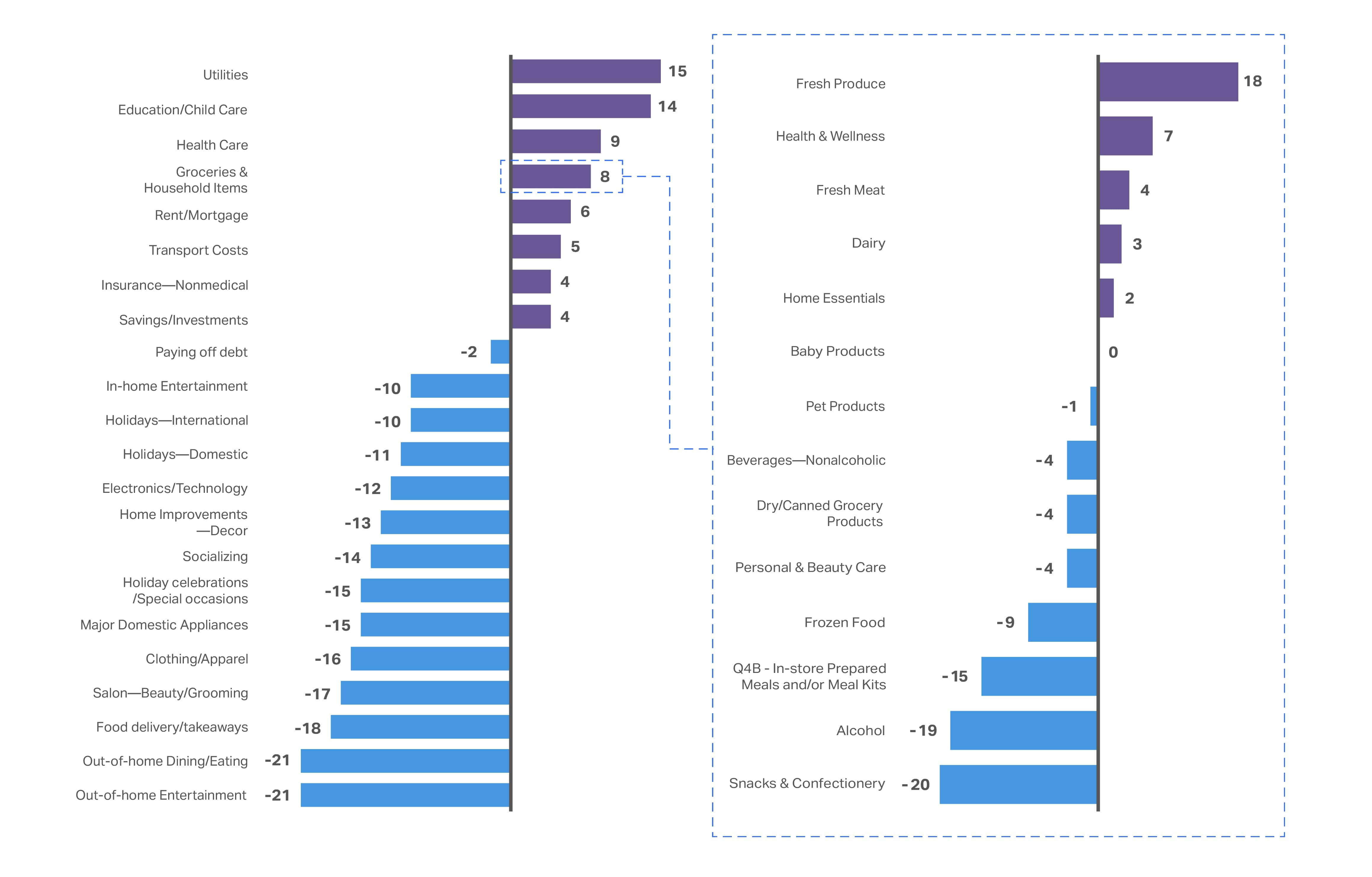

We also examined the net change in those who plan to spend more, compared with those who intend to cut back on each category of spending. This helps us uncover critical mindset shifts that may impact the CPG space.

For 2026, the spending intentions for many of the “negatively impacted” categories like Out-of-home Entertainment and Clothing/Apparel remain unchanged. Where we see some shifts is in the “positively impacted” categories like Utilities and Groceries & Household Items. Utilities, for example, has a net change in spending intention of 15% (vs. 18.9% in 2024). Similarly, Groceries & Household Items is down to 8% (from 12.2% last year). Meanwhile, more consumers are planning to spend less on Fresh Produce, Health & Wellness, Fresh Meat, and Dairy.

In 2026, consumers plan to continue prioritizing “non-negotiable” essential expenses

These essentials include Utilities, Education, Health Care, and Rent/Mortgage.

Omnishopper data insights reveal areas of growth

In leading markets like the United States, NIQ’s Expanded Omnishopper data proves that this positive consumer sentiment is clearly impacting spending. The dollar spend per US household per year is up across major departments, most notably with Health & Beauty products (+8%), Baby Care (+7%), Food (+4%), Pet Care (+4%), and Household Care products (+3%).

Health & Beauty products are being purchased more frequently, with shopping occasions per buyer up 4.9% vs. last year. Baby Care shopping occasions per buyer are up 5.6%, and Pet Care shopping occasions are up 3.6%.

Meanwhile, Food & Beverage occasions per buyer remain flat. However, absolute dollar buy rate on Food & Beverage products remains considerably higher than every other major department, sitting at $7,127 per household per year. This is fueled by a much higher purchase frequency, with Food & Beverage products being purchased throughout 227 trips, on average, during a 12-month period. For context, the next highest absolute dollar buy rate is Health & Beauty products at $1,784 per household per year, with around 83 purchase occasions per year.

When it comes to spend per trip, Household Care comes in the lowest (at around $16 per trip), while Food & Beverage is the highest (about $31 per trip).

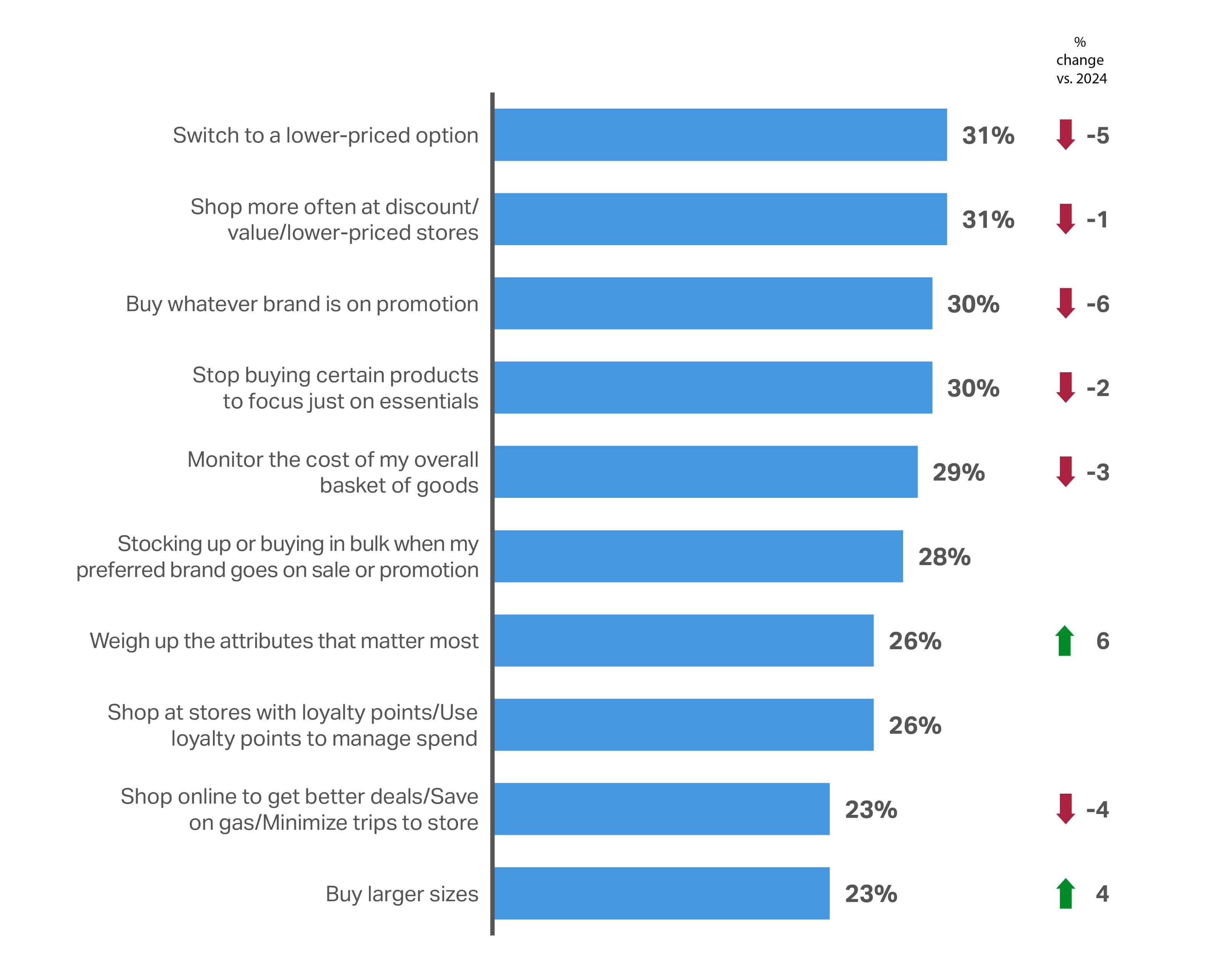

Simplicity is the new premium

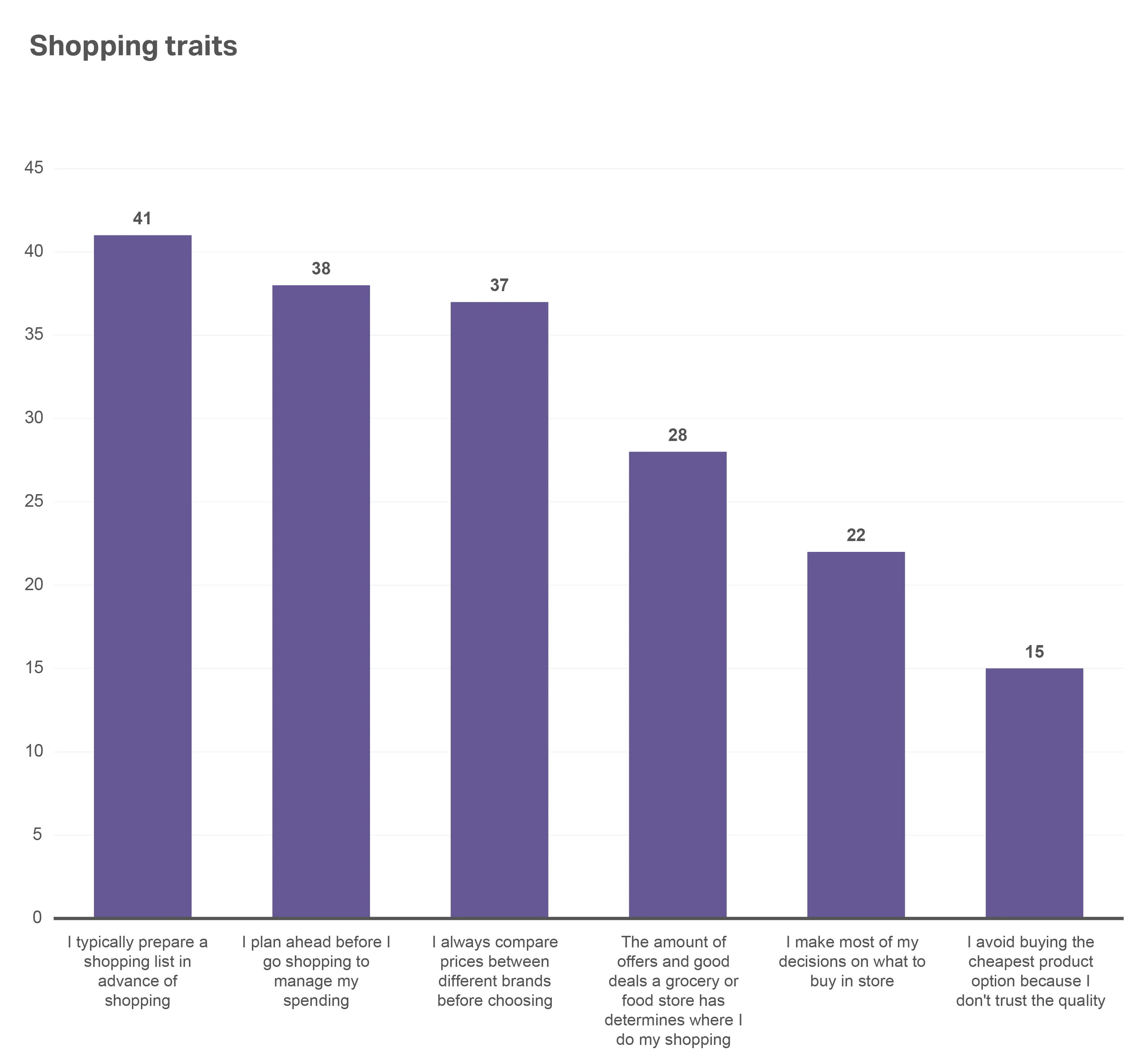

We asked consumers, “Which of the following strategies have you taken to manage expenses?”—and almost every strategy is down from last year, indicating that consumers aren’t scrutinizing their purchases as vigilantly as they were going into 2025. The only concerted effort is to “buy larger sizes” (up 4% from 2024). Otherwise, they’re employing a general strategy to “weigh up the attributes that matter most” (up 6% from 2024).

Purely focusing on the lowest-priced brand (e.g., “Switch to a lower-priced brand”, “Buy whatever brand is on promotion”) has become less popular than last year. More thoughtful approaches have become more popular (e.g., “Evaluate and prioritize attributes that matter most”, “Buy larger sizes to get a better price per amount of product”). This may suggest there’s hope for brand loyalty—if a brand offers the right holistic value proposition.

That said, price will always remain an important factor as part of the entire value proposition offered by a brand. This is evidenced by the fact that only 12% of respondents were willing to “Stick to my regular brands, regardless of price.”

With rising cognitive fatigue, simplicity is critical. Consumers are valuing fewer, clearer choices that offer price, quality, and values in one aligned proposition. Streamlined formats, low-friction experiences, and bundle-based value will outperform feature-rich complexity.

Top 10 consumer saving strategies for CPG/FMCG: Global

Last year, we saw consumers switching brands more often, looking for the best promotion. When it comes to national brands vs. private label products in 2026, NIQ’s Expanded Omnishopper US data reveals that both are growing at similar rates compared with last year (+6% and +5.5%, respectively).

Value per buyer is also growing at a similar rate to total FMCG households. Where they diverge is in the value per occasion. National brands continue to command twice the value ($31.60/occasion) of private labels ($14.90/occasion).

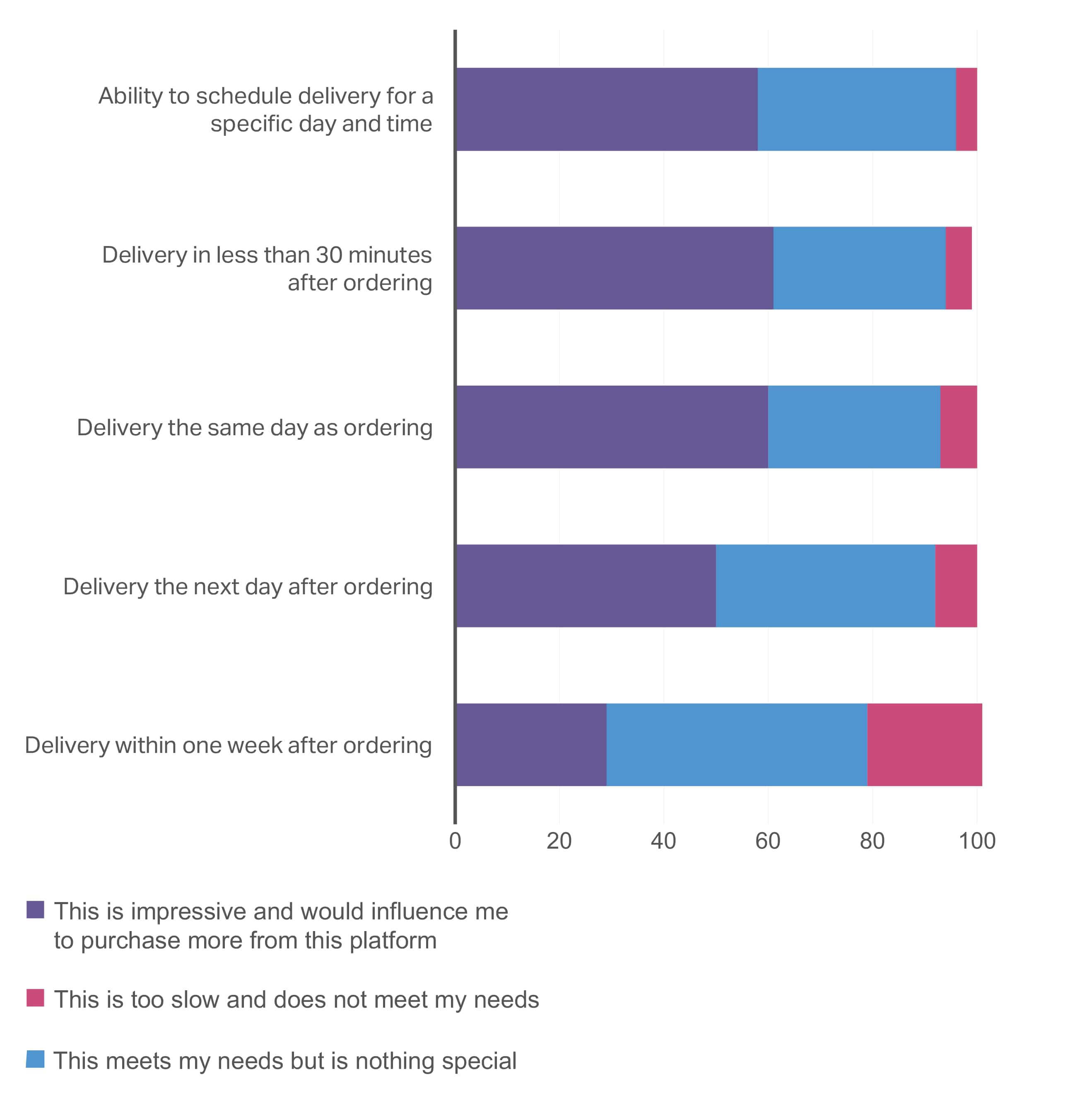

Delivery time is the new global luxury

Consumer expectations for delivery times are rapidly evolving. Our global survey shows that anything slower than “next day” delivery would not motivate consumers to purchase. Interestingly, there’s not much difference in purchase influence between “next day,” “same day,” or even “30-minute” delivery options.

When purchasing on a digital platform, what are your expectations regarding delivery timing?

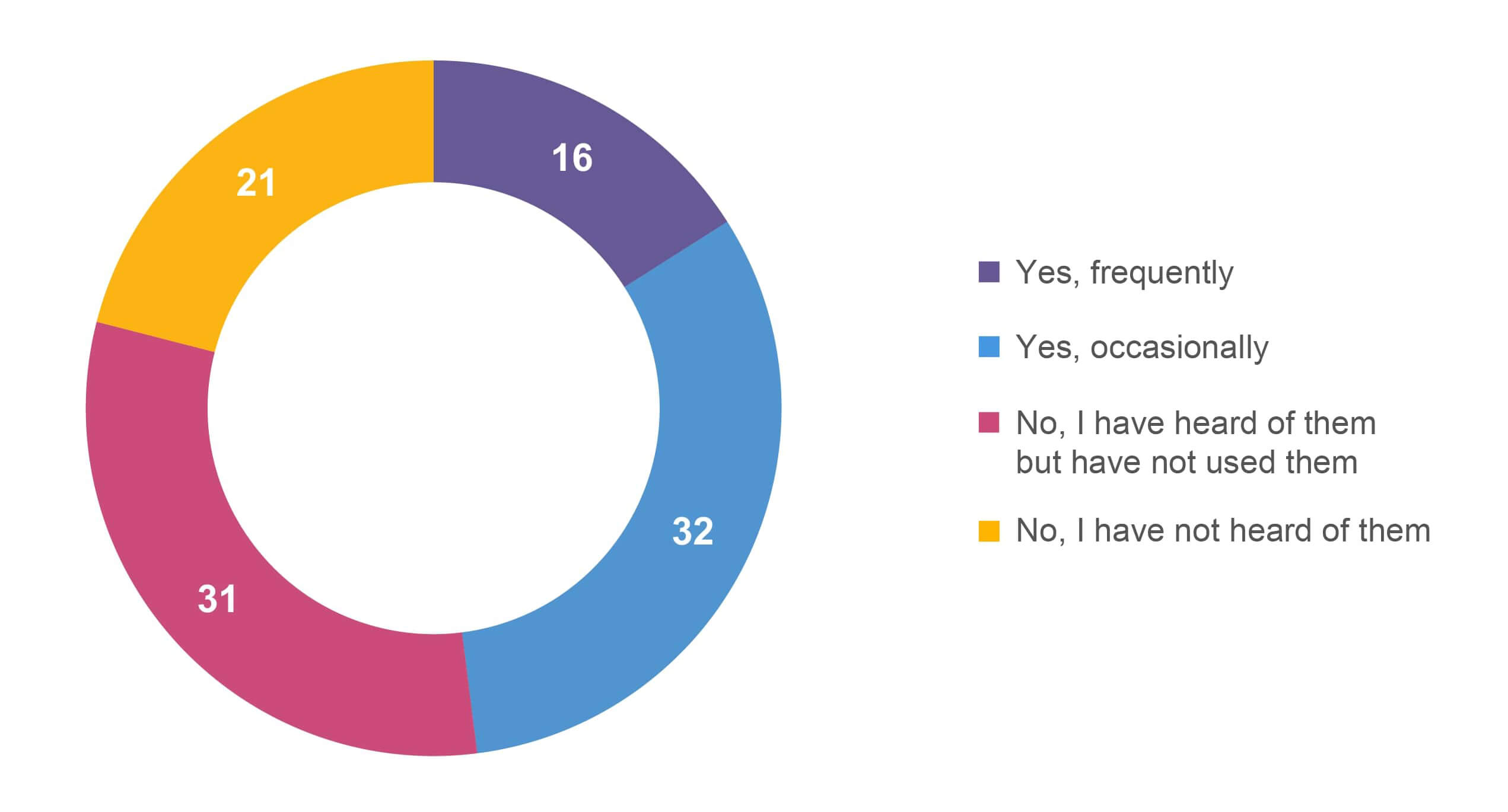

Have you used quick delivery (30 minutes or less) apps?

Time-saving features are “nice to haves”

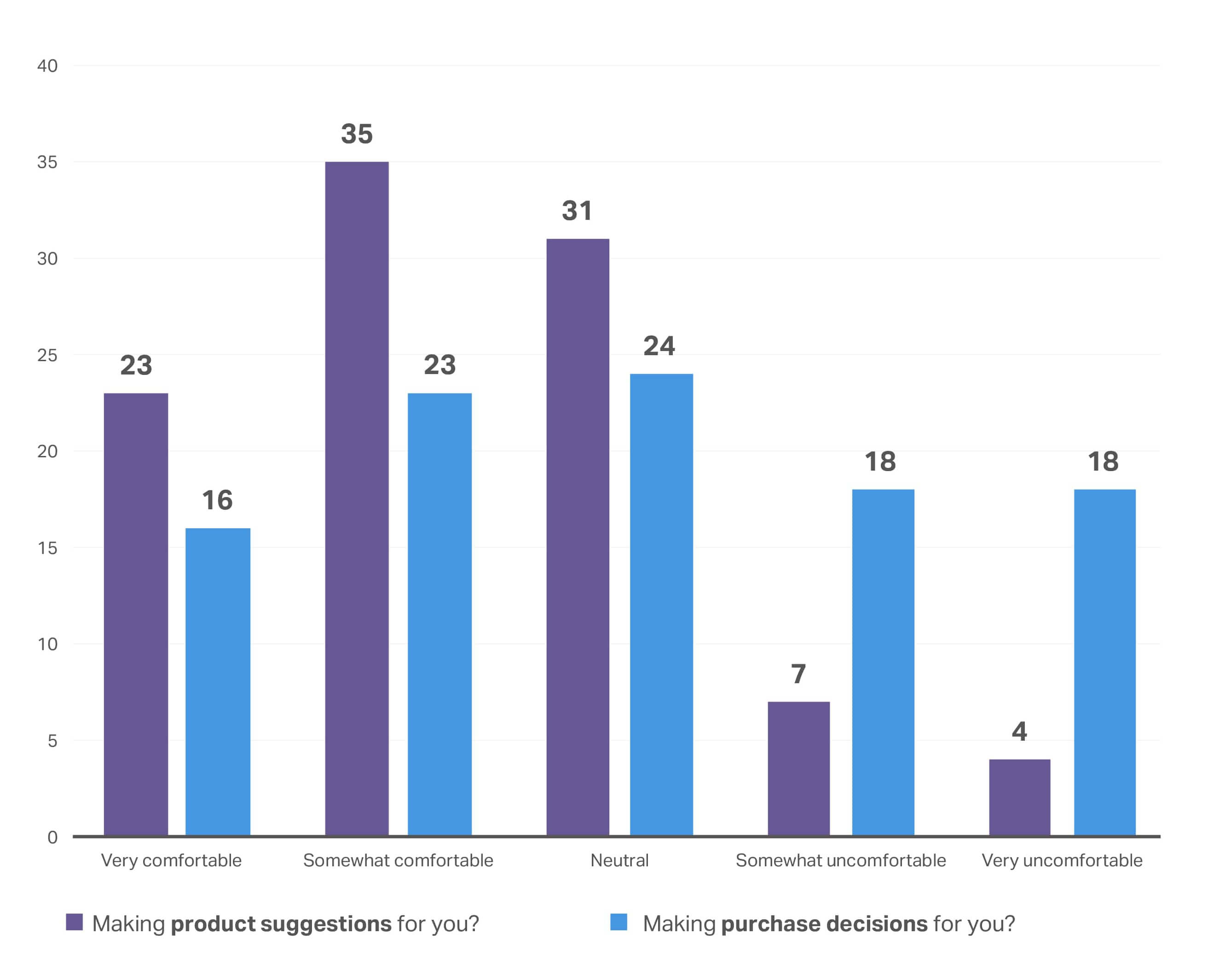

Consumers are actively seeking ways to simplify the buying process. They identified product suggestions based on past purchase as a helpful feature, but most still want to make purchasing decisions autonomously. The ability to compare product attributes is also viewed as a “nice to have” but not necessarily a decision-driver.

I find it helpful when a retailer suggests products to me based on my previous purchases/preferences

How comfortable are you with a digital shopping platform doing the following?

How much more likely would you be to purchase a product if the retailer made it easy to compare key product attributes?

Key takeaways

In spite of cooling global inflation, consumers remain cautious. Even households that are financially thriving are seeking “insurance” through secondary income streams, reflecting lingering uncertainty about future stability. While mandatory expenses like utilities are no longer expected to keep rising sharply, this is more a sign of consumer fatigue than true relief. Core expenses remain protected and prioritized.

Within CPG, the mood has turned constructive. NIQ’s Expanded Omnishopper US data proves that this positive sentiment is lifting household spend across major categories, most notably Health & Beauty (+8%), Baby Care (+7%), Food (+4%), Pet Care (+4%), and Household Care (+3%). Health & Beauty, Baby Care, and Pet Care are seeing stronger engagement with more frequent trips, while Food & Beverage continues to command the lion’s share of household budgets, driven by exceptionally high purchase frequency (227 trips per year vs. 83 for Health & Beauty).

Looking forward, the opportunity shifts from price-led growth to volume and occasion-led growth. Retailers and manufacturers will need to focus on increasing shopping occasions and unit volumes while giving consumers a greater sense of autonomy and control. Simplicity remains critical: Consumers want to feel firmly in the driver’s seat of their spending decisions.