As Canadians continue to search for ways to save money on food, the discount channel is getting more and more attention from manufacturers and retailers.

For those already in the space, drug stores deserve a closer look, too.

The $12 billion channel accounts for more than $2 billion in yearly food sales. More than two-thirds (65%) of Canadians visit drug stores an average of 13 times a year. That number might well grow as pharmacists prepare to take on a bigger role in the country’s health system by offering more medical service and advice at drug stores.

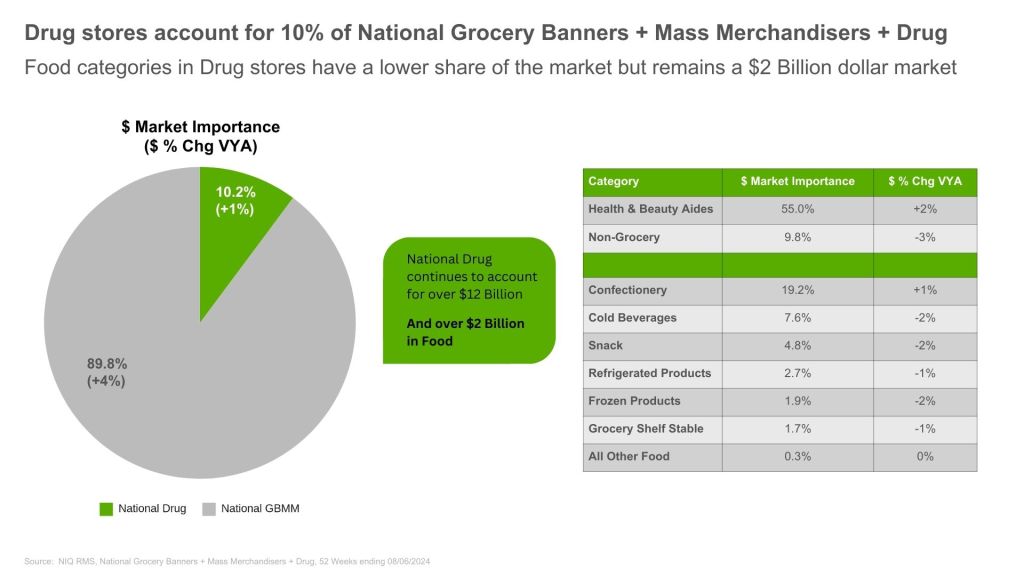

The drug store channel is growing about 1% annually, compared with 4% growth in the grocery channel (in Canada, grocery channel is defined as Grocery Banners + Mass Merchandisers) driven mostly by discount banners, according to NIQ Insights. Food sales in drug stores, which account for 2.4% of the national market, are declining slightly each year. Still, some food categories do very well at drug stores. For instance, confectionery item sales at drug stores account for nearly 20% of the Canadian confectionery market.

With these facts and figures in mind, here are a few ways insights managers, sales executives and business development professionals can go about boosting their brands’ current presence in the drug store channel.

The Right Product Mix for the Highest Impact

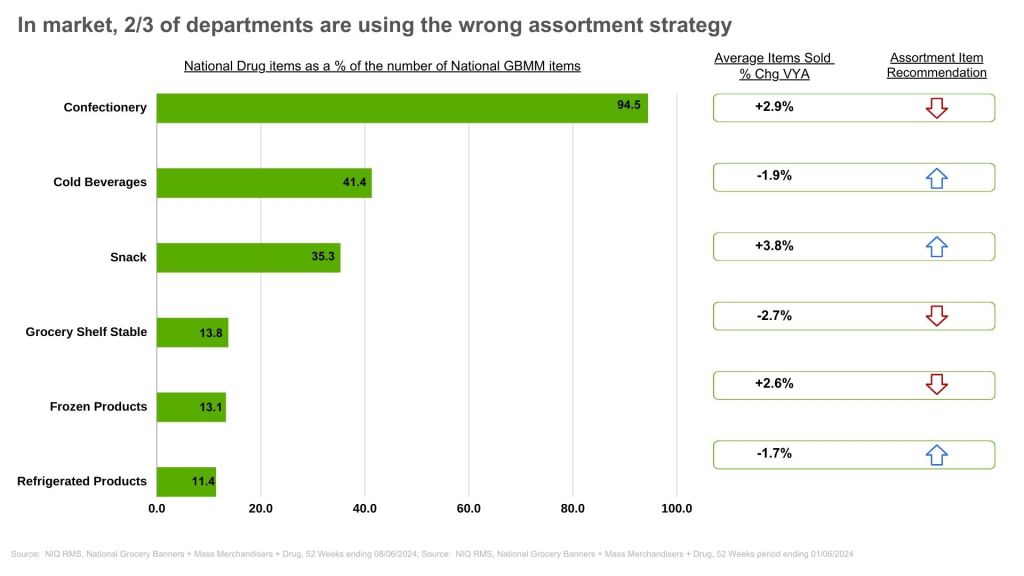

Except for confectionery, drug stores sell far fewer food items than grocery stores. Why? Drug stores have smaller footprints and allocate less space to food categories. For CPG manufacturers, this means less competition on the shelf and a greater opportunity for a more effective and impactful assortment of items that will meet shoppers’ demands.

NIQ advanced assortment models allow for a deeper understanding of consumer’s demand for the number and variety of items on shelf. For instance, to meet consumers’ demand more items are required in cold beverages and refrigerated products, both of which are currently reducing the number of available items in drug stores, and snack foods, which are currently expanding offerings. Shoppers are looking for more items in these departments, so expanding them, either through innovations or by pulling successful items from the larger market into drug banners, provides an opportunity for greater sales.

Reducing and optimizing food items in each category to avoid cannibalization, and offering the perfect balance of choice, can also boost food sales in drug stores. Overall, companies should consider sales rates and incrementality to understand cannibalization and volume flowback when deciding which items should be removed. NIQ research indicates that cold beverages, frozen products and shelf-stable grocery items could be reduced with a better item set to increase sales potential.

Revisiting Price Points in Drug Stores

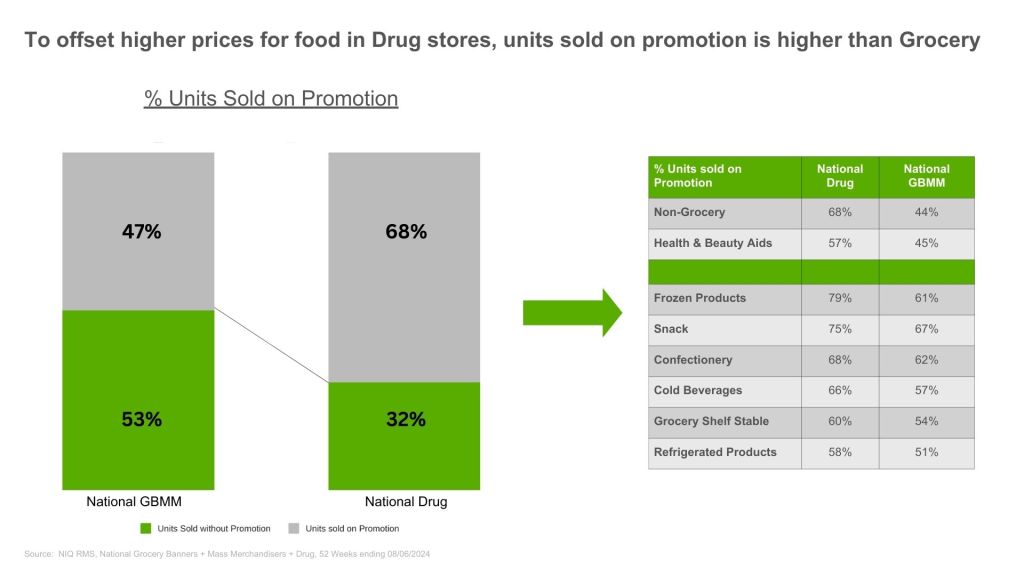

Canadians overall are price sensitive, as nearly half (46%) will switch products for a lower-priced item and almost a third (30%) will switch to a private label to save money, according to a recent NIQ Global Consumer survey. Shoppers at drug stores, however, react much differently to pricing. That’s why revisiting trade strategies and promoted price points is one of the biggest opportunities for food categories in this channel.

To start, shoppers are less sensitive to regular pricing changes at drug stores. With smaller shelf sets, price gap accounts for only 29% of a shopper’s decision-making process at a drug store, compared with 38% of the decision at a grocery store. Drug store food regular prices are higher in every department except refrigerated products. To offset these higher regular prices, a larger percentage of volume is sold on promotion in drug stores across food departments, with 75% of frozen and snack foods selling on deal.

When it comes to food categories, private label items at drug stores compare equally with private label items at grocery stores, accounting for one out of every five dollars at each of those channels.

However, shoppers’ reactions to changes in regular and promoted prices (price elasticities) are lower in drug stores. Shoppers will have less of a reaction to a regular price increase at a drug store than they will to a price increase at a similar item at a grocery store. Shoppers also react less to promotional price changes at drug stores.

Drug Store Food: Opportunity for Higher Sales

The drug store channel is underdeveloped for food categories, yet it accounts for $2 billion in annual food sales in Canada. Smaller store formats mean a smaller selection for shoppers, yet using that limited space strategically can boost food sales for CPG companies already in the space. Canadian shoppers are generally price sensitive, yet that sensitivity is generally lower at drug stores for both regular and promoted prices.

These unique channel propositions add up to opportunity for higher food sales in a channel best known for health and beauty items. Contact your NIQ Advanced Analytics partner for more information on how NIQ’s high-precision models can optimize your assortment, pricing, and promotion decisions and strategies in this unique channel.