The road to growth

There is a clear and somewhat obvious connection between consumer spending and corporate prosperity. However, what may be less apparent is how brands can foster a “prosperity mindset” in consumers to drive long-term volume growth and higher margins.

To achieve this, CPG brands and retailers must navigate current inflation challenges and anticipate the future macroeconomic obstacles that may impact consumer confidence to spend. In the short term, the cost-of-living crisis emerges as the foremost global risk, according to the World Economic Forum Global Risk Perception survey. Looking ahead, environmental pressures and the urgency to mitigate and adapt to climate change become paramount. These disruptions will test consumer confidence, resilience, and prosperity, urging companies to adapt, innovate, and seize growth opportunities.

CPG manufacturers and retailers now face a dual challenge for growth. Their strategies must consider the role they may play in building consumer prosperity and confidence. Companies must boost brand value in the present, while also strategically preparing for the forthcoming shifts that will impact consumers’ ability to thrive.

Data plays a crucial role in helping companies and consumers achieve current and future growth. Companies equipped with a full view into what consumers want and need will not only gain a deeper understanding of how to effectively impact consumer’s livelihood but will be better informed to innovate and gain competitive advantages.

How to help consumers today:

Reignite consumers’ confidence to spend

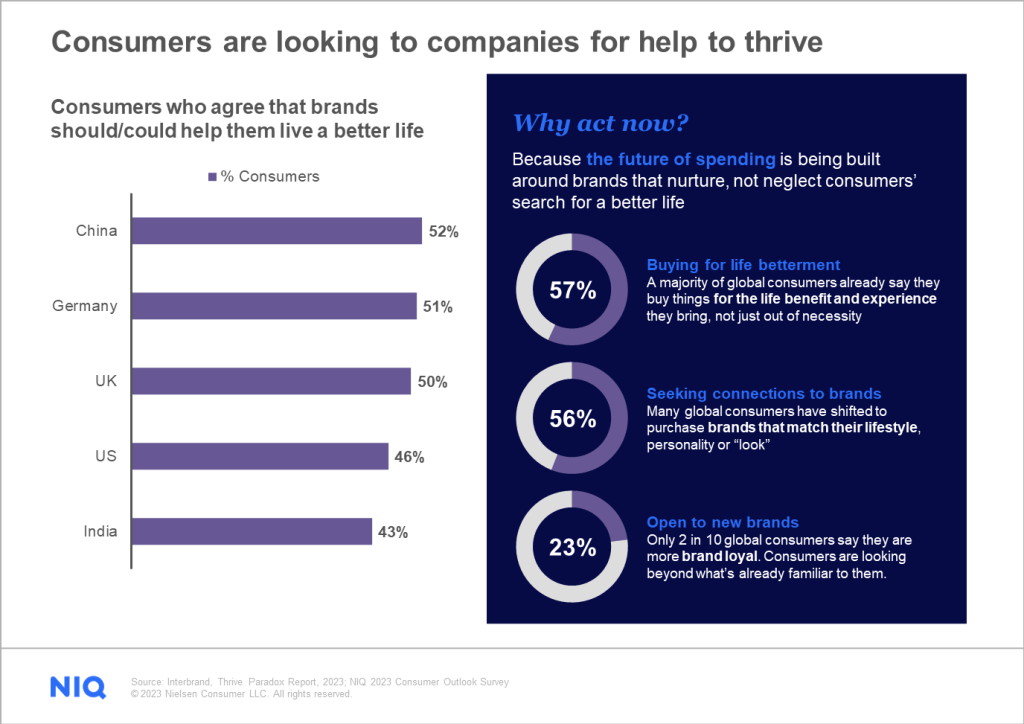

Consumers are seeking assistance from companies, as evident from Interbrand’s analysis showing that most consumers worldwide expect brands to help them thrive. NIQ’s 2023 Consumer Outlook report further emphasizes the need for action, revealing that consumers are already aligning their future spending to brands that help lift them up.

Consumers are at a breaking point

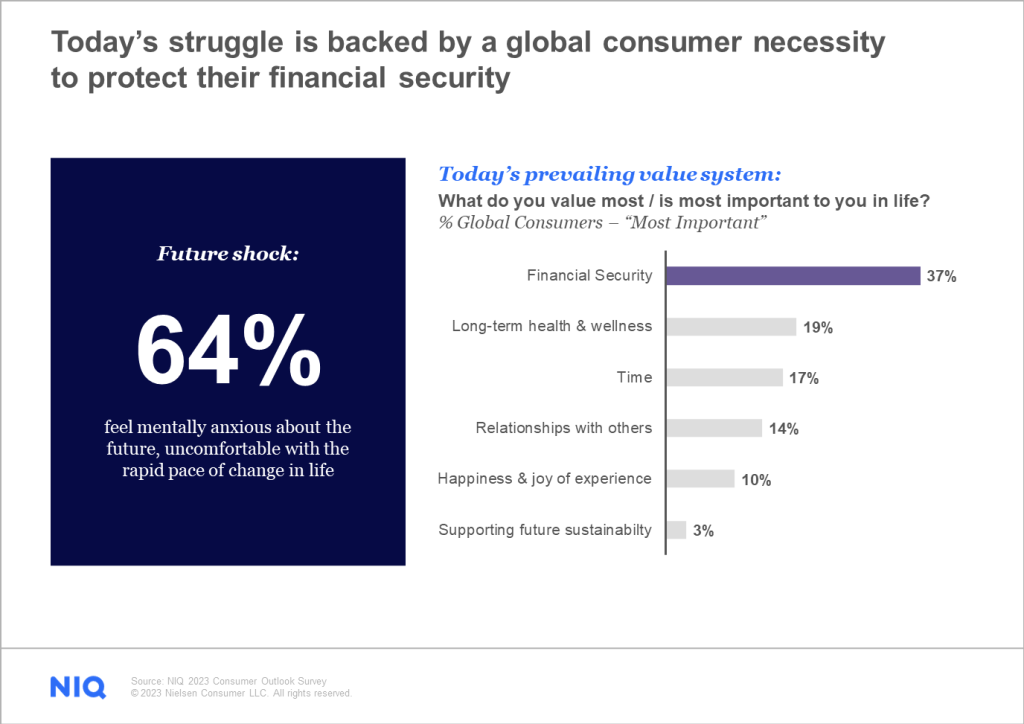

Beyond the obvious economic disruptors that sit front and center in our day-to-day lives — at the gas pump, at the shelf and in our digital grocery carts — on a larger scale, consumers are at a breaking point, and their struggle is limiting global spending and consumption rates. NIQ data shows that a majority (64%) of global consumers say they feel mentally anxious about the future and uncomfortable with the rapid pace of change in life. Leaders, take note: the purchasing power of consumers worldwide has weakened, consumers are exhibiting signs of financial future shock and the need to foster a “prosperity mindset” is high.

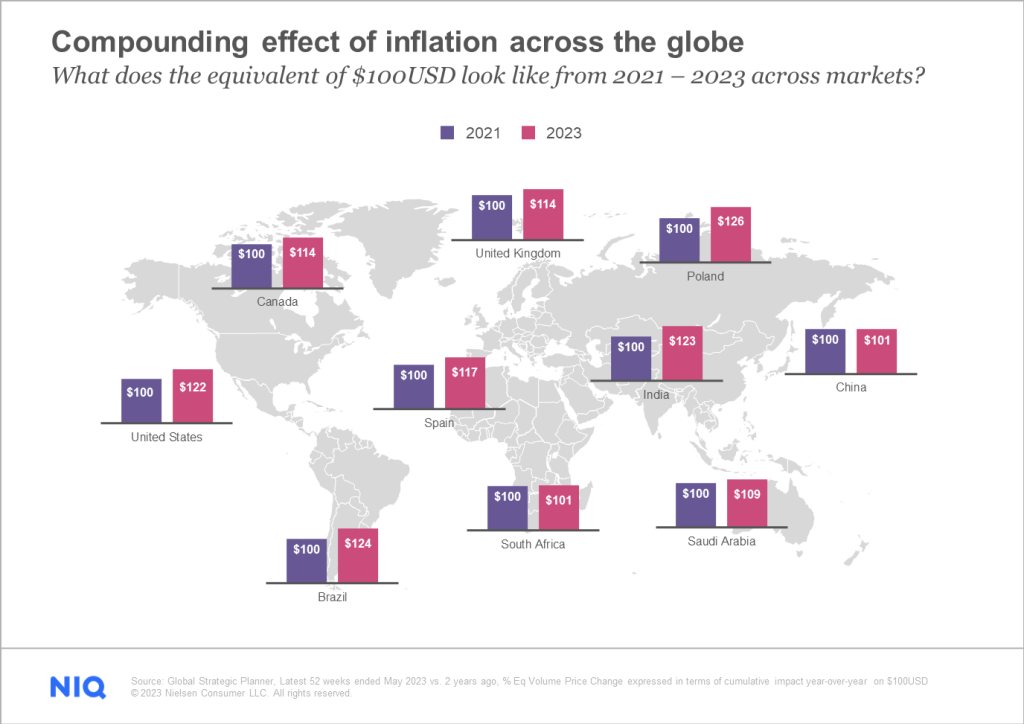

Furthering this point, a recent NIQ analysis offers a full view into the challenged wallets of today’s consumers. According to NIQ data, the compounding effect of inflation across the globe has created a substantial decline in purchasing power. Across 10 global markets, here is what the equivalent of $100 USD from 2021 looks like, today:

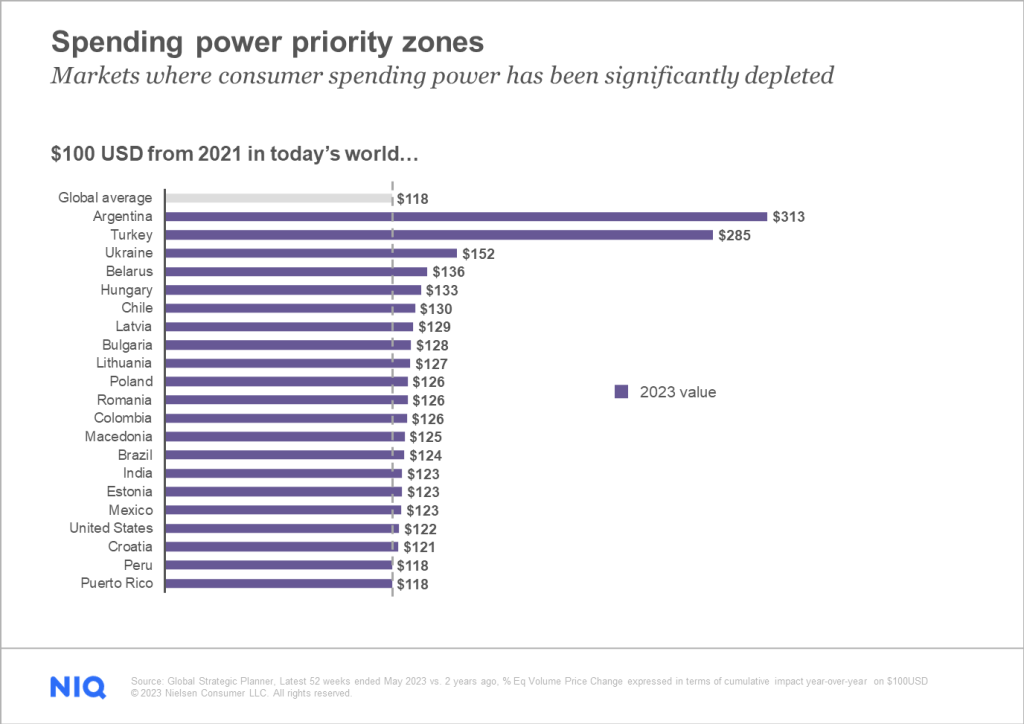

Where has spending power been significantly impacted?

The shrinking spending power of consumers around the world is being realized differently across regions. For CPG manufacturers and retailers, NIQ’s guidance highlights global priority zones where consumer spending power has been significantly impacted. In regions like Brazil, India, the United States, and excessively in hyper-inflated markets like Argentina and Turkey – the spending power for consumers has been depleted beyond the global average. For operators in these regions, consider how your company can play a more significant role in returning consumers to a healthier spending mindset.

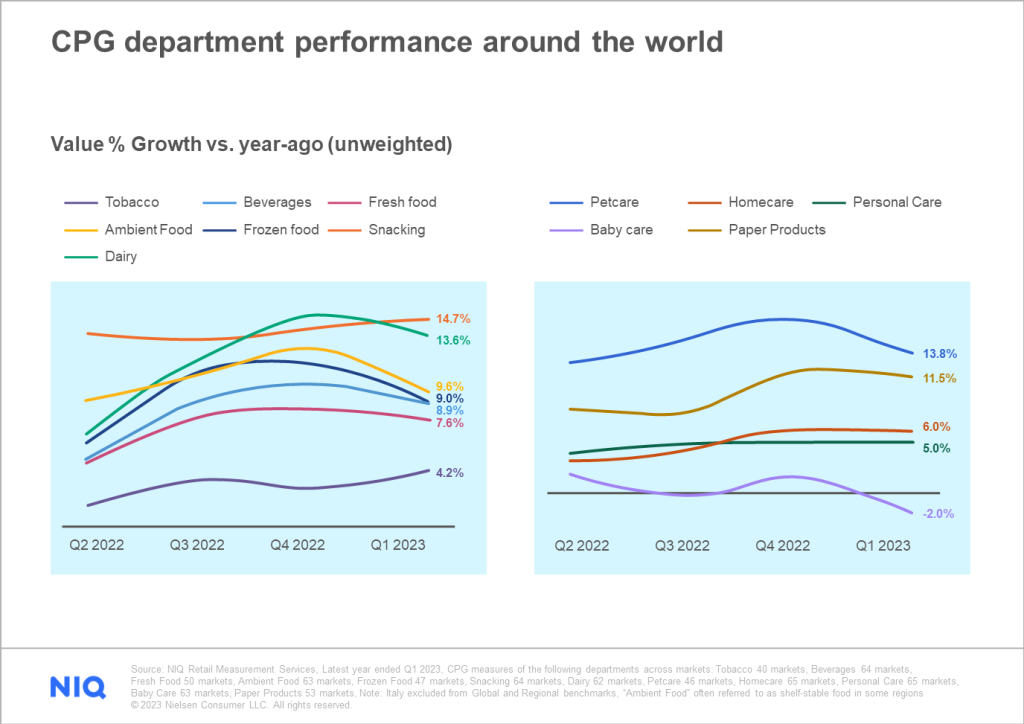

For additional context, around the world, consumption levels are declining. People are spending more but buying less. With global markets facing new and unique challenges, growth opportunities will need to be more strategic and focused on gaining market share within your category.

To drive growth beyond pricing, it is crucial to understand that consumers are actively seeking ways to save and are relying on brands and retailers to provide meaningful value in their daily lives. Gaining a comprehensive understanding of global consumer behavior is essential for maximizing effectiveness and influence.

In the U.S., rising prices have impacted almost all CPG departments, despite some recent stabilization of inflation. Key food departments have experienced particularly high average unit prices in the latest month. The decline in volume consumption of CPG products compared to the same period last year has generated some concern within the industry. Food inflation in the U.S. has slowed but remains relatively high at around 6%, with a 2% decrease in unit consumption. Non-food prices have also increased by 6% monthly, but consumers have pulled back, resulting in a 5% decline in unit sales. Currently, 35% of shoppers are focusing on purchasing only essential items, underscoring the importance of value as a growth driver.

As financial focus sharpens, CPG growth will continue to be driven by sources of saving like private label products, discount retailers and growth of products sold on promotion.

Where to cultivate growth

Guiding Questions for Growth

Recognizing the new realities of spending, how can your company meet consumer’s needs on the value spectrum to enhance future spending potential?

In a fiercely competitive promotional environment, what strategic initiatives beyond price can you deploy to effectively engage and nurture downshifting consumers?

How will you adapt to meet the stretched and fragmented economic state of consumers? What strategies will you implement to accommodate polarized price tiers, adjust assortment, and expand offerings?

With diminishing shelf space, how can you optimize your product portfolio to maximize shopper demand? How many items should you have by segment, size, and brand? Are you aware of which products within your portfolio are driving and inhibiting growth?

What does your brand represent in today’s era of value-driven consumption? How can you align your brand identity with the evolving needs and expectations of consumers? What opportunities exist to innovate?

Conclusion

To capture growth in the evolving consumption landscape, companies must adopt a balanced approach that considers both short-term business results and long-term business relevancy. Simply relying on past growth strategies will not suffice for CPG and retail leaders aiming for meaningful volume and gross margin growth.

Companies can foster a “prosperity mindset” by navigating current inflation challenges and anticipating future macroeconomic obstacles that may impact consumer confidence in spending.

Data will play a crucial role in helping companies thrive. Companies equipped with a full view into what consumers want and need will gain a competitive advantage. Actionable data will be instrumental in enabling strategic decision-making and diversifying growth strategies. By anticipating macroeconomic factors that impact consumers, companies can stay ahead of emerging consumption patterns and behavioral norms. Stay tuned for part two of the series, where we will explore long-term macroeconomic variables that affect consumer confidence and offer growth levers for brands to address these factors.